The smart building startups ecosystem could be experiencing a point of inflection. While venture capital funding has cooled by 13% in the first half of 2025, merger and acquisition activity has exploded by over 60%, signaling a maturing market where consolidation trumps speculation.

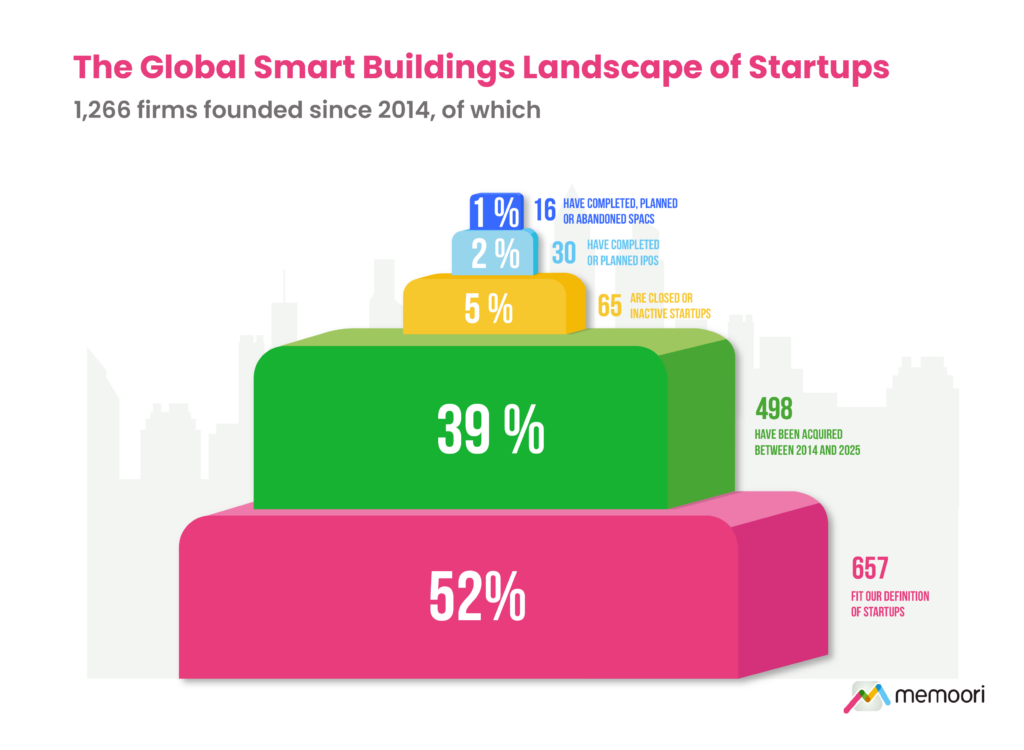

Our latest comprehensive analysis of 1,266 startups founded since 2014 reveals a sector in transition. These companies, focused on the management and operations phase of commercial real estate, are finding new pathways to growth as traditional funding routes tighten.

Funding Reality Check

The numbers tell the story.

After $7.5 billion poured into smart building startups throughout 2024, the first half of 2025 saw just $3.1 billion across 126 funding rounds, down from 145 rounds in the same period last year.

This 13% decline reflects a natural evolution from the exuberant growth phase to a more mature, results-driven investment environment. Companies with solid fundamentals and clear revenue streams are still attracting significant capital.

Energy Management Dominates Smart Buildings Startups Landscape

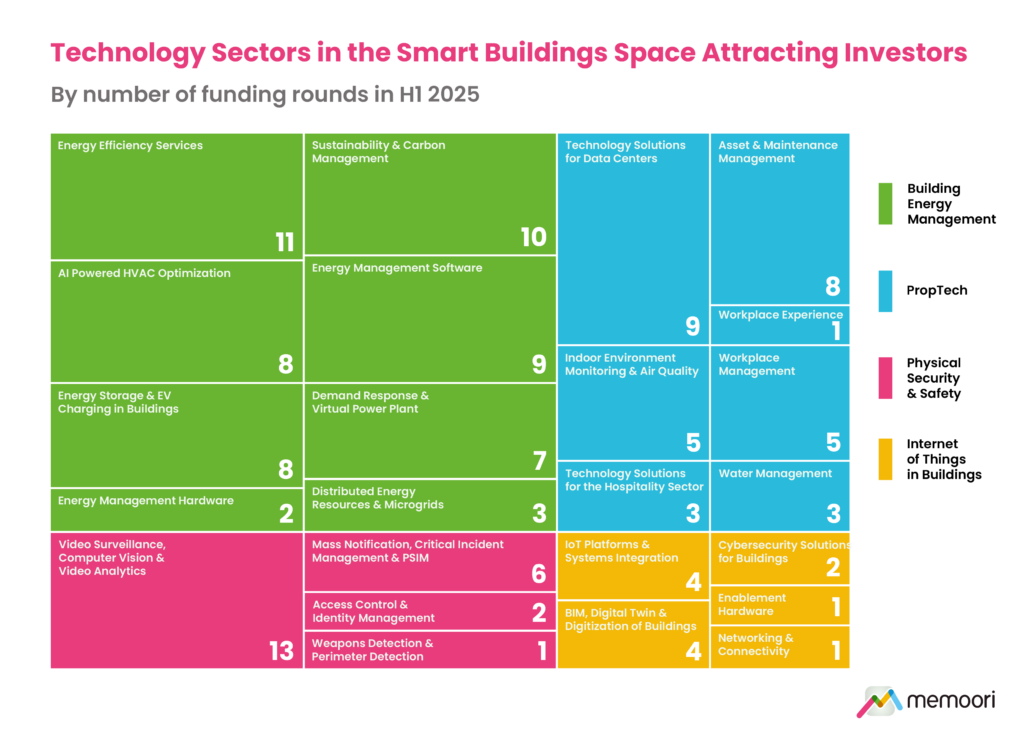

Smart Building startups in our Building Energy Management cohort captured 46% of the total funding rounds in H1 2025.

This category, which includes grid interactivity solutions, attracted 58 funding rounds, with 60% of these investments flowing to European startups. The concentration reflects the European Union’s clear legislative agenda towards decarbonization and energy security.

M&A Boom Signals Market Maturation

While funding may be tightening, the acquisition market is red-hot.

42 startups were acquired in the first half of 2025, representing a dramatic 60% increase compared to the same period last year. This surge indicates that established players are actively consolidating capabilities via inorganic growth.

The acquisition trend suggests that incumbent smart building companies recognize the value of startup innovation and are willing to pay premium prices for proven technologies and talent.

These dual trends of cooling VC funding and hot M&A activity demonstrate that we currently have a market where consolidation trumps speculation.

The Reality of Smart Building Startups Survival

Our research reveals the mathematics of startup life. Of the 1,266 companies identified (fitting our definition of a startup), 498 firms, representing 39% of the total landscape, have been acquired since 2014. Additionally, 65 startups (5% of the total) have closed or become inactive, highlighting the high-risk nature of this sector.

These statistics underscore the importance of building sustainable business models from the outset. Smart Building startups that focus solely on technology innovation without considering market fit and revenue generation will struggle to survive in the competitive smart building market.

Strategic Implications for Industry Players

For investors, the current environment demands more rigorous due diligence and focus on companies with clear paths to profitability. The days of funding purely based on potential are largely behind us.

For corporate strategists at established building technology companies, the active M&A market presents opportunities to acquire capabilities at potentially attractive valuations. However, successful integration of startup technologies requires careful cultural and technical planning. Our research highlights the strategies of 8 established building technology companies, including ABB, Honeywell, Johnson Controls, Schneider Electric, Siemens, Carrier, JLL, & Allegion.

The smart building startups landscape is consolidating around proven winners, creating opportunities for both strategic acquirers and investors willing to support companies with strong fundamentals and clear market positioning.