In this Research Note, we examine several of the European startup firms addressing elevator maintenance solutions and services. This analysis covers the business models, stakeholders, funding and acquisitions of WeMaintain, Digital Spine and Uptime, accompanied by Memoori’s own assessment of these startups.

The lift and escalator industry has been shaped by a small number of key OEM players - Otis, Schindler, Kone and ThyssenKrupp – who have all introduced digital tools and technology-enabled solutions for the maintenance and service business of their installed base.

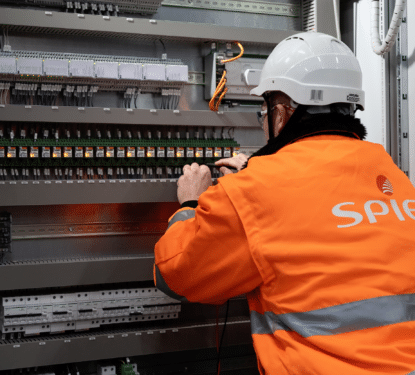

However, they are now being challenged by a raft of independent new entrants who claim to disrupt the notion that only elevator OEMs can maintain their own brand and are providing facility owners and operators with data-driven maintenance solutions based on increased performance and at better prices.

WeMaintain, a Paris-based French startup founded in 2017 is one of the most mature new entrants. The company launched in the UK in 2020 and is currently rolling out its facilities maintenance offerings in APAC markets, through a Singapore office. They have received around $40 million in disclosed funding with a Series B $36 million growth funding round in June 2021. Some of the world’s largest asset owners, such as Allianz, WeWork, the London DLR, and BNP Paribas are clients of WeMaintain in Europe. With a team of over 110 people, they have deployed their in-house IoT solutions in over 1,000 buildings.

Memoori Take: WeMaintain’s primary offering is focused on lift & escalator work. However, their goal is to apply this approach to maintenance of other critical building equipment such as fire and life safety systems. The acquisition of Shokly in 2021 has enabled them to roll out this offering in France and the UK.

Digital Spine, the Berlin-based proptech company is a German new entrant founded in 2020. Their cloud software and IoT-based smart devices are enabling a platform-as-a-service business model and making elevator data increasingly transparent for predictive maintenance and increased elevator operation. In July 2022, the firm completed a Series A financing round with new investors Join Capital and Phoenix Contact Innovation Ventures together with existing investor Goldbeck Family Office. With this round, they are aiming to capture market share in the DACH region. Digital Spine has increased its customer base to a three-digit number and was also able to double its Contracted Annual Recurring Revenue (CARR) every month in 2021.

Memoori Take: With a strong strategic investor aiming to further extend their footprint in the building automation market, Phoenix Contact Group, a global manufacturer of electrical connection products and industrial automation systems, is planning to partner Digital Spine with their own operating units.

Uptime, another Paris-based French startup founded in 2016 is a developer of predictive maintenance technology for independent elevator service providers. Uptime claims to have developed the only multi-brand device that connects directly to the lift control board, with a single cable. They collect more than 7,000 events per day per lift, in real-time. Their IoT device detects faults and weak signals before a failure occurs, to obtain precise information on the elevator components, and then to provide appropriate maintenance recommendations to technicians. They have raised more than $11 million in external investment through two funding rounds. Uptime is currently used by more than 200 companies in France and the UK. In 2021, they signed contracts to deploy their IoT devices on more than 20,000 elevators with independent service providers across Europe. The company plans to expand into multiple countries by equipping 100,000 elevators by the end of 2023.

Memoori Take: Uptime’s business model to support key Independent Service Providers in each European market with their technology is proving to be a smart move, as these firms are gradually eroding the maintenance portfolios of major players in the sector.

Other European new entrants addressing the maintenance of elevator fleets, include Simplifa, the digital property manager for elevators, founded in 2013 in Berlin, Germany and View Elevator, Austria, the developer of LiftBook, a digital elevator management solution covering operational control and condition-based maintenance, which is manufacturer-independent.

CreditSuisse Global Elevators & Escalators research has estimated that 63% of lifts worldwide are maintained by companies independent of major manufacturers. The four main lift companies are losing maintenance market share, dropping from 43% in 2012 to 37% in 2020 of the installed lift base, with independent service providers rapidly gaining contracts.

Startups, therefore, have seen a market opportunity to enter this business by offering real-time data to monitor safety, increase performance and modernize the outdated elevator experience, while the availability of transparent information strengthens trust between building managers and elevator service providers.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.