Memoori has been charting Merger and Acquisitions in the world of Physical Security Manufacturing for the last 15 years and whilst it has been a continual roller coaster ride during that time, we have never experienced before such a dramatic rise in value of deals as we have in the first two months of 2016.

The total value of M&A expenditure reached $21.531 billion in 7 deals. This excludes the merger between ADT and Protection 1 for $6.9 billion because it does not fit within our definition of a Physical Security manufacturing business in the commercial market.

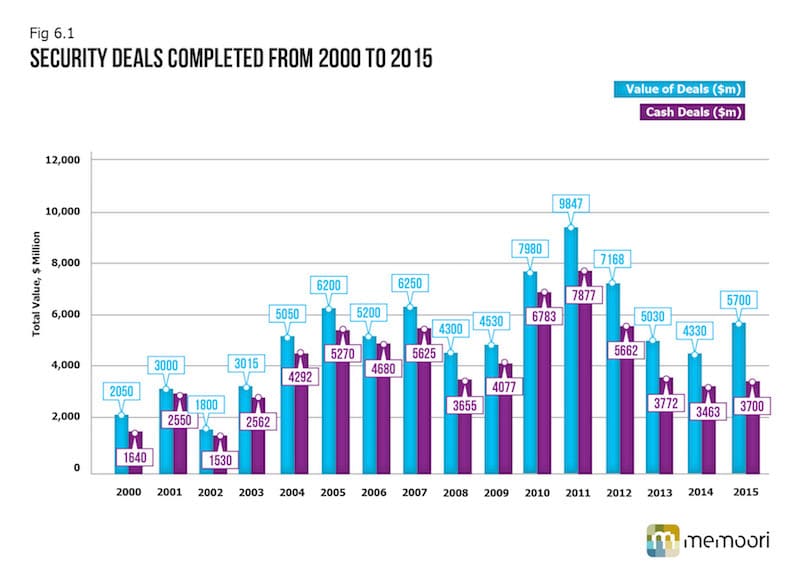

To put this in perspective the average annual expenditure on M&A over the last fifteen years is around $5.09 billion, which is only around 24% of the investment made in just the first 2 months of 2016. As you can see from our graph above, the peak year of 2011 reached $9.847 billion, which is less than 50%.

This mammoth leap forward is basically the result of just one deal, the $20 billion merger between Johnson Control and Tyco which accounts for 93% of the total M&A investment.

As big a deal as this is, we don’t believe that it will have a major impact on the product market for security equipment but could strengthen the combined Tyco / Johnson Controls solutions business, bringing together expertise across other BAS services. This takes a contrary position to Honeywell who recently announced that they are interested in selling their total solutions business across all BAS services.

Last year the value of deals reached $5700 million with Axis Communications being acquired for $2800 by Canon and the merger of Kaba Holdings and Dorma Holdings. The first shocked the market with an offer of $2.8 billion cash, which delivered an exit value on revenue of 4 and an exit value on EBIT of 45.

The world’s largest camera maker offered 340 kronor per share, almost 50 percent more than the stock’s closing price. The merger of Kaba Holdings and Dorma Holdings was the second mega deal and together these accounted for more than 80% of the total value of acquisitions in 2015, but this is still down by 40% on the peak year of 2011.

So what does the past history tells about the future size, direction and impact of mergers and acquisitions on our industry? The last three years has shown that there is a much stronger drive for acquisition to be an internal matter driven by the need to acquire leading edge technology, expand geographic scope and extend across the different branches of physical security.

Six of the seven deals so far this year follow this trend with the Tyco / Johnson Controls deal looking more like a marriage of convenience. We expect that this trend will continue whilst the conglomerates decide to opt in or out of the systems solution business.

[contact-form-7 id="3204" title="memoori-newsletter"]