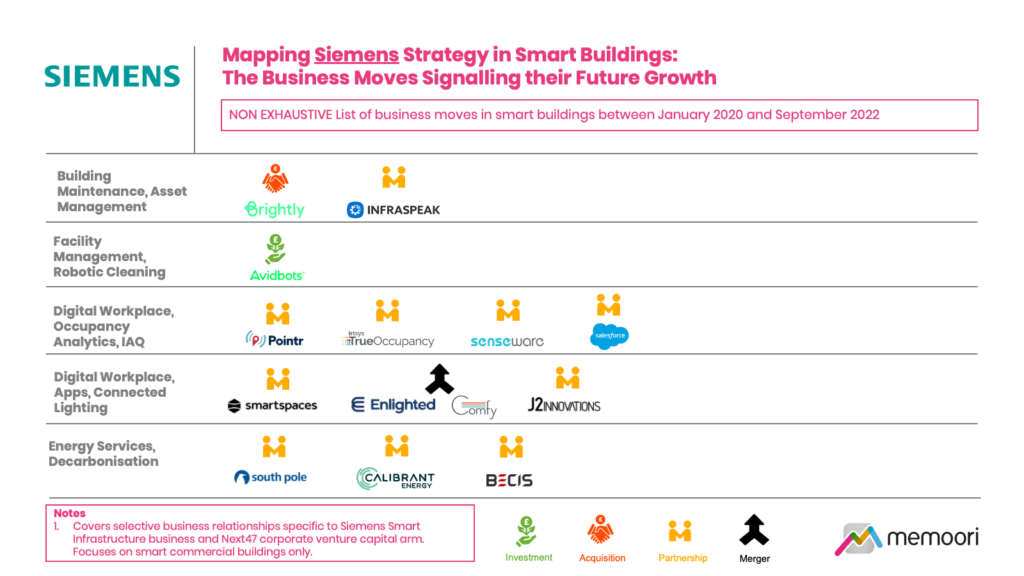

This Research Note examines the emerging strategic priorities of Siemens in the smart commercial buildings space. We have mapped acquisitions, mergers, strategic partnerships and investment activity to ascertain the Siemens Smart Infrastructure division's growth by categorizing the various business relationships by technology and investment type over a 3-year period. This article, Part 1 of a 2-part analysis, is intended as a non-exhaustive indicator of Siemens’ strategic direction between January 2020 and September 2022.

The Buildings business of Siemens is focused on accelerating growth in digital building operations through software acquisitions, investments and co-innovation with partners for their new Building X smart buildings SaaS software suite, previously covered in our July Research Note.

Their Xcelerator platform and marketplace, announced in parallel with Building X, is an ecosystem of technology partners bringing together hardware, software and digital services from Siemens’ various portfolios as well as a range of certified third parties in order to make digital transformation easier, faster and scalable.

Our strategy mapping exercise highlights 16 partnerships, 3 acquisitions, 1 merger and 3 venture capital investments of relevance over the last three years.

The commentary below highlights some of the key investments and partnerships in the Building Maintenance, Facility Management, Digital Workplace and Energy Services sectors.

Building Maintenance, Asset Management

Siemens Smart Infrastructure announced its largest building technologies acquisition to date in June 2022: the purchase of Cary, NC based Brightly Software, a provider of cloud-based asset and maintenance management software for $1.575 billion. With $180 million in revenues and 800 employees, Brightly Software offers CMMS, EAM, Strategic Asset Management, IoT Remote Monitoring, Sustainability and Community Engagement software and services for clients in the education, healthcare, public infrastructure and manufacturing sectors. More details can be found in our July Research Note.

In June 2022, Infraspeak, a Portuguese startup offering an intelligence maintenance management platform, announced the integration of its software with Siemens Desigo CC BMS. Data collected by Siemens Desigo CC is shared with Infraspeak meaning that whenever an asset faces a potential issue, it is flagged, before a work order is automatically created, helping to meet predefined SLAs.

Facility Management, Robotic Cleaning

Next47, the corporate venture capital unit of Siemens, participated in a $70 million Series C funding round of Avidbots in September 2022. The Canadian startup has developed Neo, a robotic floor cleaner widely deployed in airports, warehouses, manufacturing sites, malls, universities, and other high-traffic commercial environments.

Digital Workplace

Siemens announced in April 2021 that it was merging its two previously acquired subsidiaries, Comfy App and Enlighted into one entity under the leadership of the Enlighted CEO. The rationale for the merger was the combined view of data and insights that each company could bring to workplace management. In September 2022, Enlighted reinforced this merger with the launch of a new portfolio of IoT building solutions, which combine cognitive environmental IoT sensors and lighting controls that connect to intelligent workplace experience apps. They also announced a strategic partnership with J2 Innovations, another Siemens subsidiary acquired in 2018, to integrate J2’s FIN Framework with Enlighted’s portfolio.

Pointr, a UK startup offering indoor location technology and a mapping platform, announced in July 2022 that it was a certified third-party partner for the Xcelerator platform, chosen during the first phase of partner selection. Pointr’s SDK has already been integrated into Siemens’ workplace technology solution, Comfy. Pointr’s positioning technology is hardware and software agnostic, enabling the solution to be quickly integrated with the Comfy app and Enlighted sensors, to accurately detect a user’s position within 1-3 meters.

In a somewhat surprising alliance between Siemens Middle East and a Workplace Experience platform competitor to Siemens Comfy App, a strategic partnership with Smart Spaces, a UK startup offering a smart building operating system and app was announced in November 2021. Siemens will integrate the app at the University of Birmingham’s Dubai campus with its Enlighted IoT sensors to detect space occupancy and utilization and help users navigate the campus. The app will also be linked with the Siemens Desigo CC Building Management System so that users can control their personal environment in certain spaces.

Energy Services, Decarbonization

Siemens Smart Infrastructure and South Pole, a Swiss climate solutions provider and carbon project developer, announced a partnership in August 2022 to offer a full range of solutions and financing models for companies with the aim of reducing energy-related emissions. Drawing on their respective areas of expertise, Siemens Smart Infrastructure and South Pole will provide companies with advisory services – from setting emission reduction targets, and developing strategies to get there, to monitoring and reporting on compliance, renewable energy procurement, as well as support with implementing company or site-level plans, including the financing and delivery of decarbonization projects.

Part 2 of this Research Note, will be published next week, and examines the emerging strategic priorities of Siemens in Building Management Systems, IoT platforms, Smart Windows, Data Center Cooling, Enterprise Security and Life Safety sectors.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.