The physical access control (PACS) market is continuing its transformation from a hardware-centric business focused on locks, card readers, and control panels to a software-driven ecosystem. Cloud platforms, mobile credentials, and artificial intelligence are redefining how organizations manage security, workplace operations, and building intelligence.

This transformation represents both significant opportunities and competitive threats across the entire value chain, from manufacturers and integrators to building owners and facility managers. Understanding these dynamics is critical for anyone operating in the smart building technology space.

Access Control Market Size & Momentum

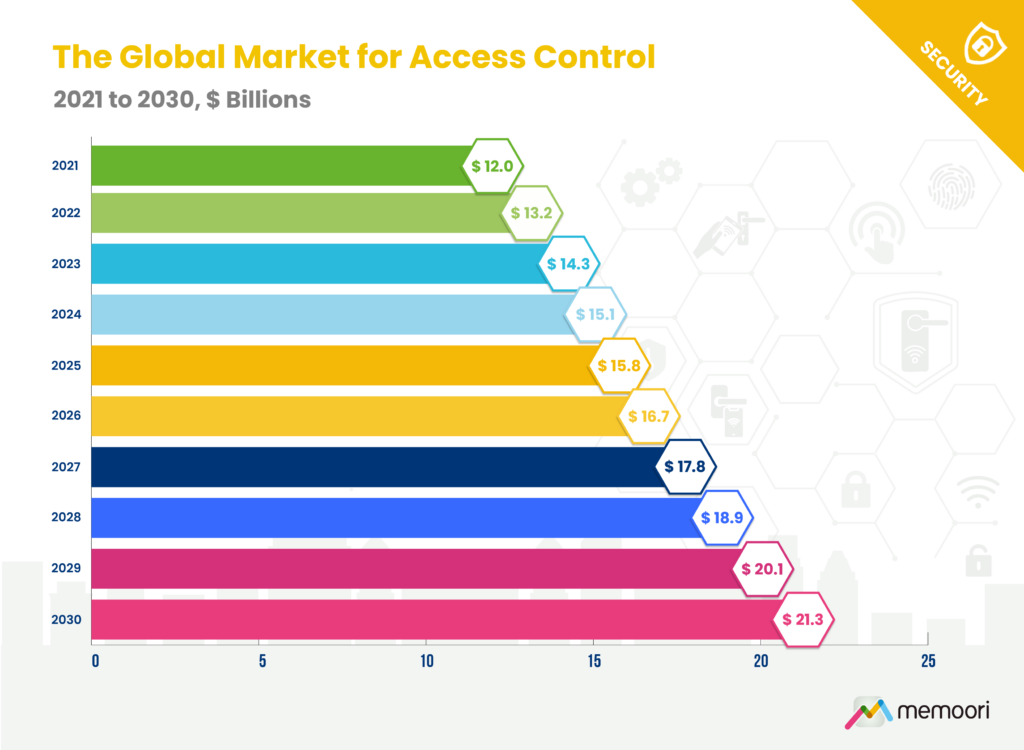

The global physical access control market reached $15.1 billion in 2024 and is projected to grow to $21.3 billion by 2030, representing a compound annual growth rate (CAGR) of 5.94 percent.

While North America and Europe have traditionally dominated the physical access control landscape, Asia Pacific is emerging as the region to watch. Our analysis indicates that Asia Pacific will overtake Europe as the second-largest market by 2030.

Group A companies (those with access control annual revenues exceeding $1 billion) collectively represent around 24 percent of global revenues. Meanwhile, Group B companies (those generating between $100 million and $1 billion annually) encompass 28 firms with average revenues of $327 million. Together, this group accounts for a substantial 64 percent, demonstrating that mid-sized specialists continue to hold significant market influence despite consolidation pressures.

M&A Reshaping the Competitive Landscape

The access control industry continues to experience consolidation. Between September 2023 and September 2025, 16 transactions totaling $7.9 billion were completed. The most notable was Honeywell’s $4.95 billion acquisition of Carrier’s access control business, a deal that fundamentally altered competitive dynamics in the market.

This M&A activity reflects strategic repositioning as traditional hardware vendors recognize that future value lies in software platforms, recurring revenue streams, and integrated ecosystems. Companies are not just buying market share; they’re acquiring technology capabilities, cloud platforms, and subscription customer bases.

Investment and Partnership Dynamics

Venture capital investment in access control platforms declined sharply from a 2021/22 peak, but significant capital continues flowing into the sector. Between September 2023 and September 2025, 12 investment deals directed over $326 million in disclosed funding into access control companies. Verkada secured $200 million in Series E funding at a $4.5 billion valuation, while Rhombus Systems raised $45 million in Series C funding. Both companies are building unified cloud platforms that integrate access control with video surveillance and environmental sensors.

These investments signal where the market is heading: toward integrated platforms that break down the silos between different building systems. Strategic partnerships between credential providers, smartphone manufacturers, and cloud platform vendors are accelerating this convergence and normalizing multi-vendor ecosystems.

The Platform Transformation

Our comprehensive analysis examines three core revenue categories: hardware (electronic locks, readers, control panels, and infrastructure), credentials (cards, mobile credentials, biometrics, and alternative formats), and software (on-premises and cloud-based platforms). Critically, the report documents how value capture is shifting.

Recurring software revenue, managed services, and cloud subscriptions are displacing traditional hardware margins. This transition from product sales to platform economics is concentrating profits in different places across the value chain. For systems integrators and consultants, understanding where these profits are flowing is essential for advising clients and positioning service offerings.

Mobile Credentials

The market is shifting away from proprietary app-based credentials toward wallet-native credentials embedded directly in Apple Wallet and Google Wallet. This enables tap-to-enter experiences without unlocking devices and supports biometric authentication by default.

This shift reduces deployment friction for organizations, improves user experience for employees and tenants, and accelerates adoption. However, it also requires infrastructure investment and navigation of competing standards. The report analyzes adoption patterns across vertical markets and quantifies what these infrastructure requirements look like.

Why this Matters?

For companies operating in the smart building technology sector, this report provides a comprehensive view of competitive positioning, market structure, and strategic dynamics. It is designed to inform business strategy development, merger and acquisition decisions, and strategic alliance formation.

The transition from hardware-centric business models to software-defined platforms will create winners and losers. Companies that understand these dynamics and position accordingly will capture disproportionate value over the next five years. Those that cling to legacy models face margin compression and strategic irrelevance.