Dahua

Cracks in Foundations of the Video Surveillance Business could be Cause for Concern

September 27th, 2016Volume is Now King in the Video Surveillance Business

August 29th, 2016

Are Western Manufacturers of Video Surveillance Cameras Ready for Commoditization?

Our next annual report on the Physical Security Industry due to be published late in the 3rd Quarter of 2016 will show that western manufacturers of video surveillance cameras are not only rapidly losing market share in their home markets to the major Chinese manufacturers but also cannot penetrate China, which is the largest single […]

Audio: China’s Security Industry Flexes Its Muscles!

For those who missed it or want to listen again, below is the Audio Stream from our 4th Free Webinar in the 2016 Smart Buildings Series, sponsored by Tridium… “China’s Security Industry Flexes Its Muscles!” A Webinar Q&A with Michael Yang CEO of the CPS Media Group. We discuss the Chinese market for Video Surveillance […]

The Competitive Landscape of the World Video Surveillance Business

Whilst growth in demand for video surveillance cameras slowed down in 2015 it was nevertheless a good year for almost all the major brands. Most predictions for 2016 look less promising as a result of forecast poor economic trading conditions, although recent terrorist activities could compensate for this. Whatever, the competitive landscape is intensifying and […]

Western Video Surveillance Manufacturers Need New Strategies to Compete with the Chinese

One of the main findings in Memoori’s New Annual Report on the Physical Security Industry shows that business models need to be constantly fine tuned, in order to meet the needs of all stakeholders in the supply chain. The two major disruptive factors that bring about the need for change is the introduction of emerging […]

The Chinese Video Surveillance Market – No. 1 Opportunity or No. 1 Threat?

In 2014 Chinese video surveillance manufactures sent out a strong message to the major western markets that they are moving up the value chain with better than “just OK” products at significantly lower prices than local offerings; And have extended and improved their distribution network to include System Integrators and provide local back-up services. 2 […]

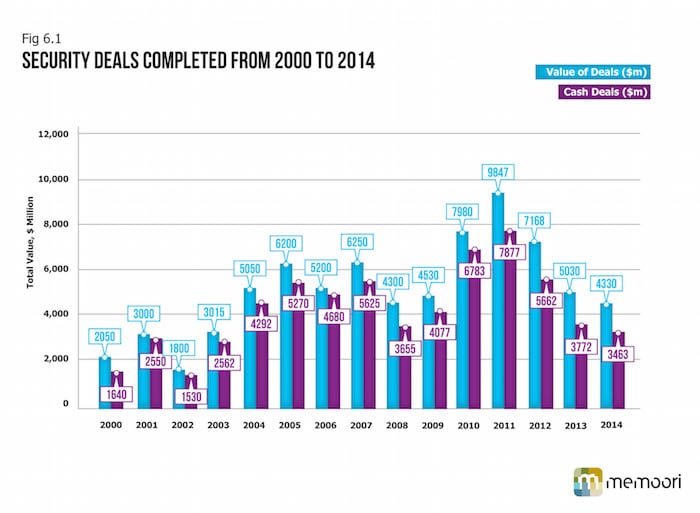

Strategic Acquisitions Dominate Security M&A; Whilst Major Conglomerates & External Buyers lose their Appetite

In the last 6 years M&A activity within the security industry, has for the most part been driven by the major conglomerates through strategic buys to acquire new technology, expand their product range, or improve focus on particular vertical markets and regions in the world where demand is growing. However within the last 4 years […]

Leading Manufacturers of IP Network Products Having Difficulty in Seeing Through the China Smog

New Research from Memoori http://memoori.com/portfolio/thephysicalsecuritybusinessin2013/ demonstrates that the geographic distribution of sales of security products is clearly changing with Asia becoming the dominant region. A major change in the geographic distribution of sales is taking place with Asia delivering the highest rate of growth and increasing its market share. This is set to continue because […]