This Research Note examines the recent Legence Corp. filing at the US SEC for an Initial Public Offering. We highlight the transaction details, profile the business segments offering engineering, installation and maintenance services and sustainability consulting, and explore the financial highlights of the $2.1 billion revenue company. Transaction Details Blackstone is exploring a potential sale or IPO for its portfolio company, Legence Corp. filing for an initial public offering with a preliminary prospectus on 15th August 2025. The number of shares to be offered and the price range for the proposed offering have not yet been determined. After the completion of the deal, Blackstone will remain a controlling investor, following its agreement to acquire the company in 2020, when it was known as Therma Holdings. Legence Profile Legence is an integrated provider of energy efficiency and sustainability solutions for the built environment in the USA. Headquartered in San Jose, California, the company specializes in helping […]

Most Popular Articles

Video Surveillance Market 2025: Ongoing Shift towards Software Drives Growth

The video surveillance industry is undergoing its most significant transformation since the shift from analog to digital. What was once primarily a reactive security tool, cameras recording footage for post-incident review, is evolving into a proactive intelligence infrastructure. The traditional model of video surveillance centered on cameras, on-premise storage and software. That era is coming […]

deskbird Raises $23m with View to Dominating Europe’s Hybrid Workplace Market

This Research Note examines the growth of deskbird, a Swiss startup offering a workplace management platform that addresses hybrid working. We explore the company’s disclosed funding and its acquisitions completed last year before highlighting one of the firm’s recent reports on the German workplace market. Finally, we provide our view on the company and the […]

MazeMap Acquires Thing-it: Key Insights from 2025 Workplace Platform Consolidation

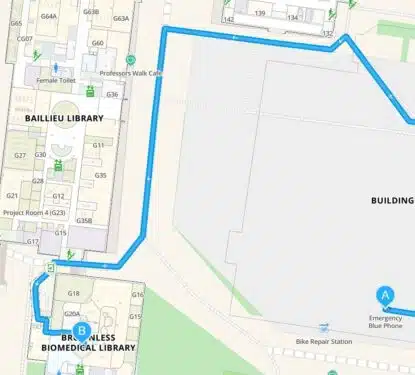

This Research Note examines the acquisition of the German software company Thing-it, by MazeMap, a Norwegian indoor navigation provider. We examine the development of the two startup companies prior to their merger and conclude with our perspective on the consolidation. Transaction In August 2025, Thing-it became part of MazeMap. Since then, the company reported that […]