“We have just lived through a decade of historically low-interest rates, which has now all but come to a stop. While this has broad sweeping impacts for the economy at large, for venture capitalists this has dramatically increased the opportunity cost of capital for general partners,” says Mike McAra, director at Second Century Ventures and NAR REACH Canada. “On a risk-adjusted basis, the hurdle rate for investment is much higher now than just six months ago, and thus capital is being allocated much more diligently and much slower.”

Commercial real estate is going through a tough time in the wake of the pandemic and as economic clouds loom on the horizon. Soaring interest rates and low vacancy levels are forcing real estate firms to streamline expenses by cutting out any non-essential spending, which has left a wide range of proptech technologies on the wrong side of the budgeting discussion.

The “nice to have” products and services offered by the smart building market’s innovative startups are often the first to go when real estate firms tighten their purse strings, creating knock-on effects for the venture capitalists (VCs) that fund them.

“Proptech valuations are coming down quite a bit, because their product, software, or service may not be as mission critical as they once thought for a real estate market in flux,” says Jeffrey Berman, general partner at real estate focused VC firm Camber Creek.

“Even if you're in the need-to-have category, you might have a renegotiation on your hands with a real estate company that says, 'Listen, we really need your product, we know this is valuable, but here's what's happening with us, we need to figure out how to be able to continue using your product at a lower price.'

Camber Creek now has nearly $1 billion in assets under management, from over 300 strategic Limited Partners representing leading global real estate owners, operators, and service providers. Camber Creek invests in proptech companies and over has seen several successful exits, including selling TaskEasy to WorkWave and Building Engines to JLL. However, Berman sees pressure on SaaS models for tenant and occupant amenities, which are now facing the cut as conditions worsen.

“Many businesses in our ecosystem, I would argue, are good businesses, but not venture appropriate,” he continued in an interview with Fortune. “Proptech deservedly had a light shone on to it but at the same time, you have this misunderstanding for many entrepreneurs and even VCs that overestimated how quickly something could scale in an industry that typically has not been quick to scale.”

Up to the end of 2022, funding from venture capital was still growing, with $5.9B invested by private equity and corporate backers in 2022, according to our Smart Building Startup report published at the start of the year. Total capital invested in startups in the global smart building space since 2015 amounts to over $31 billion, with the top 20 firms in the past two years each attracting between $225 million and $2.6 billion in total disclosed funding.

“The number of companies identified which fit our definition has increased by 20% compared to the 665 startups in 2021,” explains our separate study: The Smart Building StartUp Landscape 2023, which evaluates these startups. “It is clear that the smart building startup landscape is continuing to expand, but it is at a slower rate than in 2021 when we saw a 38% increase in the number of new entrants founded.”

The average pre-money valuation of proptech firms this year is $64 million, according to PitchBook, the lowest level since 2013. New funding for proptech firms is at its slowest pace since 2015, and the situation has not been helped by the US banking crisis involving Silicon Valley Bank, Signature Bank, and First Republic. Existing real estate focused startups and those just entering the space must consider different approaches that serve increasingly cost-sensitive and risk-averse stakeholders at every stage of the process.

Startups Underestimating the Complexity of the Supply Chain?

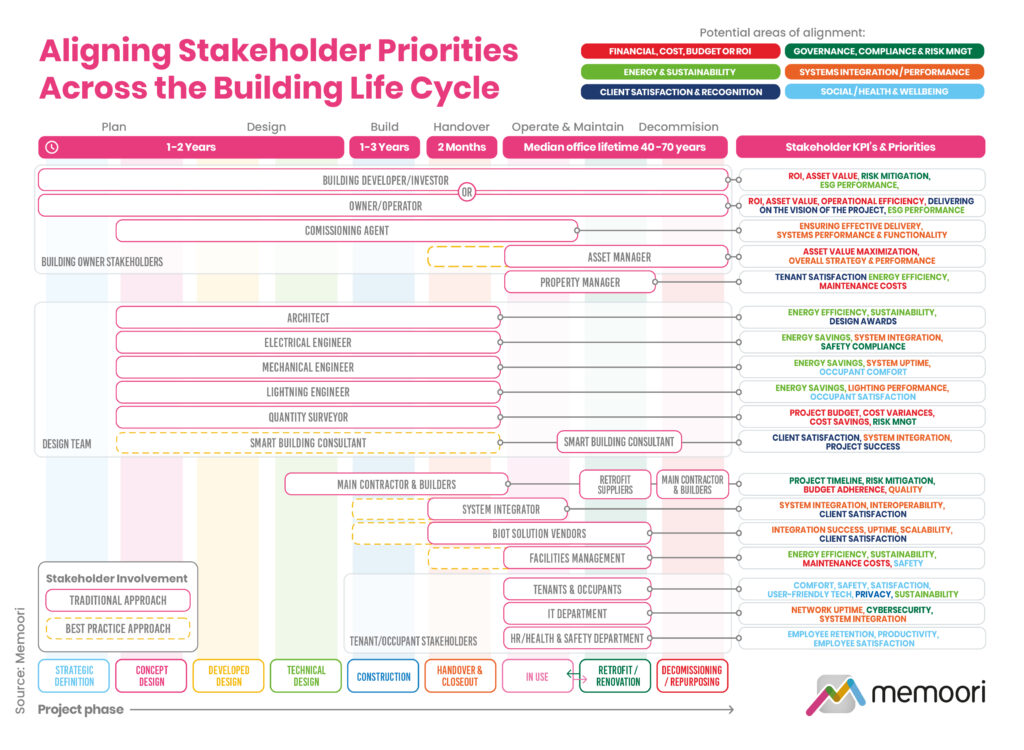

It would be easy for startups to underestimate the complexity of the supply chain and the competing priorities of different stakeholders during this turbulent period for the commercial real estate sector.

The graphic above, from our Internet of Things in Smart Commercial Buildings 2023 report, attempts to visualize that complexity over the course of the building lifecycle, highlighting the late addition of smart building consideration in the traditional approach.

The real estate sector will continue to consolidate, triggering a flight-to-quality for the remaining market to compete for tenants. As a result, smart building startups will have to deliver more value to stay afloat.

“Proptech startups can’t just buy growth. They’re going to have to really demonstrate their value proposition and get tight on their business model,” Jenny Song, principal at Navitas Capital, said. “That’s going to be a big win for the real estate industry overall in terms of the value that will be felt.”