In this Research Note, we examine Skyfii, a Sydney-based Australian public company providing crowd analytics and occupancy management solutions to public venues and commercial properties. This analysis covers their latest financial results y/e 30 June 2022, vertical market focus, acquisitions and growth strategies.

Skyfii completed an IPO (ASX: SKF) on the Australian Stock Exchange in 2014. The company positions itself as a global omnidata intelligence company which is transforming the way organisations collect, analyse and extract value from data. They help physical venues use data to better understand visitor behaviour and improve experience.

Skyfii ingests data from a diverse range of technologies including WiFi, cameras, people counters, LiDAR, and IoT devices. They combine these datasets with contextual data such as weather, retail sales and sociodemographic data to improve operational performance for retail properties, airports, stadiums, smart cities and other public and commercial venues.

Data analytics solutions are currently provided to over 12,000 venues in APAC, EMEA and the Americas region. Skyfii is intent on expanding its global footprint in the rapidly growing omnidata intelligence sector, in which the company processes more than 11 billion data points daily. The IO platform is comprised of three core product modules; IO Connect (data collection), IO Insight (data analytics) and IO Engage (marketing tools). In addition, Skyfii launched Occupancy Now in 2021 to help measure and maintain safe occupancy and social distancing guidelines.

FY2021 revenue was AUD 15.9M (USD 11.1M), of which 61% originated in Australia. The company also operates in the United Kingdom, North America, South America and South Africa.

FY2022 Highlights

- Total operating revenues of AUD 23.6M (USD16.4M), up 49% vs FY2021.

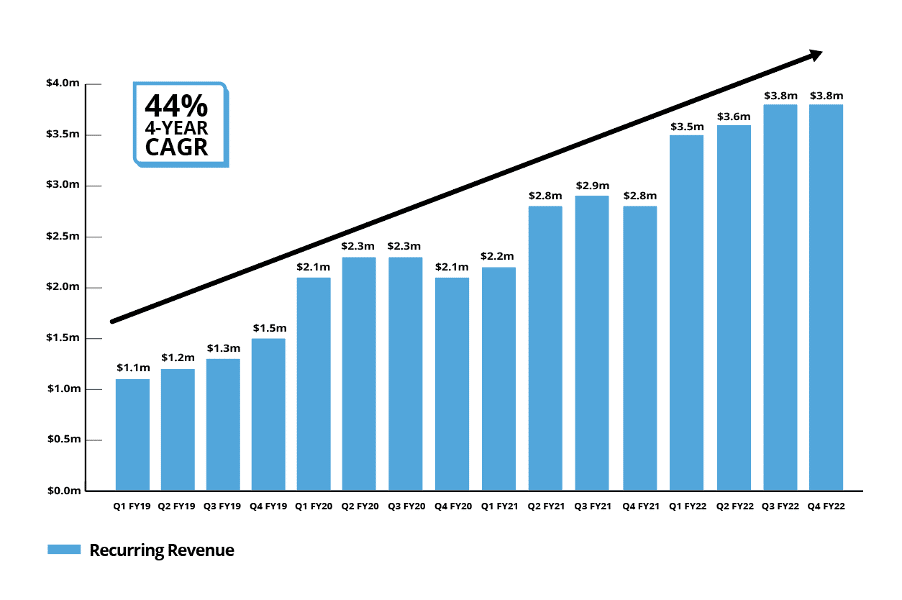

- Recurring revenues of AUD 14.6M, up 24% vs FY2021.

- Recurring revenue accounted for 62% of total revenue (74% in FY2021) due to a greater proportion of project and implementation work conducted in FY22which will lead to recurring revenue generation in FY2023 and beyond.

- Proforma Annualised Recurring Revenue (ARR) exited FY2022 at AUD 16.0M.

- Operating EBITDA loss of $1.8m and net cash outflow from operating activities of AUD 1.7M reflecting the Company’s stated investment for growth program conducted in FY2022.

FY 2023 Outlook and Strategy

- Skyfii strategy during FY 2023 is to continue business development focus on key verticals including airports, stadiums, transit hubs and quick service restaurants.

- Increasing adoption of advanced behavioural intelligence technology solutions such as LiDAR continues to drive a strong pipeline across all regions.

- Rationalisation of costs and efficiency initiatives are underway, including offshoring of talent, to deliver material cost savings and strengthen margins.

- Skyfii expects to grow ARR to >AUD 20 million during FY2023 and achieve a sustainable cash flow breakeven position during the second half of FY2023.

The company has undertaken a number of strategic acquisitions since 2019:

In May 2019, Skyfii acquired Beonic Technologies, an Australian provider of people counting technology. Through its advanced people counter and camera technologies, Beonic has helped over 600 venues across industry sectors gain a deeper understanding of traffic to, and throughout, their spaces. While Skyfii’s IO Platform already supports the ingestion and visualization of people counter data, the acquisition of Beonic allows Skyfii to augment those capabilities, and integrate with an even wider range of devices.

In September 2020, Skyfii acquired Blix, an Australian-based venue analytics business servicing small and medium format retail venues. Established in 2013, Blix offers a ‘plug and play’ solution that combines WiFi and people counting technology. Blix’s CountSmart technology counts foot traffic, measures sales conversion, manages staffing rostering and improves the overall business efficiency, strengthening Skyfii’s presence in high-value retail outlets and auto dealerships.

In April 2021, Skyfii acquired Crowdvision, a computer vision and AI-driven video analytics company, focused on airports, stadiums, transportation hubs and large-scale resort hotels and casinos. One of the key aims of the acquisition was to expand into airports; Skyfii is used in 30 airports globally and CrowdVision is in 35, more than doubling the company’s presence in the space.

Also in April 2021, a partnership with BrainBox AI enabled Skyfii customers to have the ability to rapidly optimize their occupancy data to drive significant energy savings. BrainBox AI’s solution enables the HVAC (Heating, Ventilation and Air Conditioning) system in a building to operate autonomously, in real-time, and generate up to a 25% reduction in total energy costs, 20-40% reduction in carbon footprint and 60% increase in occupant comfort. By utilizing Skyfii’s OccupancyNow tool and the direct integration with BrainBox AI, building owners can measure the occupancy of their building in real-time to drive greater efficiency and reductions in energy consumption.

Skyfii’s position as a leading provider of data driven venue analytics has been strengthened through strategic acquisitions which have broadened company offerings and extended their presence in key verticals.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.