Occupancy Analytics has been a growing force in commercial buildings for the last decade but, accelerated by the pandemic, this broad range of technologies is becoming critical to progressive buildings in recent years.

Our new comprehensive market report on Occupancy Analytics and Location-Based Services offers an objective assessment of the dynamic space from 2023 to 2028. In this research note, we pick highlights from the study to get a glimpse of the evolving landscape.

The new research shows a global occupancy analytics market for Occupancy Analytics and Location-Based Services in commercial office space that is anticipated to grow from $3.25 billion in 2022 to $7.07 billion by 2028, a CAGR of 13.8%.

The market is being driven by enterprises exploring hybrid work options, which demand real-time occupancy data to inform future space requirements. However, the study also found challenging conditions in the commercial real estate (CRE) sector could hold back growth.

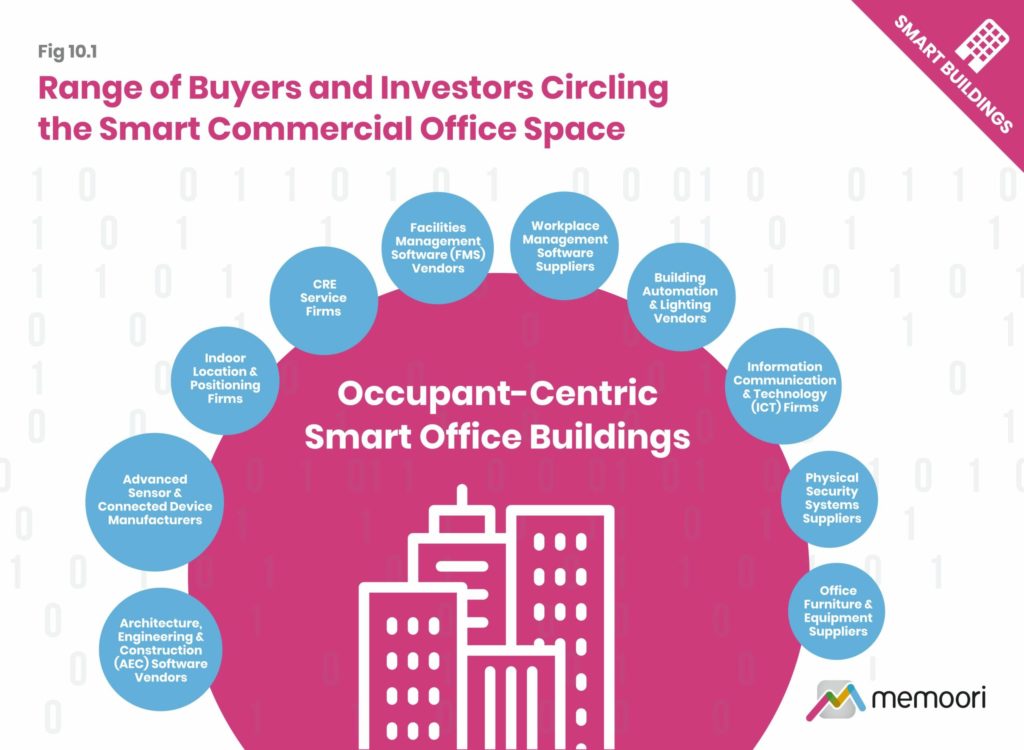

Our analysis of Occupancy Analytics technology for office buildings reveals a complex and multifaceted market. Key players range from traditional building automation companies to specialized manufacturers, IT vendors, property firms, and software vendors.

Due to the complexity of occupancy dynamics in hybrid workplaces, larger offices and real estate portfolios often require more complex, integrated platforms from established multi-functional solution providers. However, 121 of the 250 companies researched for this report were founded in the last decade. This indicates low barriers to entry and highlights the disruptive influence of software, analytics, and IoT in smart buildings.

The competitive landscape remains diverse and potentially confusing for the buyer, with numerous vendors offering point solutions and platforms. Solution providers originate from various sectors, including commercial real estate, facilities management, lighting, building management, office equipment, and safety and security sectors. These established companies compete with niche SaaS players, startups, and major IT networking and telecommunications companies.

Occupancy Analytics Regional Markets

Through the continued development of smart buildings in Saudi Arabia, Qatar, and the UAE, the Middle East joins Europe as the most mature geographical smart building region. However, as with the wider IoT sector, the fastest growth is predicted in Asia, where we forecast a CAGR of 17.3% for the region. North America, meanwhile, presents a strong growth trajectory, as illustrated in some of the 30+ infographics included in the 100+ page report.

Despite the diversity of global sales, the location of occupancy analytics and location-based service providers is still more concentrated in two regions, North America and Europe, with a combined 87% of companies in the segment. Asia & Australasia made up the remainder of companies.

Growth in the sector will be driven by cost-control measures for real estate around the world. Space “rationalization”, for example, allows businesses to explore reconfigured solutions with accurate, real-time data, helping them set up safe and effective hybrid workspaces and make informed decisions about future space requirements. However, they will be hoping to explore this technology under budget constraints creating a double-edged sword scenario for IoT investments in this space.

“On the one hand, IoT investments may prove critical in upgrading the efficiency and desirability of office spaces moving forward, but on the other hand, real estate developers will be increasingly constrained in terms of their access to the capital required for new investments, limiting their ability to invest in IoT retrofits and upgrades,” explains the report.

This report is the first instalment of a two-part series covering Workplace Technology. Part 2, covering Workplace Experience Apps, Tenant Engagement Platforms and Mobile Access Control, is to be published later in Q2 2023. Both these reports, and many more, are included in Memoori’s 2023 Premium Subscription Service.