We has charted the fortunes of the worlds physical security business over the last 12 years. Despite cycles of poor world trading conditions and slow economic growth it has delivered a compound annual growth rare (CAGR) of 6.6%; reaching 8% in its peak year of 2019. Then along came COVID-19. GDP has drastically reduced and in some countries by as much as a 20% in April this year compared with the same month in 2019. How quickly we can get back to normal will depend on how fast we can contain COVID-19. The physical security business will play a significant role in the “new normal” post-COVID but at the same time it poses a huge challenge for the industry. COVID-19 and the resultant lockdown this year has stopped normal business operations and this has stemmed the flow of business. The immediate future depends upon releasing the lockdown and introducing measures to contain COVID-19. Lockdown is […]

Most Popular Articles

A SEA of Energy Efficiency Opportunities in 2025!

Southeast Asia stands at a critical juncture in its energy journey. With electricity demand surging by over 60% in the past decade and projected to more than double by 2050, the region presents both a formidable challenge and an extraordinary opportunity for energy efficiency solutions. Our new report is a collaboration with Singapore-based Ampotech and […]

Hager Group’s Energy Management Software Expansion: 15 Years of Acquisitions Analyzed

This Research Note examines Hager Group, the German supplier of electrical distribution products for residential applications, which has extended its business focus to commercial buildings. We comment on its recent inorganic growth strategy in energy management software and services, before analyzing the impact of their acquisitions since 2010. Hager Group Profile Hager Group is a […]

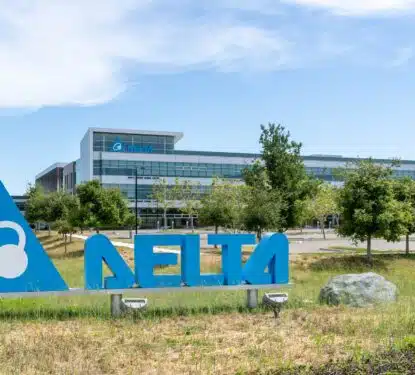

Delta Electronics Building Automation: Key Insights in 2025

In this Research Note, we examine the building automation business of Delta Electronics, a Taiwanese public company. We review the current brand offerings, financial highlights, a recent significant deployment, and provide a Memoori view of this second-tier player, building on our coverage of their strategy last year. Building Automation Brands The building automation business has […]