There are two major forces that have over the last 5 years brought about a reshaping of the structure of the Security Industry. The first is a rapid consolidation process that is particularly rife when a business is young, immature and growing fast. The second is a heady cocktail of converging technologies brought in from the even faster growing Web Services, IT and Digital Electronic industries. These technologies require companies to have a much larger minimum economic size in order to be viable. It is inevitable that these new technologies will continue to penetrate the business and accordingly consolidation through mergers and alliances will become more intense in the future. However we are now entering a period of meltdown in the world’s financial markets the scale of which has never been realised before and the impact of this is on our industry and the consolidation process is difficult to gauge at this stage. This article reviews the impact that mergers and acquisitions have had on this industry in the last five years and the future consolidation process.

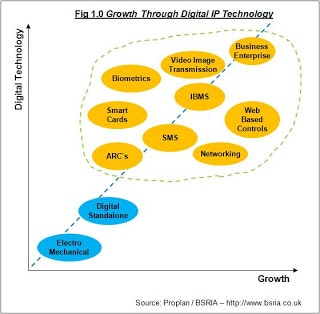

The speed of innovation in the physical security industry is faster than any one supplier can possibly achieve or fund by themselves. In addition technology is being imported from the electronics, computer and IT industries all requiring new areas of expertise and developing this internally is just not practical in the short term. This is why new alliances and partnerships are occurring, between these businesses and the security industry. But to leverage the research and development costs there is a need to rapidly scale up and establish a global presence and this can be best achieved through or by the acquisition of those companies that have either the technology or the distribution networks in place.

Memoori has been reviewing and analysing in a monthly Executive Brief the activity in Mergers and Acquisitions in the world wide Security Industry. Its objective has been to measure the consolidation process and benchmark its performance identifying the target companies for acquisition based on the future technology direction and the requirements of buyer’s in particular vertical markets. It has gone back 5 years to analyse the acquisition strategy of the major manufacturer’s suppliers, during this period of rapid technology change. This has been valuable in showing how a few players from outside the industry have established a presence that has taken them from zero to one of the leading market shares within 5 years and why new start high tech companies are selling at high multiples measured by either exit sales or EBITDA.

Both Schneider Electric and UTC commenced business in the Security and Safety industry in 2003 through the acquisition of major players. Since then they have both pursued a policy of buying companies with a very significant share of the business and geographic spread. They have both made a heavy investment in a series of acquisitions in this business and are in 2008 amongst the top ten world suppliers. Now they have size, expect their additions to be smaller high tech companies. Stanley Works is another company that has spent heavily in the electronics security market since 2003, making its first change in future direction from mechanical to electronic systems with the purchase of Blick Plc. Since then it has majored in buying large US installer / automatic receiving service suppliers building up a country wide network and is now also included in our league table of the top major suppliers in the world market. Siemens and Bosch both well established leaders in this market for many years have not pursued an aggressive acquisition policy favouring a more selective acquisition of strengthening technology and geographical gaps in their portfolio. Tyco and GE Security have in the last few years slowed down their policy of acquisition, but the former has in the last three months made a couple of acquisitions in the retail market further establishing its world dominance in this vertical market.

If we make comparisons with sister industries in the Built Environment then it is clear that Security is still much more fragmented and has a long way to go in order to catch up. In the building environmental controls market just 5 companies take more than 80% of the world’s product business whilst in Fire Detection some 12 companies achieve the same market share but in the Security business it takes more than 50 companies.