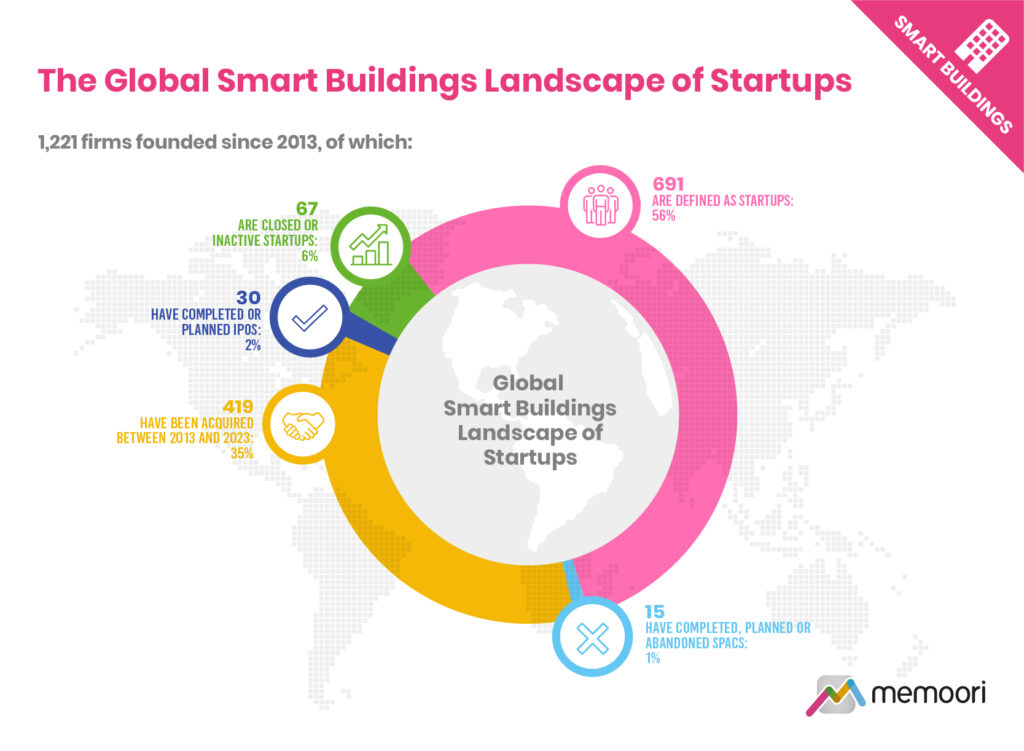

The global smart buildings landscape is heavily populated with new entrants, according to our new research, which identified 1,221 startups founded in the last ten years that serve the management and operations phase of commercial real estate.

In total 35% of startups have been acquired since 2013, and 6% are closed or inactive.

Funding for Commercial Building Operations Startups

Our new research reveals information on 284 funding rounds for startup companies, amounting to around $5.5 billion across the smart buildings sector in the 16 months since January 2023.

With over $2 billion already invested in the first 4 months of 2024, we believe that the outlook for investment and alliances with new entrants this year remains positive.

Strategic investments from corporate stakeholders in the built environment have contributed to a maturing smart buildings space, often accompanied by partnership agreements.

Energy dominates funding in the commercial building operation space, with energy hardware, software, efficiency services, and distributed energy representing four of the top six, from the 21 funding areas identified in the report.

Strategic corporate investors across the built environment are playing an increasingly significant role in supporting startups in the smart buildings space. Our report looks at 14 key players who are building relationships with startups, such as established; building automation players, real estate service firms, HVAC equipment companies, and physical security solution providers. This year’s new additions to the list of strategic corporate investors include; Belimo, Panasonic, Trane Technologies, Alarm.com, and Allegion.

M&A in the Commercial Building Operations Startups

Strategic M&A has enabled incumbent players across the smart buildings landscape to augment their technology offerings with bolt-on acquisitions and increase their focus on software solutions and recurring revenues.

Some consolidation has also occurred due to distressed asset sales of struggling startups. Private equity firms have also taken majority stakes in new entrants providing them with growth capital.