This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.

In the first quarter of 2021, Memoori recorded 58 acquisitions in the Smart Buildings space, continuing the trend in the acquisition of IoT technology to enhance the workplace experience of building occupants and to sense, control, visualize, monitor and predict a range of operational parameters to improve building performance. This article provides a snapshot of some of the notable acquisitions in the building automation, IoT, proptech and smart home sectors during the quarter.

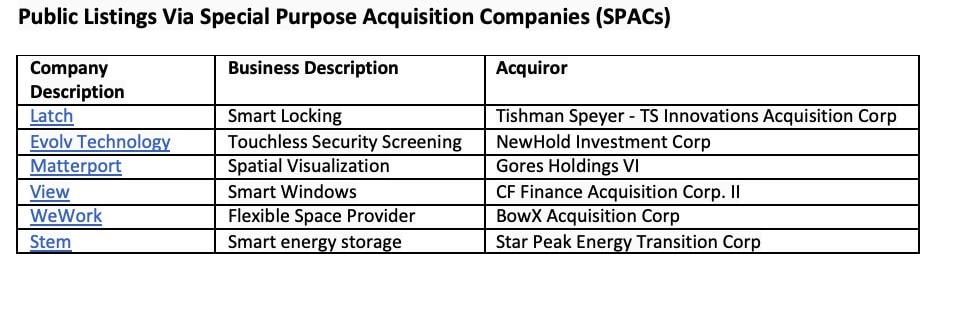

In the smart buildings space, we have already seen 6 VC-backed companies going public via SPAC this quarter, confirming our previous supposition that this route will provide alternative exit opportunities for companies in the smart buildings space.

PropTech and Workplace Management Software

Building Engines, a provider of building operations software for commercial real estate (CRE), announced its acquisition of Ravti, a proptech startup founded in 2012. The company’s software manages HVAC maintenance programs, emergent repairs, scheduled repairs, capital replacement and capital expenditure management, enabling property owners and real estate organizations to reduce deferred maintenance issues in triple net properties that can delay leasing, improve asset visibility and the bottom line. Ravti will form the foundation of a new HVAC management module in Building Engines’ Prism, a building operations software platform for CRE managers.

MRI Software, a leading player in real estate software, announced its intention to acquire Manhattan, the real estate and workplace solutions division of Trimble, based in California. The acquisition aligns with the strategic expansion of MRI’s corporate occupier business, giving clients a 360-degree view of their workplace and simplifying the complexities of managing diverse portfolios. Additionally, the acquisition enhances MRI’s Integrated Workplace Management System (IWMS) offering with workplace scheduling and facilities management capabilities, complementing its lease accounting and administration offering.

VTS, a proptech startup offering a leasing, marketing, and asset management technology platform, announced it had agreed to acquire Rise Buildings, a workplace mobile app provider that integrates multiple real estate systems to enhance the tenant experience of commercial real estate. Used by landlords including Blackstone, Hines, and CIM Group, the acquisition will broaden VTS’ existing offerings and is the next step in their strategy to digitize the tenant experience and provide landlords with a full-service platform.

Building IoT

Turntide Technologies, the company responsible for a sustainable electric motor with digital DNA, acquired Riptide, a cloud-based building automation software company. The acquisition of Riptide's building automation solution will accelerate the development of Turntide's BOS (Building Operating System) platform. Turntide plans to extend its platform to office buildings, retail locations, schools and more. Riptide's application currently helps customers manage over 50 million square feet of space. Santa Barbara, California-based Riptide was founded in 2012 by former management at Cisco Systems Smart Connected Buildings group. The company was a Memoori Startup To Watch in 2017 and attracted a minority stake from Daikin in 2015.

Allegion plc, a global security products and solutions provider, has acquired technology startup Yonomi. Founded in 2013, Yonomi is a provider of IoT Cloud platforms, which creates an agnostic smart-home ecosystem that automatically discovers and coordinates devices. The acquisition of a 25 employee company is at first glance not significant; however Allegion augments its capabilities through this first acquisition of a pure software player and intends to develop the platform to support their global businesses, assisted by their capital and software development resources.

Significant Acquisitions by Private Equity Firms

Funds advised by Triton agreed to acquire ACRE, a leading security solutions provider based in Dallas, USA and Dublin, Ireland. Triton will bring industry expertise and additional capital to support ACRE’s buy & build strategy, which includes previously acquired brands - Vanderbilt, Open Options, RS2 Technologies, Comnet, and Razberi. The financial terms of the transaction were not disclosed.

Resurgens Technology Partners announced a strategic investment in Pennsylvania-based EnergyCAP, Inc. This investment marked Resurgens’ sixth platform investment and eleventh acquisition, continuing to build on the firm’s momentum of partnering with lower middle-market businesses with a focus on application and IT/infrastructure software. EnergyCAP’s solution, which includes its industry-leading software and complementary services is used by more than 2,100 organizations across government, education and commercial sectors to streamline utility bill accounting and energy management.

Vista Equity Partners announced a significant strategic growth investment in AlertMedia, a US provider of emergency communication software and threat intelligence solutions. A source familiar with the matter says the investment totals $400 million. The Austin-based company has previously raised about $57 million in venture capital from investors including Silverton Partners, Next Coast Ventures and JMI Equity.