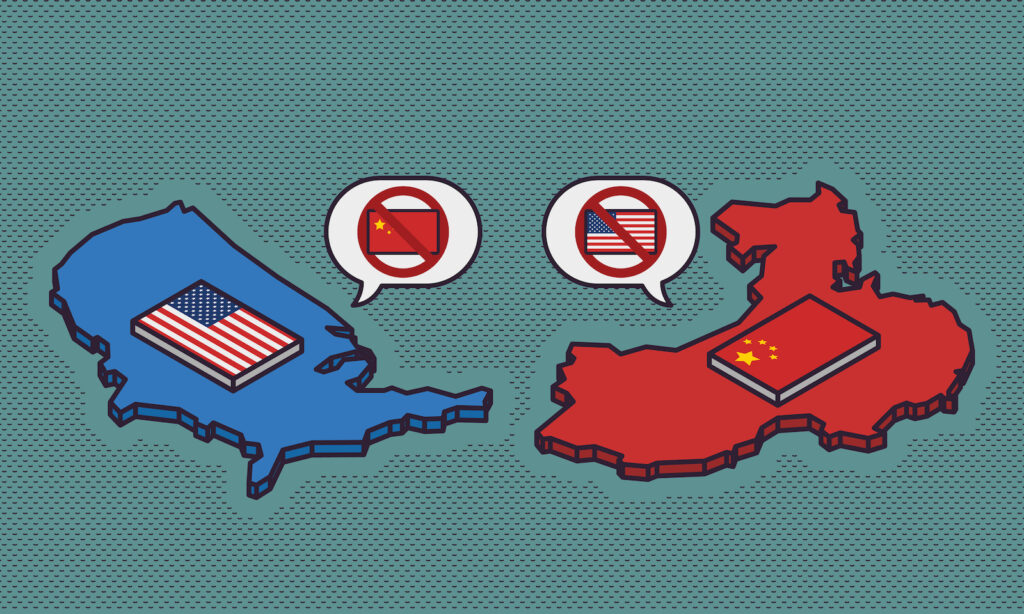

The Physical Security industry has found itself on the frontline of the US-China trade 'war' and its involvement could have significant implications for its future and the future of the wider smart buildings and cities technology markets.

“In recent years US-China geopolitical tensions within the physical security industry have escalated,” reports our latest security research. “Tensions between China and the US have seen a series of legislative moves, new sanctions, and tit-for-tat trade barriers erected that have hugely disrupted the flow of both physical security products and key product components critical to ongoing innovation between the two nations, as well as the ability of their respective manufacturers to trade in their respective markets.”

In the US, 10 separate pieces of legislation that restrict the ability of Chinese physical security firms to operate in the US —spanning national security, cybersecurity, human rights, and copyright infringement— have been created since former-president Donald Trump triggered the current trade war in 2018. While the first two of these legislative acts, the National Defense Authorization Act (NDAA) and US Entity List, were put into place by former-president Donald Trump, eight more have become law since president Joe Biden was inaugurated in January 2021, implying support for this legislative approach across government.

In China, the governing Communist Party of China (CPC), has made a series of moves that have progressively restricted the sale of foreign technology in China, particularly to government agencies, in moves that mirror those made by the US against China. However, while the Chinese domestic market for physical security is considerable, the majority of sales are directly to the government, meaning it was already relatively inaccessible to most foreign companies. Where Chinese firms do depend on US supply is in the high-end chip market, which is also under attack.

“In 2019, the Chinese government summoned representatives of major international tech firms including Microsoft, Dell, and Samsung, to warn of dire consequences if they cooperate with the US ban on sales of key American technology to Chinese companies,” our new physical security research highlights. “After the announcement of the new Foreign Direct Product Rules governing chip exports in 2021, the Chinese foreign ministry responds by accusing the US of attempting to impose a "tech blockade" on China, while its commerce ministry said such actions would undermine the stability of global supply chains.”

Complying with NDAA regulations means US physical security systems companies selling to any US federal agency must ensure that products do not incorporate any devices or components from any of the Chinese manufacturers on the sanctions lists. Compliance has already posed significant challenges for many US tech firms, particularly for those who were previously utilizing low-cost Chinese components and devices. The reshaped US market will inevitably mean higher costs for US consumers, even as US-based manufacturers continue to emerge to fill the gaps left by banned Chinese suppliers.

“The CPC has been vociferous in its condemnation of US sanctions on its tech firms. Arguing that the US government's real goal is to stifle China's growth, and that the trade war has had a negative effect on the world,” reads our in-depth market report. “A combination of political pressure from the US and increasing awareness and concern amongst European lawmakers mean that many of the same trade tensions seen in the US/China relationship are also spilling over into Europe.”

While there are no EU-wide restrictions on either Hikvision or Dahua in Europe at the present time, such discussions continue as the reputation of both companies and the Chinese market, in both commercial and political circles, has taken a big hit in recent years. European governments have taken direct action to protect their domestic semiconductor industry like it was a strategic resource, blocking takeover bids from Chinese firms, such as with Newport Wafer Fab in the UK and the Elmos Semiconductor factory in Germany. The European Commission has proposed the European Chips Act, which promises €43 billion to develop a resilient domestic sector.

Just last week, the UK government issued a directive to restrict Chinese cameras in “sensitive” buildings. The decision was made after a warning from the National Cyber Security Centre, a long period of consultation and growing pressure from politicians on all sides, and pressure from human rights campaigners Big Brother Watch. The US and the UK have instigated the ‘Five Eyes’ alliance with Australia, New Zealand, and Canada to ban all Huawei and ZTE 5G equipment in matters of national security while growing awareness of Chinese influence on the Indian physical security industry has seen contracts cancelled and officials scrutinized.

“Restrictions on Chinese physical security products sales to particular market verticals (or indeed a total bar on sales of all of a particular company’s technology) continue to increase not only in the US, but also in other Western nations,” states our brand new research report. “It seems that the geopolitical and trade tensions are set to get worse before they get better.”