Trane Technologies is a global provider of climate solutions for residential, commercial, and industrial applications. The company specializes in heating, ventilation, air conditioning (HVAC), and refrigeration systems through its brands Trane, American Standard, and Thermo King. In this research note, we will examine Trane Technologies' performance and key activities in the past year, based on their March 2023 Investor Presentation and Full Year Financial Results.

Trane Technologies reported strong financial performance in 2022 with total revenue increasing by 13% to $16 billion, compared to $14.1 billion in the previous year, and organic revenues up 15%. While operating income saw a 14% increase to $2.4 billion, up from $1.84 billion in 2021. Revenue is divided 68% of equipment sales and 32% for aftermarket services. Growth in revenue and operating income was primarily driven by higher sales volumes, favourable price and mix, and ongoing productivity improvements, which helped offset higher material and other costs.

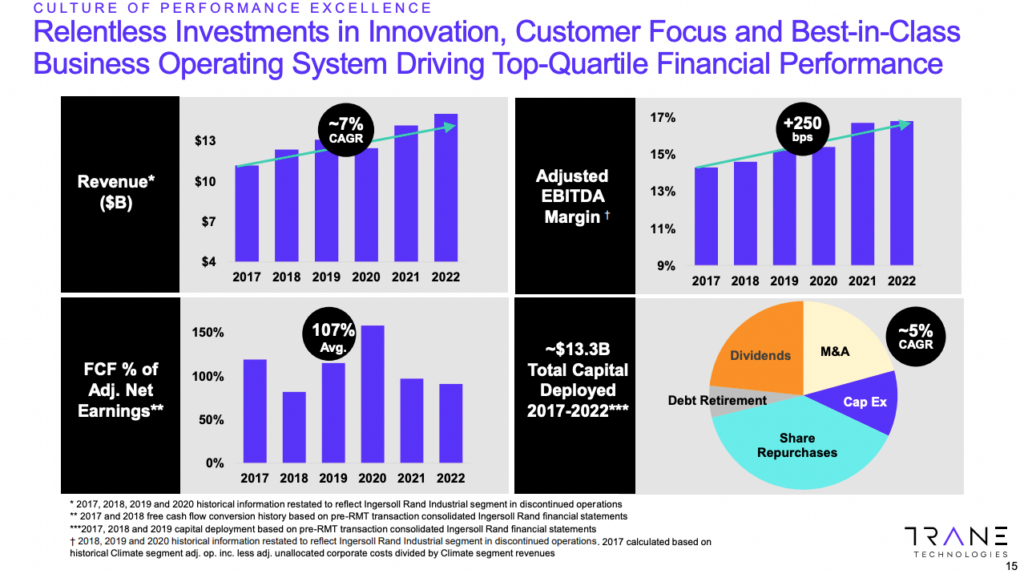

"2022 marked another year of top quartile financial performance for Trane Technologies,” said Dave Regnery, chair and CEO. “Over the last five years, we have delivered compound annual revenue growth of 7 percent, adjusted EBITDA margin expansion of 250 basis points and free cash flow as a percentage of adjusted net earnings* of 105 percent, while deploying $11.5 billion of capital. With our focused strategy, ongoing reinvestment in business innovation and uplifting culture, we are well positioned to continue delivering differentiated shareholder returns over the long term."

Trane is a global company and divides its activities into three regions; Americas, EMEA, and Asia. The Americas segment is by far the largest with net revenues of $12.6 billion, representing 79% of the firm’s total revenues. The region shows strong demand from data center, education healthcare, and high-tech industrial verticals, driving an all-time high backlog of orders. While regulatory tailwinds from the Inflation Reduction Act, ESSER education stimulus funding, and the CHIPS and Science ACT also supported the firm’s regional performance in 2022.

Continuing a long-term distribution strategy, Trane Technologies completed a channel acquisition of Philadelphia-based Tozour Energy Systems, a longtime Trane sales and service agent on April 1st 2022. Tozour is a leading regional distributor and service provider of commercial HVAC systems with more than 250 employees, further expanding Trane’s network and service area in the northeast US.

EMEA is the next most active region for Trane, with net revenues of $2 billion in 2022 it makes up 12.5% of total revenue. Demand for Trane products in the region is driven by sustainability and energy concerns following the 2030 EU Climate and Energy Framework, leading to strong sales in thermal management systems. While in Asia, which is dominated by China, gradual growth in data center, electronics, pharma, and healthcare have led to net revenues of $1.3 billion, making up 8.5% of the global total.

To support its global expansion, Trane Technologies completed the acquisition of AL-KO Air Technology, a division of AL-KO SE based in Germany, on October 31st 2022. AL-KO brings complementary, high-performing solutions to Trane’s commercial HVAC product and services portfolios in Europe and Asia. Approximately 800 AL-KO employees in Europe and China have joined the Trane Technologies team, in addition to two manufacturing sites in Germany and one in China, as well as a network of sales offices across the regions.

Trane’s s2022 results have come about despite significant challenges from the ongoing pandemic and the war between Russia and Ukraine. The pandemic has led to disruptions to its supply chain, fluctuations in customer demand, and adjustments to remote and hybrid working models. While the increased geopolitical tensions and economic instability caused by the conflict in Ukraine brought supply chain disruptions, raw materials cost increases, and volatile currency exchange rates.

Trane exited full-year 2022 with a backlog of over double historical normal and expects a strong year in 2023, forecasting revenue growth of approximately 7% to 9% and organic revenue growth of approximately 6% to 8% versus full-year 2022. Considering the company’s strong foothold in the US market, more significant growth would depend largely on international expansion strategies. So, we could expect more acquisitions like 2022’s AL-KO Air purchase to drive their activity outside North America.