“We have just lived through a decade of historically low-interest rates, which has now all but come to a stop. While this has broad sweeping impacts for the economy at large, for venture capitalists this has dramatically increased the opportunity cost of capital for general partners,” says Mike McAra, director at Second Century Ventures and NAR REACH Canada. “On a risk-adjusted basis, the hurdle rate for investment is much higher now than just six months ago, and thus capital is being allocated much more diligently and much slower.” Commercial real estate is going through a tough time in the wake of the pandemic and as economic clouds loom on the horizon. Soaring interest rates and low vacancy levels are forcing real estate firms to streamline expenses by cutting out any non-essential spending, which has left a wide range of proptech technologies on the wrong side of the budgeting discussion. The “nice to have” products and […]

Most Popular Articles

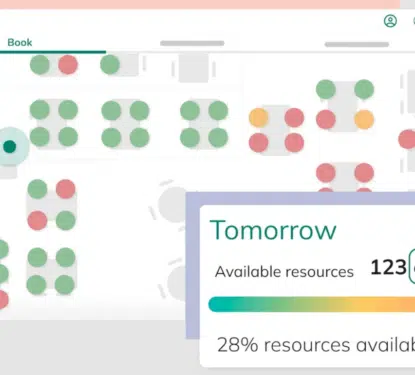

Hubstar Acquires Spica Technologies: 4th Strategic Deal Revealed

This Research Note explores the acquisition of UK-based Spica Technologies Ltd (formerly owned by Nordomatic) by Hubstar Group Ltd, announced on 9th October 2025. We examine the Spica Technologies software offering before highlighting Hubstar’s strategy with 4 acquisitions to date and concluding with our view of the transaction. Spica Technologies Profile Spica Technologies is a […]

A SEA of Energy Efficiency Opportunities in 2025!

Southeast Asia stands at a critical juncture in its energy journey. With electricity demand surging by over 60% in the past decade and projected to more than double by 2050, the region presents both a formidable challenge and an extraordinary opportunity for energy efficiency solutions. Our new report is a collaboration with Singapore-based Ampotech and […]

Hager Group’s Energy Management Software Expansion: 15 Years of Acquisitions Analyzed

This Research Note examines Hager Group, the German supplier of electrical distribution products for residential applications, which has extended its business focus to commercial buildings. We comment on its recent inorganic growth strategy in energy management software and services, before analyzing the impact of their acquisitions since 2010. Hager Group Profile Hager Group is a […]