The physical security industry in the first half of 2011 has well outperformed what most stakeholders had forecast; despite setbacks in economic fortunes. ‚Â Towards the end of last year optimism had returned to the market as economic trading conditions started to improve; but in the last 3 months indebtedness has come back to haunt the financial markets and the mood of optimism for world trade has been seriously set back. Despite this the physical security business has in the last 3 years proved to be very robust and now that growth has returned to the market it is not for turning. The drivers that have made the difference to our industry are still fortunately well in place. Terrorism, safety, and shrinkage issues have not gone away, but it is the adoption and application of new technologies that is playing the major part in driving the industry forward. The emerging markets have for the most part […]

Most Popular Articles

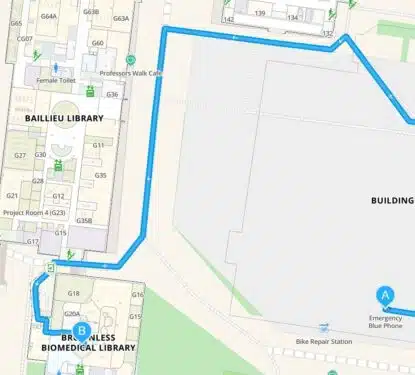

MazeMap Acquires Thing-it: Key Insights from 2025 Workplace Platform Consolidation

This Research Note examines the acquisition of the German software company Thing-it, by MazeMap, a Norwegian indoor navigation provider. We examine the development of the two startup companies prior to their merger and conclude with our perspective on the consolidation. Transaction In August 2025, Thing-it became part of MazeMap. Since then, the company reported that […]

Smart Building Tech Evaluation: Build a Framework with Me!

The smart building technology market presents a unique challenge for commercial real estate professionals: how do you efficiently evaluate thousands of technology vendors when every week brings new pitches, new solutions, and new promises? The sheer volume of vendors, from energy management platforms to occupancy analytics providers, makes systematic evaluation nearly impossible with traditional methods. […]

Johnson Controls UK Analysis: 8 Strategic Acquisitions Since 2022 Drive Revenues

This Research Note examines the major Johnson Controls UK businesses relating to building automation, fire and security systems, highlighting their latest financial data, year ending 30th September 2024. It is based on the annual reports of 3 companies, Johnson Controls Building Efficiency (UK), Tyco Fire & Integrated Solutions (UK) and ADT Fire & Security. We […]