This Report is a new 2019 Study which makes an Objective Assessment as to How Owners & Investors in Commercial Real Estate can Future Proof Their Assets.

Confidence in the capabilities and viability of Smart Building Technology to improve sustainability, operational efficiency and even to enable a more productive workforce is steadily growing. However the following question is still regularly posed “I’m being asked to invest significant amounts in new building technologies, how can I make sure that investment isn’t worthless in a few years?” This report seeks to help answer that question.

It seeks to address all of the key challenges in turn and contains a comprehensive evaluation of the current state of the market, including consideration of market adoption rates, return on investment, solution maturity, technology trends & impacts on the market and leading adoption drivers.

It draws on over a decade of experience in tracking the various technology and market innovations that have brought us to this point in the lifecycle of smart building technologies.

REPORT HIGHLIGHTS

- Any lack of effective data, information and responsibility transfer at the “Practical Completion” of a new building can have serious adverse effects on operational effectiveness. While the design & build phases of the building lifecycle may typically range from a combined 2 to 5 years, the “in-use” phase of building operation constitutes the vast majority of the building’s lifespan.

- The most cost effective and efficient means of smart solutions delivery for developers working on new build projects will involve embedding the technology delivery plan into the building design at an earlier stage than has been the norm in the past. Developers should look to adopt a Life Cycle Costing approach that considers potential improvements to operational efficiency and the building’s revenue generation potential in terms of higher rents or occupancy rates and offset these against the incremental cost of deploying and maintaining the technology.

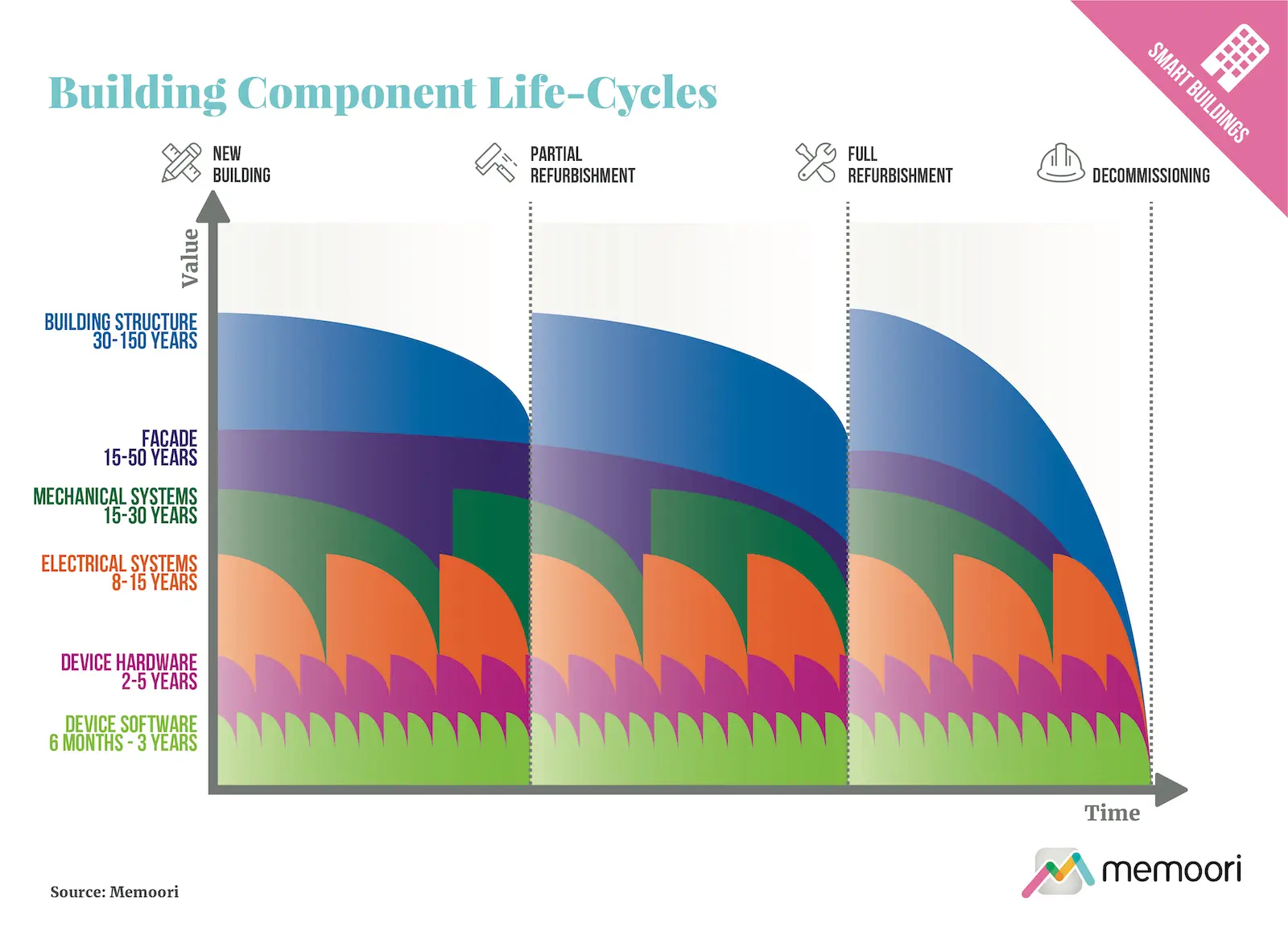

- Understanding expected component lifecycles and attempting to align their refurbishment can help designers and building owners to plan more effectively, optimize ongoing performance and reduce the cost and complexity of refurbishment programs.

The Future is Open Standards. Adoption of an open data management and systems procurement strategy will help ensure a much greater degree of flexibility for the future integration of new systems and applications into the smart building, as well as helping reduce costs, implementation time and overall complexity of the communications architecture.

Determining whether existing data sets can be relied upon to effectively measure priority KPIs can be critical to the effective return on investment of any smart systems investment. Organizations should formulate data management and governance policies, document metadata requirements, and data specifications that mitigate the risk that bad quality data might adversely impact on critical decision making, end user trust in data outputs or operational efficiency.

WITHIN ITS 144 PAGES AND 16 CHARTS AND TABLES, THE REPORT FILTERS OUT ALL THE KEY FACTS AND DRAWS CONCLUSIONS, SO YOU CAN UNDERSTAND EXACTLY WHAT IS SHAPING THE FUTURE OF COMMERCIAL REAL ESTATE;

- As the relevant smart systems expertise is commonly lacking in internal IT and Facilities departments, building owners may also seek to engage with specialist 3rd party consultants including Smart Building Consultants, Master Systems Integrators and Cyber Security consultants prior to any vendor selection process.

- Engagement as part of the systems planning and design phase can help ensure that the overall systems design is coherent, based on open protocols that support interoperability, whilst still maintaining cybersecurity.

- Working with relevant 3rd party experts can also help to deliver specifications that provide clearly defined data output, processing and analytics requirements, including consideration of APIs, data processing strategy, platform options, data formats (including metadata) and data reporting requirements.

Starting at only $1,995 USD (Single User License) this report provides valuable information so companies can improve their Vendor Selection Processes AND look at the potential for developing their Corporate Real Estate Portfolio.

WHO SHOULD BUY THIS REPORT?

The information contained in this report will be of value to all those engaged in managing, operating and investing in Commercial Smart Buildings (and their Advisers) around the world. In particular those vendors wishing to understand buying decisions and mindsets of Commercial Real Estate companies will find it particularly useful.

Table of Contents

- Preface

- Executive Summary

- 1. Introduction: Future Proofing Smart Buildings

- 1.1 What Defines a Smart Building?

- 1.2 What Do We Mean by Future Proofing?

- 1.3 Why Future Proofing Is Important

- 2. Building Costs & Life Cycles

- 2.1 Building Lifecycles

- 2.2 Lifecycle Cost Assessment

- 2.3 Lifecycle Costs

- 3. The State of the Market

- 3.1 Smart Buildings, Are We There Yet?

- 3.2 Technology Trends & Their Impacts

- 3.3 Energy Efficiency & Sustainability

- 3.4 Operational Flexibility & Adaptability

- 3.5 Space Management & Optimization

- 3.6 Changing Workplace Dynamics

- 3.7 Wellbeing & Productivity

- 3.8 New Build vs Retrofit

- 3.9 Policy & Regulatory Drivers

- 3.10 Construction Output

- 4. Standards, Tools & Frameworks

- 4.1 Sustainability Standards & Certification

- 4.2 Open Data Standards & Interoperability

- 4.3 Building Data Management

- 4.4 Connectivity Standards & Certification

- 4.5 BIM & the Digital Twin

- 4.6 Wellness Standards

- 4.7 Smart Building Assessment & Evaluation Models

- 5. Where Can Improvements be Made?

- 5.1 Budgets, Costs & ROI

- 5.2 Stakeholder Engagement & Procurement

- 5.3 Supply Chain Fragmentation

- 5.4 Cybersecurity

- 5.5 Privacy

- 5.6 Data Related Challenges

- 5.7 Skills & Talent

- 6. What Do Current Market Offerings Look Like?

- 6.1 Smart Building Platforms

- 6.2 Smart Buildings Consultancy Services

- 6.3 Space as a Service

- 6.4 Flexible and Enhanced Leasing Models

- 6.5 Space Utilization & Occupancy Analytics

- 6.6 Personalization Apps & Occupant Comfort

- 6.7 PropTech & Portfolio Level Solutions

- 7. The Smart Building Supply Chain

- 7.1 ICT Vendor Positioning

- 7.2 Building Controls Vendors

- 7.3 Startups

- 7.4 Partnering & Collaboration

- 8. Conclusion

- 8.1 General Conclusions

- 8.2 CRE Developers & Investors

- 8.3 Building Owners

- 1. Introduction: Future Proofing Smart Buildings

List of Charts and Figures

- Fig 2.1 The Lifecycle of a Commercial Building

- Fig 2.2 Building Component Life-Cycles

- Fig 3.1 IoT Devices by Application in Smart Commercial Buildings – 2020

- Fig 3.2 Projected Gains from Smart Building Investments

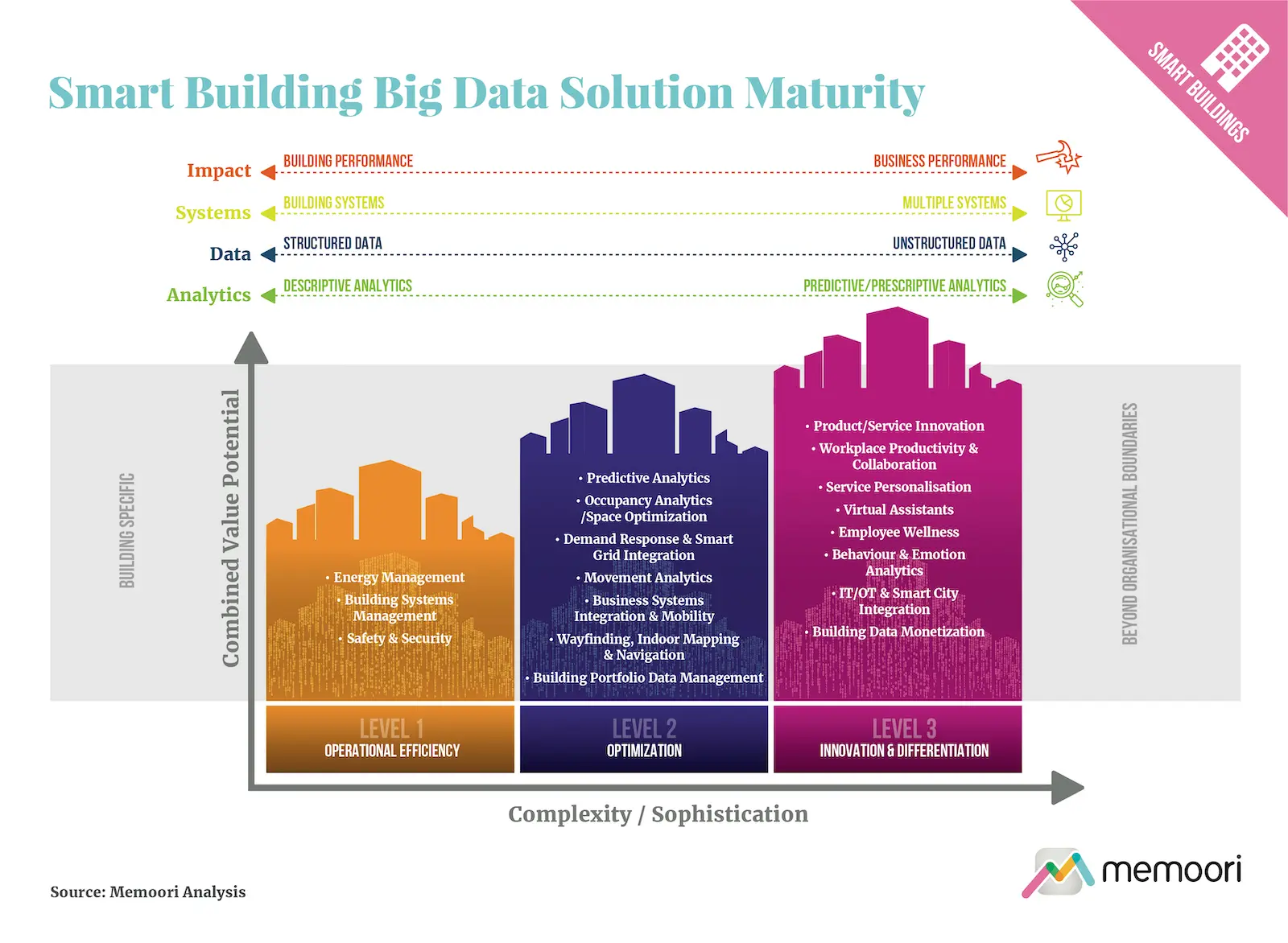

- Fig 3.3 Smart Building Big Data Solution Maturity

- Fig 3.4 The Internet of Things in Smart Commercial Buildings 2018 v3.0

- Fig 3.5 Smart City Related IoT Device Projections by Market Vertical – 2017 to 2022

- Fig 3.6 Leading Wireless Communications Technologies

- Fig 3.7 Building Sector Energy Consumption & Emissions

- Fig 3.8 Expected Changes to Commercial Lease Agreements Between Landlords & Their Business Tenants

- Fig 3.9 Total Cost of Occupancy: JLL’s 3-30-300 Rule

- Fig 3.10 EU Buildings by Construction Date

- Fig 3.11 Floor Area Additions by Region to 2025

- Fig 4.1 BPIE Smart Readiness Indicators

- Fig 5.1 Leading Challenges for Connected Building Solutions

- A1 – Building Systems Vendors: Acquisitions, Investments and Partnerships to 2018

Companies Mentioned INCLUDE (but NOT Limited to);

75F | Accenture | Acuity Brands | Aruba Networks | ASHRAE | Bosch | Brick Schema | Cap Gemini | CBRE | CIBSE | Cisco | Comfy | Condeco | Cushman & Wakefield | Dell | ECA | Gooee | Google | Hilson Moran | Honeywell | IBM | Intel | Intelligent Buildings | J2 Innovations | JLL | Johnson Controls | Knotel | Mapiq | MCS Solutions | Microsoft | Project Haystack | RealEstateCore | RIBA | Savills | Schneider Electric | Senion | Siemens | Switch Automation | Tridium | WeWork | Wiredscore | WSP | Yardi

DOWNLOAD THE BROCHURE OR CONTACT US DIRECTLY TO DISCUSS ALTERNATIVE PAYMENT OPTIONS.