In the first quarter of 2010 the number of acquisitions announced has grown by 50% on the same period of 2009 and has more than doubled based on the cost of buying. This trend looks set to continue for the rest of this year. Deals announced in March have significantly increased on February but have not reached the January bumper start to 2010 that had 9 deals including the Broadview Security acquisition which added $2 Billion to the acquisition kitty. We recorded 7 deals in March compared with 3 transactions in the same month of 2009. On both the metrics of volume and value acquisition activity is well up on the same period of 2009, confirming the continuing trend for growth in the consolidation process during the last 7 months. Schneider Electric has returned to the dealing table with the purchase of Zicom Electronic Security Systems one of India’s leading security companies. This looks a […]

Most Popular Articles

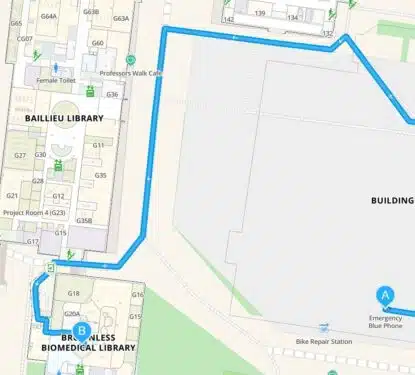

MazeMap Acquires Thing-it: Key Insights from 2025 Workplace Platform Consolidation

This Research Note examines the acquisition of the German software company Thing-it, by MazeMap, a Norwegian indoor navigation provider. We examine the development of the two startup companies prior to their merger and conclude with our perspective on the consolidation. Transaction In August 2025, Thing-it became part of MazeMap. Since then, the company reported that […]

Smart Building Tech Evaluation: Build a Framework with Me!

The smart building technology market presents a unique challenge for commercial real estate professionals: how do you efficiently evaluate thousands of technology vendors when every week brings new pitches, new solutions, and new promises? The sheer volume of vendors, from energy management platforms to occupancy analytics providers, makes systematic evaluation nearly impossible with traditional methods. […]

Johnson Controls UK Analysis: 8 Strategic Acquisitions Since 2022 Drive Revenues

This Research Note examines the major Johnson Controls UK businesses relating to building automation, fire and security systems, highlighting their latest financial data, year ending 30th September 2024. It is based on the annual reports of 3 companies, Johnson Controls Building Efficiency (UK), Tyco Fire & Integrated Solutions (UK) and ADT Fire & Security. We […]