The video surveillance industry is undergoing its most significant transformation since the shift from analog to digital. What was once primarily a reactive security tool, cameras recording footage for post-incident review, is evolving into a proactive intelligence infrastructure.

The traditional model of video surveillance centered on cameras, on-premise storage and software. That era is coming to an end. Our new research shows a market that is increasingly defined by software capabilities and recurring revenue models, with analytics and cloud services growing at more than twice the rate of traditional equipment sales.

AI-enabled cameras with edge processing capabilities are steadily gaining market share. These systems perform object detection, license plate recognition, behavior analysis, and privacy-preserving redaction in real-time. This shift transforms video surveillance from passive recording to active operational intelligence.

For commercial real estate owners and facility managers, this represents both opportunity and complexity. The question is no longer simply “what cameras should we buy?” but rather “how could we integrate intelligent video analytics into our broader building operation and management strategy?”

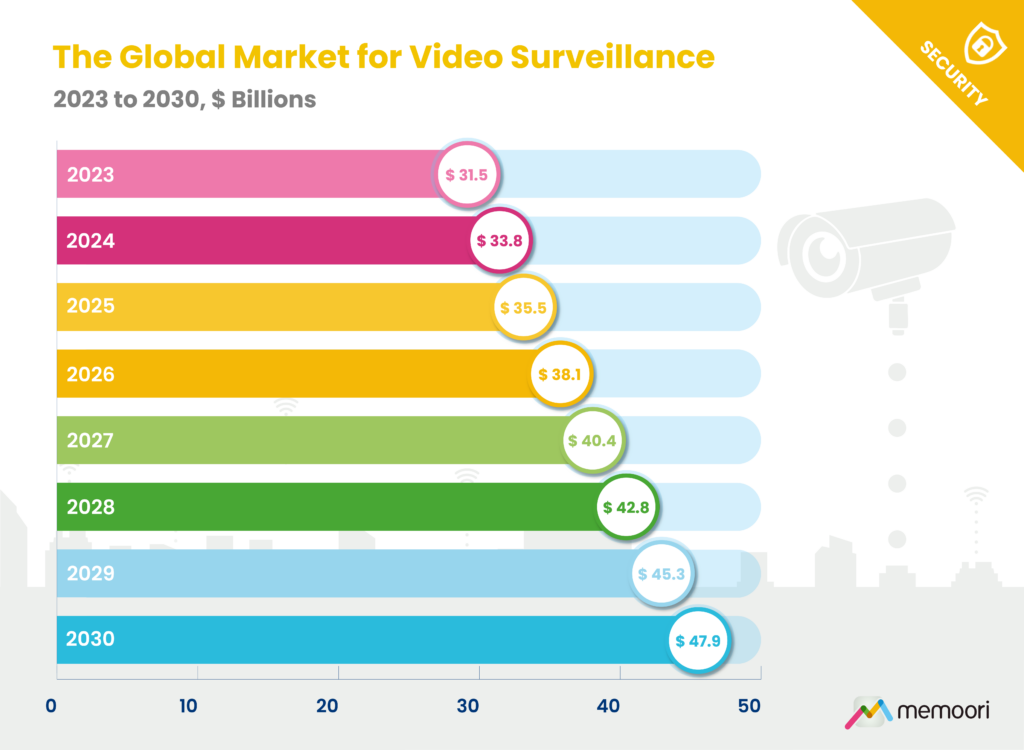

The Global Video Surveillance Market

We estimate global video surveillance revenues reached $33.8 billion in 2024 and are projected to climb to $47.9 billion by 2030, representing a compound annual growth rate of nearly 6%.

Market dynamics are being dramatically altered by US-China trade tensions. Chinese vendors now face US procurement bans, Federal Communications Commission equipment authorization restrictions, and expanding export controls.

This bifurcation has created sustained opportunities for compliant alternatives, particularly those meeting National Defense Authorization Act (NDAA) requirements.

The Drone Factor

Perhaps the most intriguing development is the emergence of drones as a significant expansion vector. Drones extend surveillance coverage to areas impractical for fixed cameras, provide rapid-deploy capability for incident response, and enable persistent wide-area monitoring for critical infrastructure and large campuses.

The integration of drones with ground-based systems represents a fundamental architectural shift, from static observation points to dynamic, mobile sensor networks. For large commercial properties, campus environments, and critical infrastructure, this capability changes the economics and effectiveness of comprehensive security coverage.

Investment & Consolidation

Between September 2023 and August 2025, 24 M&A transactions were observed. The most significant including Triton Partners’ $735 million carve-out of Bosch’s Building Technologies business, now operating as Keenfinity Group, and Axon’s $241 million acquisition of Fusus to strengthen its real-time crime center platform. Investment activity totaled $3.8 billion across 38 deals during the same time period.

Key trends include;

- platform consolidation integrating hardware, software, and cloud services;

- private equity actively reshaping market structure;

- strategic focus shifting from hardware toward software and recurring revenue;

- and AI integration driving acquisitions of computer vision and privacy-preserving startup firms.

Strategic Implications

For building owners and facility managers planning technology investments, several principles emerge:

- Prioritize platforms over products. Evaluate solutions based on integration capabilities, not just standalone features.

- Factor recurring costs into ROI calculations. Software and analytics increasingly dominate the total cost of ownership.

- Assess vendor compliance and stability. Geopolitical factors and market consolidation create risk alongside opportunity.

- Consider operational intelligence, not just security. Modern video analytics deliver insights across occupancy, operations, and tenant experience.

The video surveillance industry is evolving from a security infrastructure to an intelligence layer that can enhance how buildings function.

Our market analysis covers cameras, storage, software, and analytics across global markets and industry verticals through 2030, providing a detailed view of where the industry is heading and what factors are driving change.

Who Should Buy This Research?

Our Research delivers critical intelligence on video surveillance for:

- Security manufacturers and vendors developing product roadmaps, positioning strategies, and go-to-market plans.

- System integrators and service providers evaluating technology partnerships, training investments, and service offerings.

- Private equity and strategic investors assessing M&A targets, market positioning, and competitive dynamics.

- Building owners, facility managers, and corporate security leaders planning capital investments and technology refresh cycles.

- Consultants and advisors supporting clients across procurement, compliance, and strategic planning.