Despite almost two years of challenges and uncertainty posed by the COVID-19 pandemic, the global physical security market has demonstrated a remarkable degree of resilience. The pandemic is reshaping the industry, turbo-charging certain emerging business models, whilst it also continues to make our societies safer; not just from the pandemic but also from crime and terrorism. Our latest analysis of world sales of physical security products at factory gate prices indicates that they have bounced back strongly in 2021 versus 2020, growing to over $33.8 Bn and maintaining robust growth of nearly 7.2% CAGR over the next 5 years to 2026.

“We expect the physical security industry to grow 11.9% year-on-year for 2021, rising above the highs hit back in 2019. Beyond this, the companies that have adapted their offerings to exploit the ways in which the world of work has changed have done well,” says Owen Kell, Senior Security and IoT Research Associate at Memoori. “Thermal camera sales for fever screening applications have died down now, but other solutions that enable improved flexibility, remote monitoring and control and support for Covid-specific measures, such as social distancing, and increased demand for contactless and biometric technologies have all done well over the last year.”

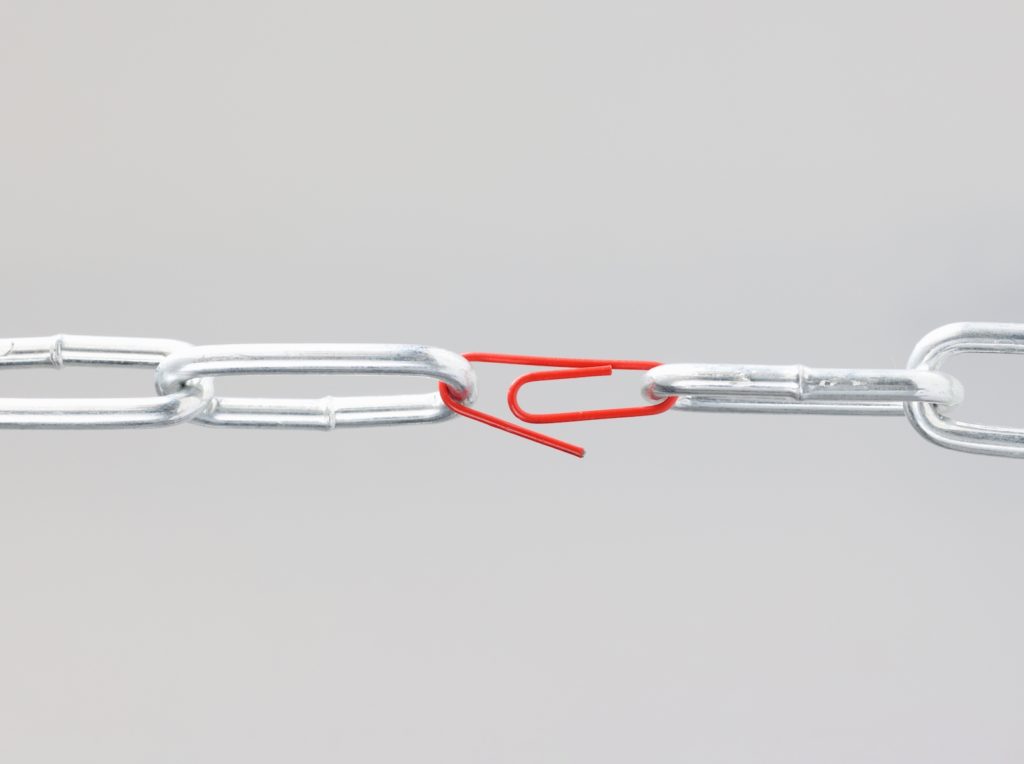

The growing demand for physical security products due to, and in spite of, the COVID-19 crisis have, however, exacerbated supply chain issues caused by the pandemic. The global electronics and semiconductor industries have suffered extraordinary disruptions due to supply chain issues and manufacturing shutdowns. A December 2020 UK survey by Axis Communications showed that as many as 41% of security industry decision-makers are concerned about their supply chains. While pressures are being felt on many industry-relevant materials and components the current pressure on semiconductor production is especially severe and influential on security and a very wide range of other technology markets.

“The pressure on semiconductor production, in particular, is both unprecedented and pronounced and that has been much discussed, but costs are also up across the board, for everything from shipping to raw materials to components, such as cases, cables, lenses, and packing materials, so it's a real issue,” says Kell, during a Secuirty InfoWatch roundtable. “These costs will eventually get passed onto customers if they aren't starting to be already. Many manufacturers and integrators have now worked through their stocks, and we're hearing a lot of murmurs of potential price rises on the horizon.”

Experts from across the logistics domain appear to be divided on when the overall supply chain challenges might subside, with predictions ranging from optimistic upturns in mid-2022 to more pessimistic estimates into 2023. For the video surveillance market in particular, the supply chain pressures are further exacerbated by geopolitical tensions due to allegations of human rights violations by the Chinese government (including over surveillance) and because of the ongoing trade war between China and the US. New legislative moves and sanctions have created a tit-for-tat trade war that significantly disrupts the flow of physical security products between the two nations, and the ability of their respective manufacturers to trade in their respective markets.

“Ongoing trade disputes between the United States and China have resulted in tariffs that are increasing cost across the industry. The impact has been so profound that the market is at risk of dividing into a two-track system, with one set of technologies, manufacturer products, systems and protocols being used in China, and a totally separate and parallel one operating in Western Nations,” reads our new report: The Physical Security Business 2021 to 2026. “Global powers are using business and international trade as economic weapons making the future of market trading conditions uncertain and more challenging for manufacturers to navigate.”

The uncertainty itself is changing the industry in many ways but perhaps none more so than triggering the sector’s decision-makers to respond by building more resilience to their supply chain. Making significant changes to established supply chains is a challenging process in any industry, and it can take decades building relationships, manufacturing facilities and logistics operations to support their legacy supply chain network. This shift to resilience, voluntary or not, symbolizes a maturing of the physical security industry as a whole. It represents a move away from the low-cost battle for market supremacy to one that gives more value to the strength and flexibility of supply but maybe also the quality of products and protection of users.

“The ‘race to the bottom’ featuring intense price competition and eroding margins for video equipment manufacturers has been the single most powerful trend shaping the market for video equipment for several years now. It has radically transformed the fortunes of many vendors, forcing many smaller operators out of the market, and everyone to reassess and adapt their business strategies and market offerings,” explains our new security report. “A series of factors, many of which relate to the wider challenges affecting the global economy, have caused stock shortages and see many professionals in the market predicting an end to the price wars and a stabilization and even possibly a steady rise in video equipment prices in the coming years.”