This article was written by Daphne Tomlinson, Independent Senior Research Associate at Memoori.

In 2017, funding for startups focused on the commercial and industrial smart buildings market reached its second highest annual level since 2008 as investments amounted to $1.11 billion, according to our recent analysis, updating Memoori's 2017 Startups Report.

Although this is a decrease of 22% from the record $1.42 billion achieved in 2016, the appetite for investing in smart building startups has not diminished significantly. The number of funding rounds, 116 in 2017 was broadly the same as in 2016, indicating that investment values have decreased, rather than the number of companies funded.

Investments in IoT platforms, digitization, Artificial Intelligence (AI) and data driven software attracted the most interest from venture capital firms and a wide range of industries including building and industrial automation, real estate and facilities management and the IT and telecommunications sectors.

For example, AI and data-driven platforms for a range of smart building applications have been backed at various stages of the investment cycle in 2017:

• Seed funding from Aviva for Shepherd Network, which uses predictive analytics and machine learning to monitor connected building systems and alert users to potential losses. The SaaS platform offers anomaly detection and a predictive maintenance service that can be connected to any assets & infrastructure.

• Series A investment for Bonsai, provider of an AI platform that empowers enterprises to build and deploy intelligent systems. Backers included Siemens, ABB, Samsung and Microsoft.

• Series B funding for Foghorn Systems, a developer of edge analytics and machine learning software for Industrial Internet of Things applications. Backers included Honeywell, GE and Bosch. Rather than sending massive amounts of building data to the cloud for analysis, smart buildings can use edge intelligence for more responsive automation while reducing bandwidth costs and latency.

• Series E investment for C3 IoT, a leading AI and IoT platform for digital transformation. Engie are using the C3 IoT Platform, in one notable project: Clara Domus, a smart building solution deployed in Italy encompassing 500 connected buildings with 16,000 sensors initially, and 3500 buildings managing 160,000 sensors by the end of 2018.

Building performance software continued to gain funding last year, with notable investments in energy management and sustainability platforms (EcoIntense, Urjanet, Entic, SensorSuite).

The highest ranked investment in the smart building to smart grid interface solutions category was the $34 million Series B funding round for Advanced Microgrid Solutions, a provider of behind-the-meter storage systems for commercial / industrial buildings.

The leading VC investment in in-building location-based systems was the $45 million Series C funding round for Vayyar Imaging, the 3D imaging sensor company whose technology makes it possible to monitor people’s location and wellbeing for office automation, security and energy efficiency. Indoor positioning technologies and occupancy analytics platforms for space optimization also received a large share of 2017 investments.

While venture capital firms remain the major source of funding for startup companies, strategic investors from leading corporations are joining funding rounds and playing an important role in supporting innovation and digital transformation in the commercial and industrial buildings sector.

Strategic investors were involved in more than 30% of the funding rounds between 2008 and 2016, according to our Startups Report. Investments in 2017 show the proportion of strategic investors rose to 38%, highlighting the increased attractiveness of smart building startups to the major corporations.

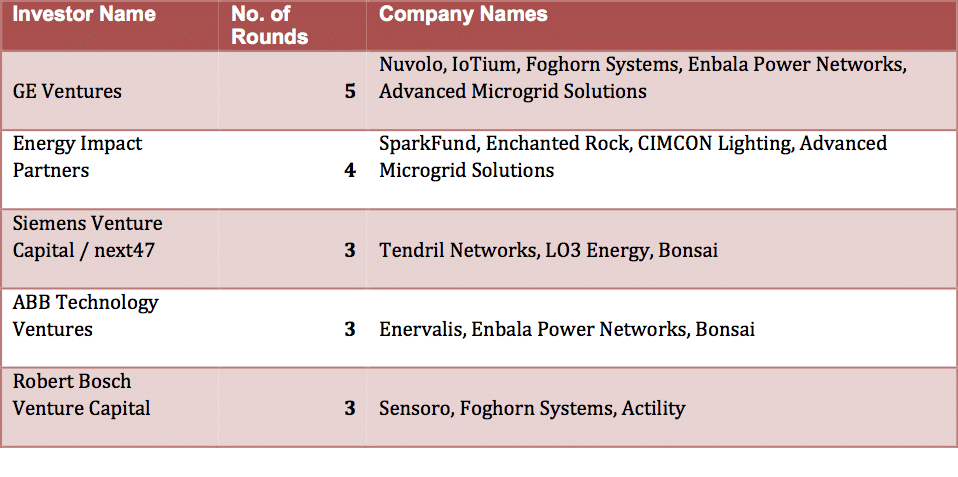

The table below lists the number of funding rounds and recipients of the top 5 smart building investors in 2017, four of whom are strategic investors.

These investments are often only part of the story; the startup is also a strategic partner, enabling access to potentially disruptive technologies and business models, while innovative solutions and services can be tested in pilot programs.

[contact-form-7 id="3204" title="memoori-newsletter"]