In August 2017, a New York co-working startup named WeWork was squeezed into a unicorn outfit and hurled on to the world stage by a $4.4 billion investment from Japanese conglomerate Softbank. By August 2018, as WeWork’s astronomical growth continued, we started to question our assumptions of this as a fad, contemplating WeWork as the start of a new era in commercial real estate and office design. While also warning that overfunding could lead to unrealistic expectations, thereby encouraging wastefulness, indiscipline and sloppiness. “Considering the money spent on somewhat-risky acquisitions, outstanding rent payments and net-loses, there are also fears that bringing in debt investors at this stage would put the firm in a financially precarious position. If, say, the tech bubble were to burst, WeWork might find themselves in free fall,” we said in a May 2018 article entitled WeWork, WeLive, WeGrow but Will We Succeed in the Long Term? In February 2019, we saw […]

Most Popular Articles

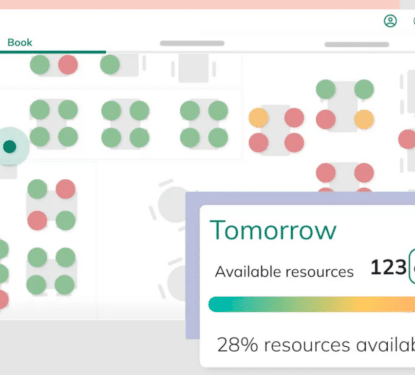

Hubstar Acquires Spica Technologies: 4th Strategic Deal Revealed

This Research Note explores the acquisition of UK-based Spica Technologies Ltd (formerly owned by Nordomatic) by Hubstar Group Ltd, announced on 9th October 2025. We examine the Spica Technologies software offering before highlighting Hubstar’s strategy with 4 acquisitions to date and concluding with our view of the transaction. Spica Technologies Profile Spica Technologies is a […]

A SEA of Energy Efficiency Opportunities in 2025!

Southeast Asia stands at a critical juncture in its energy journey. With electricity demand surging by over 60% in the past decade and projected to more than double by 2050, the region presents both a formidable challenge and an extraordinary opportunity for energy efficiency solutions. Our new report is a collaboration with Singapore-based Ampotech and […]

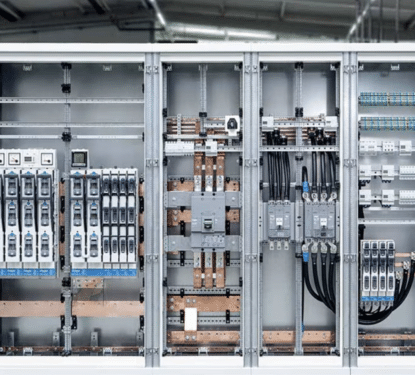

Hager Group’s Energy Management Software Expansion: 15 Years of Acquisitions Analyzed

This Research Note examines Hager Group, the German supplier of electrical distribution products for residential applications, which has extended its business focus to commercial buildings. We comment on its recent inorganic growth strategy in energy management software and services, before analyzing the impact of their acquisitions since 2010. Hager Group Profile Hager Group is a […]