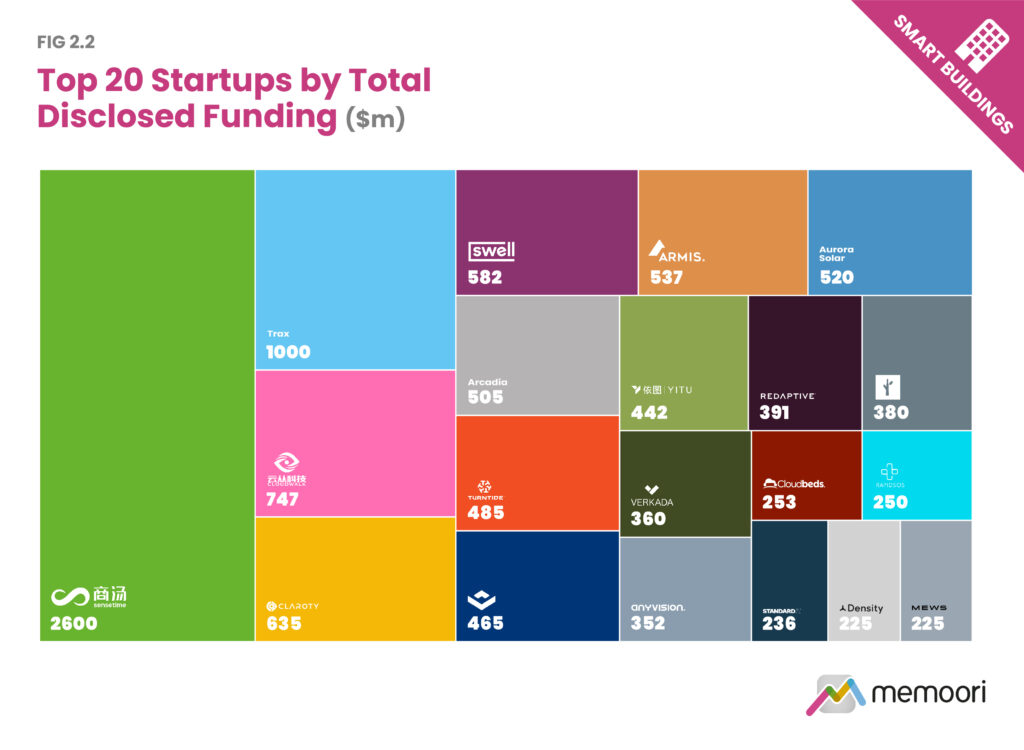

Our new research discloses the highest-funded startups in the smart buildings space in the last two years. All of these companies each attracted over $220 million in total disclosed funding.

Since 2015, total capital invested in startups in the global smart building space amounted to over $31 Billion. In the last 2 years (which are the focus of our research) it has reached unprecedented levels with $5.9 Billion being invested in 2022 alone.

We have identified 1,266 startups founded since 2012 that have targeted the management and operations phase of the commercial building industry. This number has increased 20% in the 2 years since we published our last startup research. Of this cohort, 28% (352 startups) have been acquired between 2012 and 2022. Also, 6% (77 startups) have either closed or become inactive in the same timeframe.

our definition of a Startup is “a private company formed no earlier than 2012 that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company and is often financed by venture capital or private equity funding.”

Highest Funded Startups in 2021 and 2022

- Sensetime – Total Funding $2,600m. An artificial intelligence company focusing on computer vision and deep learning for face recognition in public surveillance. They completed an IPO on the Hong Kong Stock Exchange in December 2021.

- Trax – Total Funding $1,000m. A computer-vision platform offering image recognition technology and autonomous data collection for the retail sector.

- CloudWalk Technology – Total Funding $747m. A developer of AI facial recognition hardware and software.

- Claroty – Total Funding $635m. Cybersecurity platform for industrial control networks, SCADA and other essential OT systems.

- Swell Energy – Total Funding $582m. A developer of behind-the-meter energy storage projects for commercial & industrial sites.

- Armis Security – Total Funding $537m. Monitoring of both managed and unmanaged devices across IT, IoT and OT gives organizations a single pane of glass across the built environment.

- Aurora Solar – Total Funding $520m. Software platform for both residential and commercial rooftop solar sales and design.

- Arcadia – Total Funding $505m. Clean energy tech platform providing residential and commercial businesses easy access to clean energy.

- Turntide Technologies – Total Funding $485m. A developer of super high-efficiency Internet-enabled motor for HVAC applications.

- VTS – Total Funding $465m. Commercial real estate platform providing, leasing, marketing, asset management and tenant experience software.

- Yitu Technology – Total Funding $442m. A developer of AI facial recognition software.

- Redaptive – Total Funding $391m. A provider of Energy-Efficiency-as-a-Service for commercial and industrial customers.

- Flock Safety – Total Funding $380m. Provider of security for neighbourhoods with its 24-hour wireless cameras designed to capture license plates.

- Verkada – Total Funding $360m. Enterprise video security systems that combine camera technology with intelligent, web-based software for businesses and schools.

- AnyVision – Total Funding $352m. Provider of self-learning, AI-based person and object-recognition software. Now changes its name to Oosto.

- CloudBeds – Total Funding $253m. A developer of cloud-based software for more than 20,000 hotels, hostels, inns, and accommodations in 157 countries.

- RapidSOS – Total Funding $250m. Data-driven emergency response through life-saving building data and connected equipment.

- Standard AI – Total Funding $236m. Standard offers a computer vision platform for checkout-free experiences in retail stores.

- Density – Total Funding $225m. Occupancy analytics through self-installed, Wi-Fi powered unit to mount above a doorway.

- Mews Systems – Total Funding $225m. Cloud-based open Property Management software for hospitality sector.

Smart building startups have benefited from the tremendous interest in climate-related real estate technology applied to building energy management, which is the most heavily funded area in 2022. Innovations to address energy efficiency services, HVAC optimization software in commercial and industrial buildings, the reduction of carbon emissions and the implementation of on-site distributed energy sources have attracted both financial and strategic investors.