This Report is an In-depth Study Providing a Detailed Assessment of the Growing Influence of Mobile Apps on the Commercial Workplace Environment.

Vendors in the fragmented workplace experience market are adopting various strategies to expand their businesses, including M&A, funding, investments, and strategic partnerships.

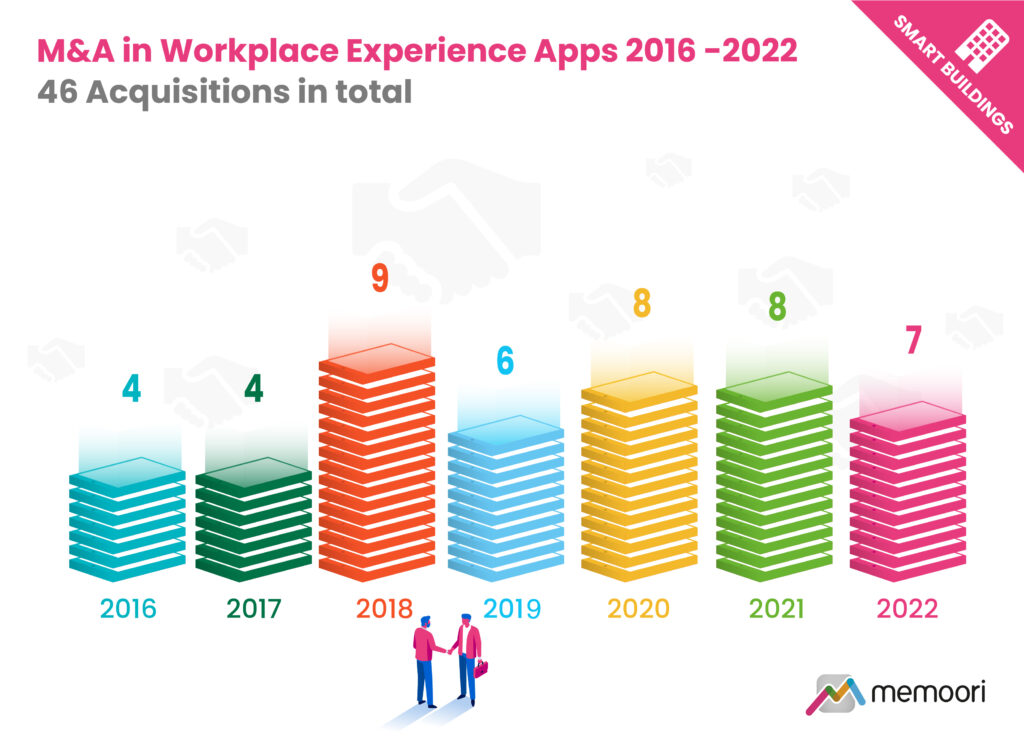

This new research estimates the global market size and identifies dozens of mergers and acquisitions in the workplace app space over the last seven years, providing strong confirmation of the recent emphasis on user-centricity in office buildings and the role that occupant experience is now playing in the hybrid workplace.

WHY DO YOU NEED THIS REPORT?

- Discover why the Global Workplace Experience Apps market in the commercial office space is estimated at $0.8 Billion in 2022, rising to $1.73 Billion by 2028, growing at a rate of 13.8% CAGR. This represents a downgrade from our previous growth assessment, as challenging market conditions facing the CRE sector act as a double-edged sword for ongoing investment into occupancy analytics and workplace experience solutions.

- Tenant experience platforms are increasingly being augmented and expanded to address landlords’ needs to strengthen tenant relationships and drive operational efficiencies in one unified platform.

- Tenant experience app vendors are addressing both space-as-a-service / coworking operators and traditional office building operators and there is a convergence between the two.

This report covers all the key drivers, barriers, use cases, and applications that shape the workplace experience market, as well as charting all major mergers, acquisitions, investments, and funding in the space. Through comprehensive analysis, the report estimates the size of the workplace apps market today and forecasts its future growth.

This report is the second instalment of a two-part series covering Workplace Technology. Part 1, covering Occupancy Analytics & Location-Based Services was published earlier in Q2 2023. Both these reports are included in Memoori’s 2023 Premium Subscription Service.

WITHIN ITS 108 PAGES & 23 CHARTS AND TABLES AND 3 SPREADSHEETS, THE REPORT FILTERS OUT ALL THE KEY FACTS AND DRAWS CONCLUSIONS, SO YOU CAN UNDERSTAND EXACTLY WHAT IS SHAPING THE FUTURE OF COMMERCIAL OFFICE SPACE;

- Established players and startups are merging as they join forces to extend their reach or scale up to gain critical mass, however, this is still a very fragmented market with significant scope for further acquisitions.

- Workplace technology deals account for a significant proportion of transactions in the smart buildings space in 2021 and 2022. These acquisitions and investments are indicative of a buoyant workplace technology market accelerated by the changing needs of landlords and tenants in a return to the office.

- As the digital workplace takes shape in businesses worldwide with a revised set of working styles, whether it be remote working, hybrid working or flexible working, this change will necessitate an enhanced toolset which includes a mobile app.

At only USD $2,000 (Enterprise Wide License) this report provides valuable information to companies so they can improve their strategic planning exercises AND look at the potential for developing their business through merger, acquisition and alliance.

WHO SHOULD BUY THIS REPORT?

This timely report will help all investors and stakeholders engaged in commercial real estate to understand this nascent, rapidly evolving market which has accelerated in the last two years, driven by new hybrid ways of working necessitated by the recent global pandemic.

Table of Contents

- Introduction

- The Executive Summary

- 1. Workplace Experience Fundamentals

- 1.1 Scope and Definitions

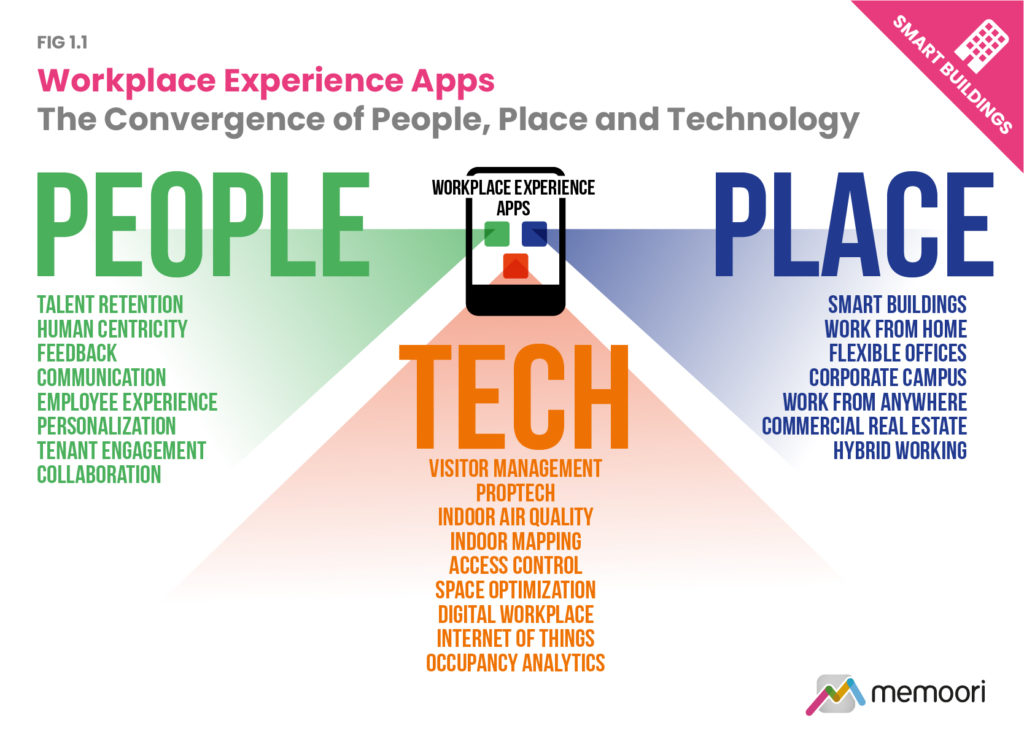

- 1.2 People, Place and Technology

- 1.2.1 People

- 1.2.2 Place

- 1.2.3 Technology

- 2. Overview of Use Cases

- 2.1 Safety and Security

- 2.2 Finding

- 2.3 Communication

- 2.4 Personalization

- 3. Apps and Platforms

- 3.1 Workplace Experience

- 3.2 Tenant Experience

- 3.3 Workplace/Tenant Experience M&A, Funding & Partnerships

- 3.3.1 M&A

- 3.3.2 Funding

- 3.3.3 Partnerships and Integrations

- 3.4 Mobile Access Control

- 3.4.1 Funding

- 3.4.2 Partnerships and Integrations

- 4. The Global Workplace Experience Apps Market in Office Buildings

- 4.1 Market Overview

- 4.2 The Global Workplace Experience Apps Market Size 2022 and Forecast to 2028

- 4.3 Breakdown of Geographic Regions

- 4.3.1 North America

- 4.3.2 EMEA

- 4.3.3 Asia

- 5. The Competitive Landscape

- 5.1 Workplace Experience Startups

- 6. M&A, Investments and Funding

- 6.1 Mergers & Acquisitions

- 6.1.1 Tenant Experience M&A

- 6.1.2 M&A by Building Automation Stakeholders

- 6.2 Venture Capital and Private Equity Investments

- 6.2.1 Corporate Real Estate Investments

- 6.1 Mergers & Acquisitions

- 1. Workplace Experience Fundamentals

List of Charts and Spreadsheets

- Fig 1.1 – Workplace Experience Apps. The Convergence of People, Place and Technology

- Fig 1.2 – Hierarchy of Real Estate Needs

- Fig 2.1 – Use Cases for Workplace Experience Apps

- Fig 3.1 – Vendors of Workplace Experience Apps and Platforms

- Fig 3.2 – Acuity Brands My Personify Mobile App

- Fig 3.3 – CXApp: Key Target Market Segments

- Fig 3.4 – Siemens Enlighted App: Office Case Studies

- Fig 3.5 – Vendors of Tenant Engagement Apps and Platforms

- Fig 3.6 – Acquisitions in the Workplace Experience Apps Market 2021

- Fig 3.7 – Acquisitions in the Workplace Experience Apps Market 2022

- Fig 3.8 – Funding of Workplace Experience Apps and Platforms 2021

- Fig 3.9 – Funding of Workplace Experience Apps and Platforms 2022

- Fig 3.10 – Mobile Access Control Vendors

- Fig 3.11 – Mobile Access Control Funding 2021 – 2022

- Fig 3.12 Microsoft Places Connected Workplace Ecosystem of Partners

- Fig 4.1 – Global Workplace Experience Apps Market 2022 – 2028 ($ Billions)

- Fig 4.2 – Workplace Experience Apps Market by Region 2022 – 2028 ($ Millions)

- Fig 5.1 – The Competitive Landscape

- Fig 5.2 – Smart Building Startups by Segment

- Fig 5.3 – Workplace Experience Startups Gaining Traction

- Fig 6.1 – M&A in Workplace Experience Apps 2016 -2022

- Fig 6.2 – VC and PE Funding in Workplace Experience Apps 2016 – 2022

Appendices

- Workplace Experience Apps / Occupancy Analytics Supplier Listing

- Mergers & Acquisitions January 2021 to May 2023

- Venture Capital & Private Equity Funding January 2021 to May 2023

Companies Mentioned in our Workplace Reports INCLUDE (but NOT Limited to);

75F | 9am | ABB | Accruent | Acuity Brands | Allthings | Appspace | Aruba Networks | AssetWorks | bGrid | Bosch | Brivo | CBRE | Cisco | Cloudbooking.com | Cohesion | Condeco Software | Coor | CountLogic | Cove | Coworkr | CrowdComfort | CXApp | Density | Desana | Deskbird | Deskimo | Disruptive Technologies | District Technologies | Eden Workplace | Enlighted | Envoy | Eptura | Equiem | Flowscape | FM:Systems | Freespace | Greetly | Haltian | HID Global | Honeywell | HqO | IBM Tririga | Igor | ilobby | Infogrid | iviva | IWG | JLL | Joan | Johnson Controls | Jooxter | Kastle Systems | Kisi | Locatee | Mapiq | MappedIn | MapsPeople | Microsoft | Modo Labs | Motorola fka Openpath Security | MRI Software | OfficeSpace Software | OpenSensors | Planon | Pointgrab | Pointr | Prescriptive Data | Prolojik | Proximity Space | Relogix | Ricoh Europe | Rigado | RightCrowd | Robin | Roomz | Schneider Electric | Sharry | Siemens | Signify | Smarten Spaces | SmartSpace Software | Spaceflow | Spaceti | Spacewell | Spaceworx | SPICA Technologies | Steelcase | SwiftConnect | Tango Analytics | UbiqiSense | VergeSense | View | VTS Rise | WeWork | Wisp by Gensler | Wx Solutions | XY Sense | Yardi

DOWNLOAD THE BROCHURE OR CONTACT US DIRECTLY TO DISCUSS ALTERNATIVE PAYMENT OPTIONS.