The Building Internet of Things (BIoT) is expected to become one of the top 5 markets for the Internet of Things. It is still in its early formation stage but the investment that it has attracted to develop new products and apply leading edge technology shows that it has the backing of both leading technology companies and the investment business at large.

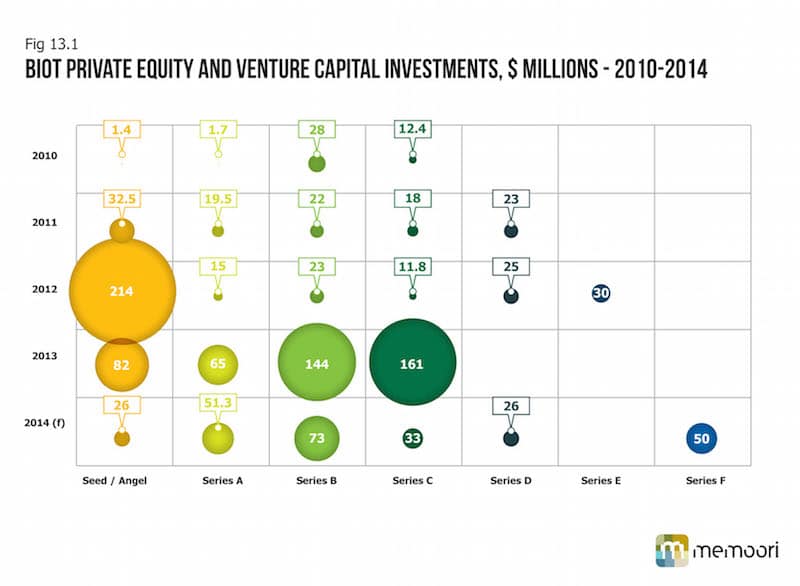

Over the course of the last 4 years we have tracked a total of 114 investment deals relating to the BIoT with funding rounds ranging in value from $1 million to over $126 million. There is a strong correlation between the development of IoT (along Gartner’s hype curve) and an almost exponential rise in deal value year on year in the 5 years analyzed by this study.

IoT is clearly not only a hot topic, but a hot investment opportunity; not only for VC's but also for the various players across the supply chain.

In the BIoT market, investment has been driven mainly by venture capitalists looking to capitalize on the projected growth in the market. Deals of this nature either seek to improve the performance of the target company or are ventures gambling on the success of a particular technology’s ability to win out in the IP race that is helping to drive the IoT market.

Over the course of the last 4 years we have tracked a total of 23 acquisitions ranging in value from $3.7 million to over $3Bn. Deals can fall into several different categories, but we have classified each by primary driver as shown below;

Technology Driven Acquisitions

The vast majority of acquisitions made over the period (13) have also been made in order to gain access to a particular technology. Be that in order to gain new IP around connectivity as seen in the Amtel purchase of Newport and ARM’s acquisition of Sensinode, or software giants obtaining device tech to access particular vertical markets, as seen in Google’s acquisition of Nest, and Samsung’s acquisition of SmartThings.

Strategic Acquisitions

The 4 strategic acquisitions we monitored have been orientated mainly through desire for improved market share, and access to a wider customer base, but also by the desire to realize costs savings. They include Vivint’s buyout of Meter Solutions in 2010, and IBM’s acquisition of Tririga in 2011 and Silicon Labs acquisition of Ember in 2012.

Vertical Integration Acquisitions

Such deals have often been motivated by the need to access new technologies, or close knowledge gaps in respective organizations IoT supply chain. The 3 deals tracked were Amtel’s acquisition of Ozmo Devices in 2012, CommScope’s acquisition of Redwood Systems in 2013 and Linear Tech’s deal with Dust Networks in 2011.

Geographical Acquisitions

Due to the fact that the majority of BIoT service provision is largely geographically agnostic and does not rely on complex supply chains, it’s perhaps not surprising that we only picked up 2 deals that were primarily motivate by access to new geographic markets. The major deal in this area was Huawei’s acquisition of Neul, the UK based IoT pioneer, which we see as being as much of a play to access the UK and European markets as a technology play.

IPOs

We have only noted one IPO relevant to the BIoT market, that of Control4. The Salt Lake City-based maker of hardware and software for automation in the home, offices and entertainment buildings raised $64 million in its IPO, offering some 4 million shares at its midpoint target price of $16 per share. That set the company’s overall valuation at about $400 million, far higher than its initial valuation target of $225 million set in its July 1 S-1 filing with the U.S. Securities and Exchange Commission.

While venture capital financing into the BIoT is heavily concentrated at the seed / Series A stages it is by no means an immature investing concept. As shown in the chart above, a growing number of deals are taking place in the latter investment stages, (Series C+), indicating the growing maturing and success of some of those receiving investment.

The $50m series F funding by Temasek Holdings into Jasper Wireless indicates the faith being shown by funders in firms that show genuine market potential.

We expect this upward investment trend to continue in 2015, as innovative companies with niche market propositions and vertical market incumbents with sector specific skills and client bases are snapped up by larger IT market players. Investment will continue to be a mix of private and corporate funding in the BIoT market. Intel Capital, and Cisco Investments in particular already have a track record for supporting innovation in the market, with investments in software, cloud, Wi-Fi, sensor and analytics start-ups.

In fact Cisco Investments, announced in April 2014 that it is allocating a further $150 million over the next two to three years to fund early-stage companies and further foster innovation in the global startup community, much of which we expect to be dedicated to IoT orientated firms. We expect others including Microsoft, Samsung, Qualcomm and GE to follow suit.

For a comprehensive overview of the BIoT market opportunity, buy our research report - http://memoori.com/portfolio/internet-things-smart-buildings-2014-2020/