In this Research Note, we examine the fire and security business of Halma plc and the financial results for their Safety Sector, year ending 31 March, announced on 16th June 2022. This analysis is based on financial releases, investor presentations and the 2022 Annual Report.

Halma is a group of around 45 life-saving technology companies with FY2022 revenue exceeding £1.5 billion. One of three broad sectors in which the UK public company operates, Halma Safety Sector protects commercial, industrial and public buildings through fire safety systems and sensors for security, elevator safety and access control. Established through the acquisitions of Apollo Fire Detectors, Advanced Electronics, FFE and Firetrace businesses, the sector benefits from a long-term focus on the fire detection market, with a strong presence in the UK and Europe.

Their sector strategy is to grow and acquire businesses in high-value niche markets with high barriers to entry and with global reach in selected market areas of fire and security, as previously outlined in our 2020 article.

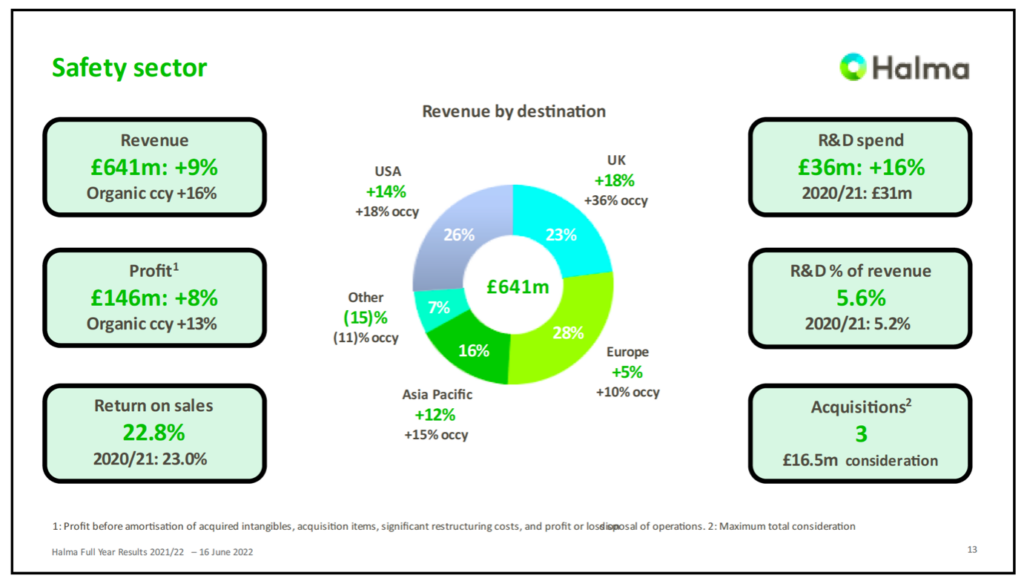

The largest of three sectors of the UK listed company, the Safety Sector accounted for 42% of group revenues, reporting £641.4 million in FY2022. The sector saw robust growth, with revenue increasing by 15.9% on an organic constant currency basis. The reported revenue growth was 9.3%.

Sector profit increased 8.1%, or 13.3% on an organic constant currency basis, and return on sales was 22.8% (2021: 23.0%), reflecting higher technology costs and an increase in R&D spend to 5.6% of revenue (2021: 5.2%).

The Safety Sector made 3 acquisitions in the year for an aggregate consideration of approximately £16.5 million. Halma acquired the Ramtech group of companies in August 2021 for a cash consideration of £15.7 million, on a cash and debt-free basis. Ramtech is headquartered in Nottingham, UK, employs 65 people and supplies wireless fire systems for temporary sites, primarily in the construction markets. Ramtech's audited revenue for the year ended 31 March 2021 was £9.3 million. The addition of Ramtech, alongside Argus and Apollo, strengthens Halma’s presence in the fire detection market and provides opportunities for the companies to collaborate and learn from one another.

Two further small bolt-on acquisitions were completed in April and May 2021, including Argus Security’s purchase of its Italian distributor, IBIT, for €0.6m (£0.5m).

In August 2021, Texecom, a UK-based provider of electronic security products and services, was divested by Halma for a total cash consideration of £64.8 million on a cash and debt-free basis in a management buyout supported by LDC, a UK-based mid-market private equity investor. Texecom, headquartered in Lancashire, UK, manufactures and supplies intruder detection and mass notification solutions to the commercial, industrial and high-end residential markets. It also uses digital and cloud-based technology to provide integrated security and building management systems. The business reported revenues of £33.4 million, the year ending March 2021 and employs more than 380 people across its manufacturing facilities in Haslingden and Delph, and international offices in India, China and Spain. The rationale for the disposal was to exit from a market which did not offer sustainable growth and returns.

Halma’s Fire Detection sub-sector is the largest business line of the sector, protecting more than 5,000km2 of buildings from fire hazards with networked fire detection systems, cloud-based fire compliance and software support services, wired and wireless fire detection components. The Safety sector has six further sub-sectors; Fire Suppression; Industrial Access Control; Elevator Safety; People and Vehicle Flow; Safe Storage and Transfer; and Pressure Management.

The strong performance in FY2022 was led by substantial growth in Fire Detection, which had been most affected in the first half of last year by lockdown restrictions and the furloughing of customer employees, with the subsector benefiting from the easing of lockdown restrictions and the resumption of construction activity. Growth in the Safety sector was strong and reflected high rates of organic growth, driven by a strong performance in UK Fire Detection, more than compensating for the negative impact from the disposal of Texacom.

Memoori expects that Halma’s fire detection revenues will continue to accelerate as the group invests in digital solutions and a common technology core to support IoT product development.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.