In the last 4 years M&A activity has for the most part been driven through strategic buys, within the security industry to acquire or leverage new technology and move into horizontal product businesses in order to provide total solutions, and / or improve focus on particular vertical markets where demand is fast growing. Strategic buys within the industry have been the main driver for consolidation in 2012 but its impact is down on 2011 and this trend may well continue as companies from the ICT and Defense business and Private Equity Companies make further forays into the security industry. The proportion of external buys has increased and in 2012 accounting for 30% of the total acquisition business measured by volume. Consolidation in 2012 has therefore been more influenced by external companies buying into the physical security market than in the previous 3 years whilst conversely the internal players, particularly the major conglomerates have decided to […]

Most Popular Articles

Video Surveillance Market 2025: Ongoing Shift towards Software Drives Growth

The video surveillance industry is undergoing its most significant transformation since the shift from analog to digital. What was once primarily a reactive security tool, cameras recording footage for post-incident review, is evolving into a proactive intelligence infrastructure. The traditional model of video surveillance centered on cameras, on-premise storage and software. That era is coming […]

deskbird Raises $23m with View to Dominating Europe’s Hybrid Workplace Market

This Research Note examines the growth of deskbird, a Swiss startup offering a workplace management platform that addresses hybrid working. We explore the company’s disclosed funding and its acquisitions completed last year before highlighting one of the firm’s recent reports on the German workplace market. Finally, we provide our view on the company and the […]

MazeMap Acquires Thing-it: Key Insights from 2025 Workplace Platform Consolidation

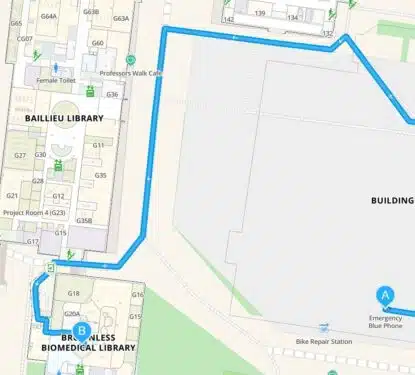

This Research Note examines the acquisition of the German software company Thing-it, by MazeMap, a Norwegian indoor navigation provider. We examine the development of the two startup companies prior to their merger and conclude with our perspective on the consolidation. Transaction In August 2025, Thing-it became part of MazeMap. Since then, the company reported that […]