Join us on Tuesday 28th February at 1400 Paris | 1300 London | 0800 New York | 1700 Dubai for a FREE 30-minute Live Stream discussing the Smart Building Startup Landscape in 2023!

The Recording of this Live Stream is now available! Click Here.

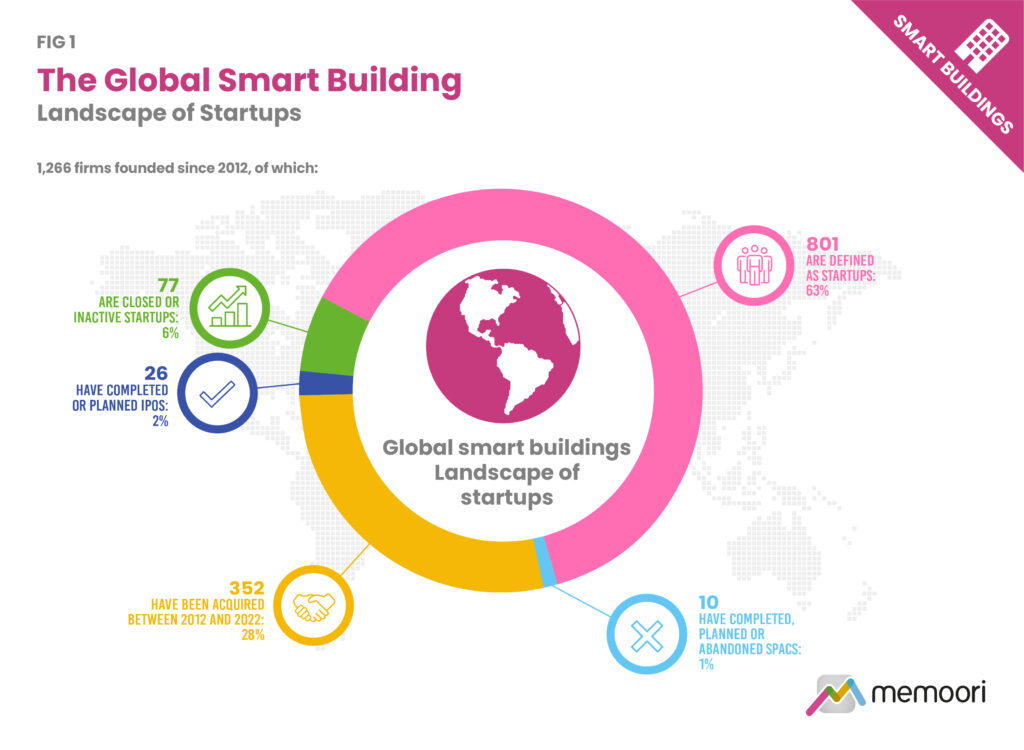

Around 1,266 startups are active in the management and operations phase of the global smart commercial buildings space. Our new research shows this has increased by 20% in the 2 years. 352 startups have been acquired between 2012 – 2022, 28% of the total. 77 are closed or inactive, 6% of the total.

Funding from venture capital, private equity and corporate backers has reached unprecedented levels since 2015, with $5.9B invested in 2022.

Aspects of the Startup Landscape we will be Discussing:

- What did VC Investment Activity Look Like in 2021 and 2022, and what are the Potential Investment Trends for 2023?

- What Impact are Startups having on Smart Building Innovation?

Space is limited and this LIVE Stream will fill up because it is FREE and also a great opportunity to hear an in-depth discussion on the funding levels behind the Smart Building Startup Landscape and its impact on innovation.