In this Research Note, we examine Spacewell, part of the Manage segment of Nemetschek, which provides software for the management and operations phase in the building lifecycle. This article is based on their 2022 annual results, investor presentations, the Annual Report of the parent company, published on 23rd March 2023 and the group’s strategy in the smart buildings space. The Nemetschek Group, the No 1 Architecture, Engineering and Construction (AEC) software provider in Europe and one of the top three global AEC software vendors, is driving the digitalization of the building industry, through its portfolio of independent brands, including Allplan, Bluebeam, dRofus, GraphiSoft, Nevaris, Vectorworks and Solibri focused on Building Information Management (BIM). Listed since 1999 and quoted on the Frankfurt Stock Exchange, the Munich-based company generated revenues of €801.8 million in 2022, an increase of 17.7% compared with the previous year. Nemetschek Factsheet, March 2023 A new Digital Twin business unit was created in […]

Most Popular Articles

Video Surveillance Market 2025: Ongoing Shift towards Software Drives Growth

The video surveillance industry is undergoing its most significant transformation since the shift from analog to digital. What was once primarily a reactive security tool, cameras recording footage for post-incident review, is evolving into a proactive intelligence infrastructure. The traditional model of video surveillance centered on cameras, on-premise storage and software. That era is coming […]

deskbird Raises $23m with View to Dominating Europe’s Hybrid Workplace Market

This Research Note examines the growth of deskbird, a Swiss startup offering a workplace management platform that addresses hybrid working. We explore the company’s disclosed funding and its acquisitions completed last year before highlighting one of the firm’s recent reports on the German workplace market. Finally, we provide our view on the company and the […]

MazeMap Acquires Thing-it: Key Insights from 2025 Workplace Platform Consolidation

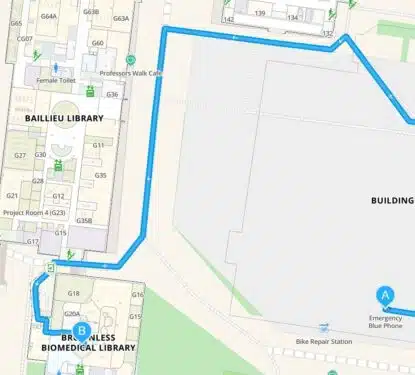

This Research Note examines the acquisition of the German software company Thing-it, by MazeMap, a Norwegian indoor navigation provider. We examine the development of the two startup companies prior to their merger and conclude with our perspective on the consolidation. Transaction In August 2025, Thing-it became part of MazeMap. Since then, the company reported that […]