Building automation is specified at the design stage for new construction, while security is frequently purchased after the building’s completion. This can pose the first barrier to integrating security with other building control infrastructures, but not convergence with IT.

The emphasis is now on convergence with IT. For one, IT security issues are the responsibility of the IT department, including all data networks. The IT department increasingly takes the initiative to ensure more robust security solutions, particularly for use of existing data networks. More importantly, it appreciates the potential benefits for the business enterprise, which has become the driver for IT convergence with security. If there is a case for IT convergence, why is it taking so long to become standard? And why is it only used by large companies and for major infrastructure projects?

Dominic Bruning, Marketing Director for EMEA at Axis Communications, said that all too often, physical security and IT are treated as two separate silos. This results in high personnel and material cost, along with inefficiencies, making it easier for security gaps to occur unnoticed. He suggested a management structure change to overcome this scenario, with the CSO reporting directly to the CEO and implementing a converged strategy.

CIOs, until recently, had little interest in physical security and often regarded it as a threat to IT security. Combining these roles would ensure a more comprehensive security solution, which is gradually taking place.

Proprietary Standards

The second barrier to integration was convergence offering fewer connectivity options, forcing users to be locked in to one supplier. This has changed, with more standard communication protocols being adopted and applied to security. It is unlikely to integrate all the sophisticated applications offered by some proprietary systems, but inter-connectivity between brands has improved over the last five years. In the physical security business, supervisory software from suppliers such as Milestone Systems melds together hardware from different suppliers in fire safety and building environmental automation systems.

On the supply side, installers and integrators have not played a dynamic role in delivering holistic solutions. In the early years, it was left to global manufacturers and solution providers to take the initiative, such as Honeywell Building Solutions, Siemens Building Technologies and Schneider Electric (TAC). These companies have delivered comprehensive solutions in vertical markets including airports, hospitals, shopping malls and industrial complexes. These are large projects on new construction sites and connect many aspects of the business enterprise with security, safety and environmental controls.

IT-data network practitioners have entered the market recently, adding much-needed expertise. As early as June 2005, Cisco Systems introduced its Connected Real Estate program. In January 2009, it expanded products and services. First, Cisco launched its comprehensive physical security solution after a series of smaller acquisitions. The company now offers network video surveillance — from capturing video to processing video at the back end — and access control. These edge devices plug into the IP network like a mobile phone or laptop.

A second component of Cisco’s Connected Real Estate vision is its Digital Media Systems. The company offers end-to-end content systems, including digital signage and media, to commercial real estate. In 2008, Cisco signed its first strategic alliance for Connected Real Estate with Johnson Controls (JCI). The JCI partnership allows Cisco global access to facility management world, securing far-reaching integration of building systems and IT networks. Cisco also launched EnergyWise, a networked energy management solution which monitors and controls the power consumption of all networked devices. Other IT companies also have a significant presence in security, such as March Networks, Controlware Communication Systems and Optelecom-NKF.

Market

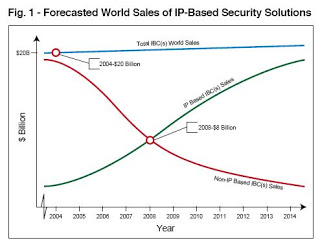

With both technical and commercial solutions available to eliminate barriers, how will the market develop? In 2006, Memoori estimated the world market for electronic security solutions to be worth US$20 billion in 2004 to 2005 at installed prices.

As Figure 1 shows, IP solutions accounted for less than 10 percent of the market. We projected an annual growth rate of 6.5 percent for electronic security over the next 10 years, with IP-based systems to take $8 billion in 2008 or approximately 30 percent of the market. By 2014, we forecast IP-based systems to account for 80 percent of the business. According to anecdotal evidence today, the recession has reduced demand in the last 18 months.

However, forecasts indicate that IP-based solutions have increased their market share and will accelerate after mid-2010. All security systems will grow less than 6.5 percent between 2008 and 2010. Regardless of whether these predictions are accurate, what is critical is that IP-based solutions will become standard within the next six years. This is driven by demand for security systems to converge with IT and deliver holistic solutions. However, as mentioned in part one, few suppliers have spent sufficient time and effort in proving the business case for convergence and integration to their customers. Until they do, all their efforts to promoting it will fall on stony ground. It may require more successful partnerships and alliances between manufacturers to reach the targets set above. Certainly, more care on delivery is required to maximize opportunities. Suppliers who are prepared to offer their solutions through managed services will be welcomed by customers.