Our new research is an in-depth analysis that maps out the global landscape of smart building AI companies, providing a clear picture of the market’s structure, and allowing the reader to assess the maturity and potential of various AI applications and identify vendors shaping the industry.

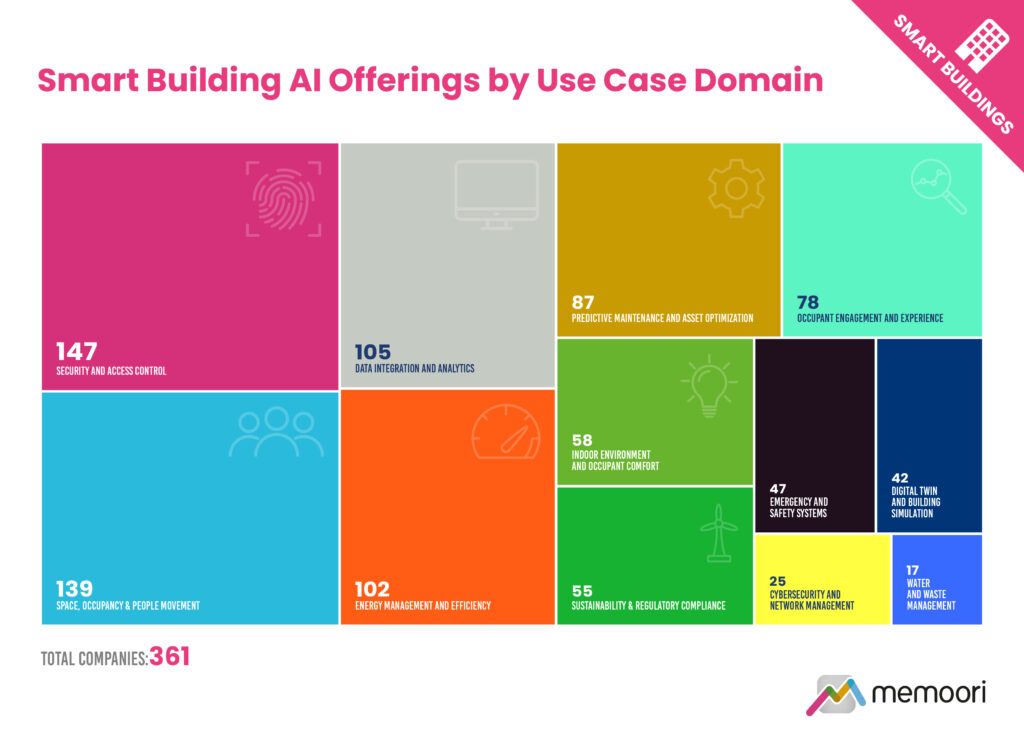

Who are the key players shaping the future of AI commercial buildings applications? The report provides a granular analysis of 361 companies that we identified as operating in the AI space, segmenting companies by use case, company age, and company size. The spreadsheet that comes with the report provides further in-depth analysis assigning companies to each of the 66 distinct individual use cases where AI is being actively developed for use in the smart buildings market.

What are the AI strategies of the major players? The report examines the strategic positioning of 17 major players whose offerings typically span multiple use cases for AI. It explores the strategies, positioning and recent innovations of leading building automation firms (e.g. Carrier, Honeywell), big tech (e.g. Amazon, Microsoft), and semiconductor companies (e.g ARM, NVIDIA).

Across 12 distinct use case domains in commercial buildings, encompassing a total of 66 individual use cases, Security and Access Control emerges as the most popular domain (40.7%), followed by Space, Occupancy & People Movement (38.5%), Data Integration and Analytics (29.1%), and Energy Management and Efficiency (28.3%).

It is the second in a 2-part series of reports, with the first report providing a review of AI technologies, opportunities and use cases in commercial buildings. Together they are the most complete assessment of the impact of AI on commercial buildings published to date. Both these reports are included in our 2024 Premium Subscription Service, which also gives access to our chatbot AIM, where you can query all our research using the power of Large Language Models (LLMs).

Mapping & Analysis of Vendor AI Solutions for the Commercial Buildings Market

Our new research builds on Memoori’s previous 2021 Artificial Intelligence (AI) market analysis, exploring the immense progress that has occurred both in the capabilities of AI and the growing vendor landscape enabling smarter, more sustainable, and more responsive commercial buildings.

The report is focused on the use cases that relate directly to the ongoing operations of commercial buildings, such as building performance, sustainability, and the occupant experience. The scope does not include AI applications for design and construction phases.