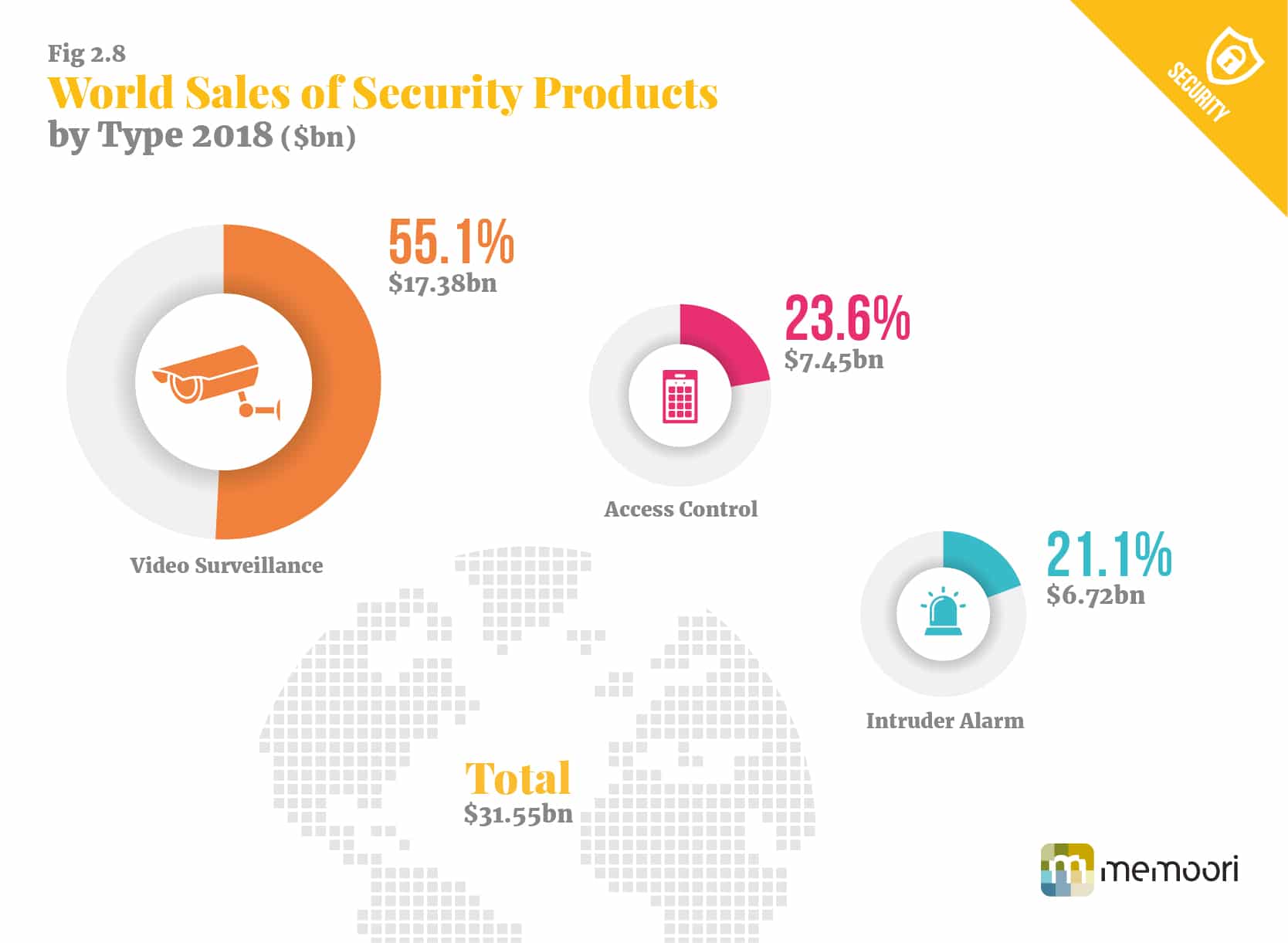

Our new 2018 annual report on the Physical Security Business shows that the total value of world production of Physical Security products at factory gate prices in 2018 was $31.55Bn, an increase of 7.% on 2017.

This is a solid improvement in performance for over the last 10 years the market has grown by a compound annual growth rate of 5.92%. However we forecast that the market will reach $51.38Bn by 2023 at a CAGR of 10.25% thanks to a CAGR of 13.4% in the word sales of video surveillance equipment. This sharp rise in growth is the result of a slow down in price competition and the growth of AI video Analytics; potentially accelerating to $2.3Bn by 2022 from a minuscule size today and further pulling demand for more video surveillance hardware.

This year Video Surveillance had the highest rate of growth at around 8.7% a significant increase on 2017, despite the fact that the last quarter of 2017 the pricing “race to the bottom” was not dead. This brings it back into line with the average growth over the previous 5 years. The underline rate of growth excluding Video Analytics will be around 9 to 10%, but this will require volume growth to deliver a CAGR of well over 10% as a result of component prices falling but far less aggressive pricing from Chinese manufacturers.

In 2018 Video Surveillance products at $17.57 billion had a share of 55.6%, Access Control at $7.45 billion a 23.6% share and Intruder Alarms and perimeter protection at $6.72 billion had a 21% share.

Access Control was expected to deliver a slightly higher performance than 8% as it further penetrated the IP Network business, advanced further into biometric, identity management, wireless locking systems and ACaaS. This was expected to be the third consecutive year that it has turned out the highest rate of growth of the three businesses. However there is some evidence that price pressures are starting to bite and this has reduced the forecast growth when measured by value.

There appears to be reluctance by Access Control manufacturers to support open standards in order to protect their heritage business. This could damage their long term future and open the way for Chinese manufactures to take up the initiative and make a strong push into the business they have recently targeted.

The intruder system business, the father of the physical security business, has long since reached maturity but its increasing use of radar, thermal and multi sensor cameras, has contributed to growth edging up to 4.5% in 2018. In addition advances in sensor technologies, wireless technology and the integration with Video Surveillance, Access and outdoor Lighting have all contributed to its growth.

Follow to get the Latest News & Analysis about Smart Buildings in your Inbox!

There are many factors that are impacting this industry and we believe the 5 below will require fundamental changes to business strategies;

1. The gap between the major suppliers and the many hundreds of smaller suppliers gets wider every year and this is rapidly increasing the minimum economic size to operate profitably in this industry. We have now reached the stage where the Video Surveillance business requires a strategy that either focuses on volume through the SMB market or brand through the enterprise business.

In the video surveillance business 2 Chinese manufacturers have built up volume, initially through targeting the SMB business and the gap between them today and the next tier of western companies is so wide that it looks highly improbable that it can be reversed and certainly not by western companies competing solely on price. Hikvision and Dahua have adopted the strategy of disrupting the industry by undercutting the profit margin of their competitors, whilst at the same time expanding markets and rapidly growing market share.

Some leading western manufacturers, whilst having to trim their margins, have improved their financial performance this year by continuing to invest in delivering better performing products more resistant to cyber attack, which has grown their share. Building Brand has shown that it has a very important role to play but in the present circumstances it is not sufficient to change the dominance of the 2 Chinese manufacturers.

Merger and acquisition between the leading western manufacturers is seen as a possible solution to match their size, but at best we believe it could only slow down further widening of the gap. Strong Brands with end to end solutions possibly focused on a number of vertical markets and having strong alliances with companies in other Building Automation services is the only other option for hardware suppliers to ensure a profitable future.

2. The region that has the highest growth and the largest share of the physical security market is China and Asia. This region has the lowest penetration of physical security equipment when measured by sales per capita and yet takes over 28% of the world’s market today but more like 40% of the video surveillance business. Therefore it should provide the best opportunity for future growth for western manufacturers.

3. It is ironic that Physical Security protection, which provides for the safety and security of people and assets in buildings and public places is perceived as having the highest level of risk of cyber crimes. This must be the biggest single threat to our industry particularly video surveillance, which is currently the weakest link. Those suppliers that can prove a high level of security against cyber crimes meet the most important buying criteria today in the enterprise business. Those that are selling vulnerable products will at best find their market share decline and probably face heavy financial damages that could ruin their business. Physical security will therefore be one of the big spenders on installing cyber security systems particularly in Smart Buildings.

4. Software services in all its guises has achieved the highest rate of growth of all components in the physical security business achieving a growth of almost double that of hardware sales for the last 5 years, but it still accounts for no more than 12% of the business. It will rapidly increase its share and continue to benefit from higher rates of growth for many years. Much of this will come from manipulating the vast quantities of information that will be generated from physical security sensors particularly video cameras. Memoori recently published a report on AI Video Analytics which showed that the technical market potential for applying AI video analytics in existing installations could be around $65Bn and we assume it could take up to 30 years for this to be exhausted. To this we have added the cost of applying AI Video Analytics to new installations to arrive at the total technical market potential.

5. Integration and IT Convergence has for almost 10 years impacted all 3 branches of the industry and in particular Video Surveillance, but its only in the last 5 years through IP networks and ONVIF that integration across all sectors has delivered more elegant and cost effective solutions. Integration has now advanced to IoT and the Building Internet of Things (BIoT), that’s joining all the Building Automation services eventually on one network. This will create open, comprehensive solutions that will not need human intervention to control them.

Today we can deliver advanced integrated security systems designed to provide a view of all relevant data points, enabling security personnel to quickly scan and mentally understand highly involved, intricate and sophisticated building intelligence. This will require strategic alliances to be formed between companies across all the Building Automation Services and will have a major impact on the routes to market.