Our new research report shows that the global market for physical security products (Access Control, Video Surveillance, Intruder Alarm & Perimeter Protection) has demonstrated both resilience and adaptability in the face of growing geopolitical tensions and looming economic recession.

Trade tensions between China and the US have seen a series of legislative moves that have disrupted the flow of both physical security products and key product components. These tensions are also spilling over into Europe. If further trade barriers are erected, we will see a polarization of the physical security global market.

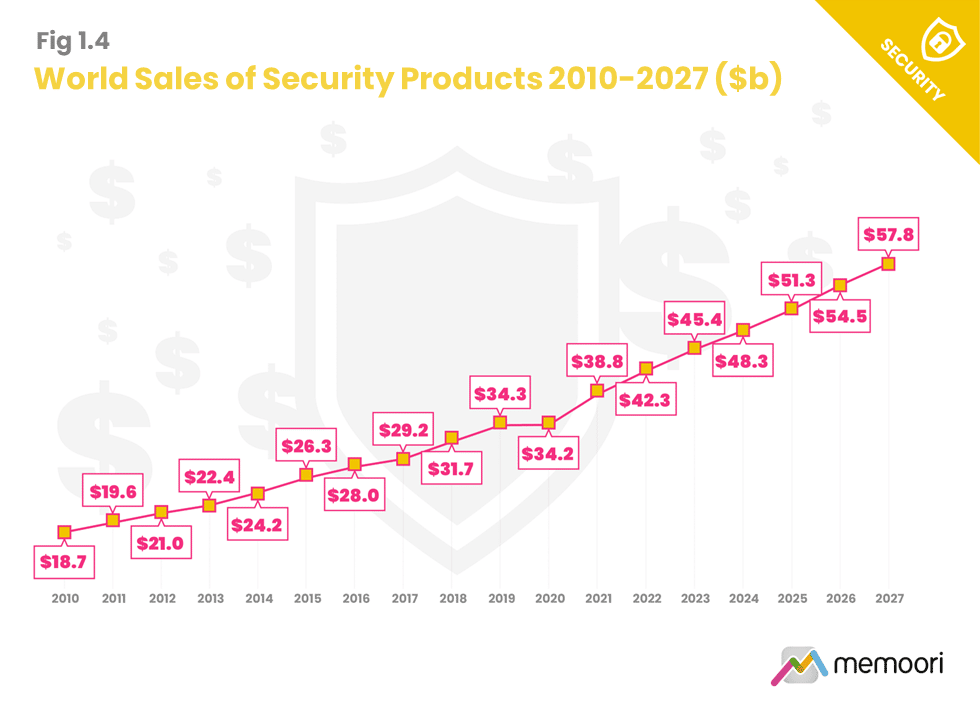

We estimate that annual revenues from the physical security product market increased over 9% in 2022, rising to $42.3Bn. Going forward growth will be tempered somewhat, averaging 6.5% per annum to 2027.

Video surveillance makes up nearly 58% of the market in 2022, with China continuing to dominate sales in this sector, accounting for just under one-third of the total global market. Whilst China’s Sharp Eyes projects are winding down, continued state investment into smart cities as well as programs such as the Safe China initiative should continue to drive sales of security products in China.

The development and commercialization of new technologies continue to drive growth in the physical security market. Our recent analysis of Artificial Intelligence (AI) in Smart Buildings found that the security market, and particularly video analytics generated the largest share of overall AI revenues in smart buildings, representing just under 50% of total sales in 2020 at $558 million.

That said, clearly not all new technology has the same impact. For example, despite various projections, We see little current momentum or market appetite for the deployment of 5G wireless video surveillance at scale. We estimate that the introduction of 5G for video surveillance data transmission will take at least another 5 years to achieve the levels of coverage, reliability and falls in cost to have any kind of real impact.

Now in its 14th Edition and with 234 pages and 28 charts, this brand new 2022 report will be of value to all those engaged in managing, operating, and investing in electronic security technology companies (and their advisors) around the world. New for 2022, the report now includes at no extra cost, a spreadsheet containing the data from the report and a graphics pack with high-resolution charts.

For more information, visit; https://memoori.com/portfolio/the-physical-security-access-control-2022/