This Report is the New H1 2025 Definitive Resource for Evaluating Startups in the Smart Building & PropTech Space

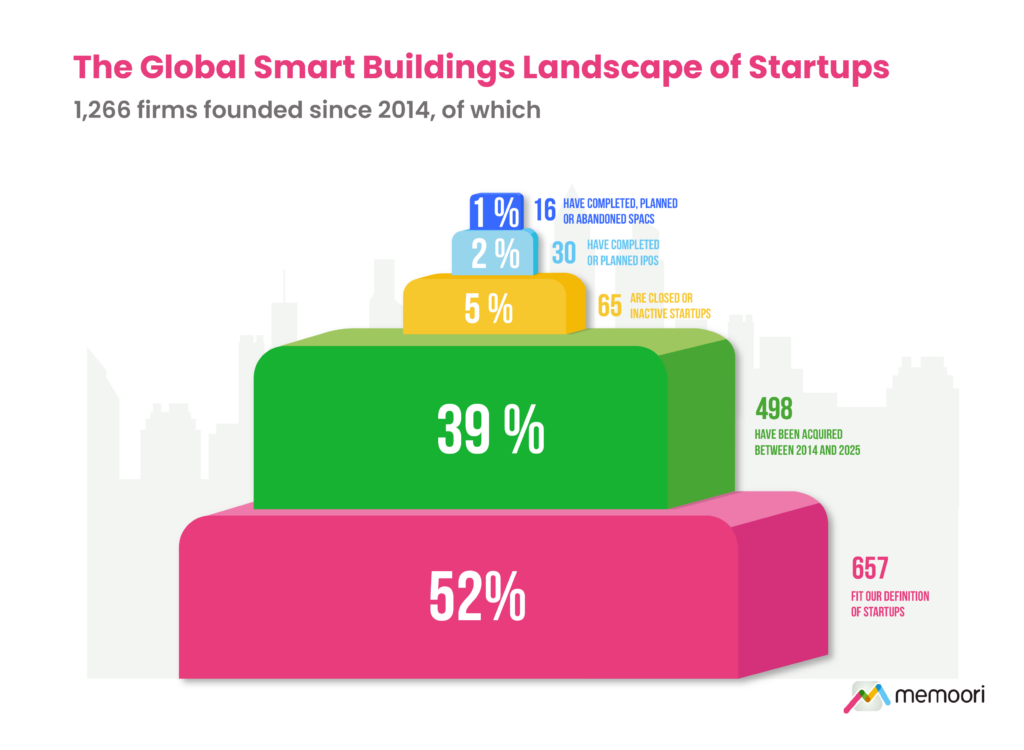

This research identifies 1,266 startups founded since 2014 in the management and operations phase of the global smart commercial buildings space. In total 498 firms have been acquired since 2014, 39% of the total landscape. 65 are closed or inactive startups, 5% of the total.

It is our 7th comprehensive evaluation of startups and scaleups in the operations and maintenance phase of the lifecycle of commercial real estate. It highlights venture capital funding, M&A, and strategic investments over the last 6 months.

The research includes a spreadsheet listing all startup acquisitions and investments in the first half of 2025, AND 2 presentation files with high-resolution charts. This report is also included in our 2025 Enterprise Subscription Service.

What does this Startups Report tell You?

- In 2024, $7.5 billion was invested in the smart building startup space. In the first half of 2025, we have tracked 126 funding rounds valued at $3.1 billion.

- Compared to the same period last year, this is a 13% decrease on 145 rounds, which suggests a reduced appetite for investing in this tech sector in 2025.

- There were 42 acquisitions of startups in the first half of 2025, over a 60% increase compared to the same period last year.

The information in this report is based on a rigorous analysis of the smart building market and builds on our previous research into Grid-Interactive Buildings, HVAC Optimization, Artificial Intelligence, the Internet of Things, Video Surveillance, and Access Control.

Our definition of a startup is “a private company formed no earlier than 2014 that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company, and is generally financed by venture capital or private equity funding.”

Within its 80 Slides and 34 Charts, The Report Sieves out all the Key Facts and Draws Conclusions, so you can Understand how StartUp Companies are Shaping the Future of PropTech.

We take a detailed look at Australasian startups gaining traction, with 15 firms including Bitpool, PlaceOS and Willow selected for this report. This is the follow-up to our report published in January, which covered Asian startups.

For only USD $3,000 this report provides valuable information into how startup companies are developing their businesses through Acquisitions, Partnerships, and Alliances.

Who Should Buy This Report?

The information contained in this report will be of value to all those engaged in managing, operating, and investing in smart building companies around the world. In particular, those wishing to invest in or acquire startups will find it particularly useful. Want to know more? Download the Brochure.

Table of Contents

- 1. The Global Smart Buildings Landscape of Startups

- 2. Venture Capital and Private Equity Funding

- 2.1 10 Notable Startup Investments in Smart Buildings H1 2025

- 2.2 External Funding for IoT in Buildings

- IoT Platforms for Smart Buildings

- 2.3 External Funding for Building Energy Management

- Energy Management Software

- HVAC Optimization Software

- Sustainability & Carbon Management in Buildings

- Energy Efficiency & Renewable Energy Services

- 2.4 External Funding for Grid Interactivity

- Demand Response & Virtual Power Plant

- Energy Storage & EV Charging in Buildings

- 2.5 External Funding for PropTech

- Asset & Maintenance Management

- Workplace Management & Tenant Experience

- Technology for Data Centers

- 2.6 External Funding for Physical Security

- Video Surveillance & Video Analytics

- Mass Notification & Critical Incident Management & PSIM

- 3. Smart Building Incumbents Partner with Startups

- 3.1 ABB

- 3.2 Honeywell

- 3.3 Johnson Controls

- 3.4 Schneider Electric

- 3.5 Siemens

- 3.6 Carrier

- 3.7 JLL

- 3.8 Allegion

- 4. Mergers & Acquisitions of Emerging Players

- 4.1 10 Notable Startup Acquisitions in Smart Buildings H1 2025

- 4.2 Acquisitions of IoT & Digital Twin Startups

- IoT Platforms for Buildings

- 4.3 Acquisitions of Building Energy Management & Grid Interactivity Startups

- Energy Management & Grid Interactivity

- Energy Efficiency & Renewable Energy Services

- 4.4 Acquisitions of PropTech Startups

- 4.5 Acquisitions of Physical Security Startups

- Video Surveillance & Analytics

- 5. Startups Reducing Headcount or Closed

- 6. Australasian Startups Gaining Traction

- Allume

- Bitpool

- Bueno

- CIM

- CriticalArc

- Exergenics

- FMClarity

- NUBE IO

- PlaceOS

- Skedda

- Tether

- Unleash

- Uptick

- Willow

- XY Sense

List of Charts and Figures

- The Global Smart Buildings Landscape of Startups: 1,266 Firms Founded since 2014

- Regional Distribution of 1,266 Startups Founded since 2014

- Startups VC and PE Funding: Number & Value of Funding Rounds 2015 to H1 2025

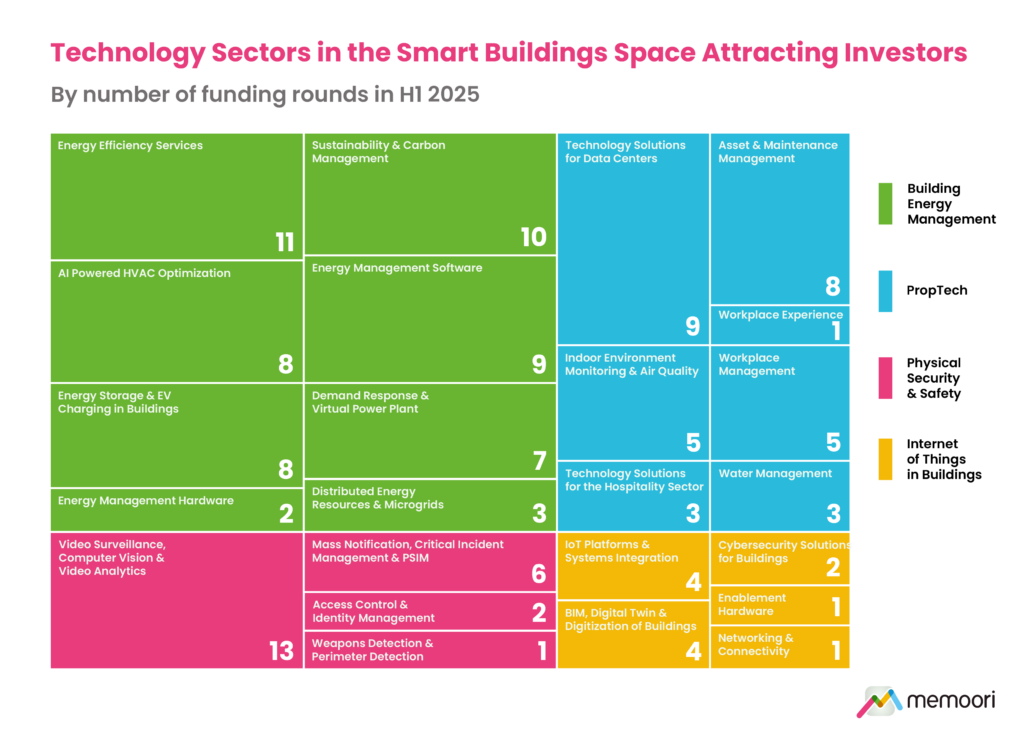

- Technology Sectors in the Smart Buildings Space Attracting Investors H1 2025

- Startup Acquisitions in the Smart Buildings Space 2014 to H1 2025

Appendix

- 1. Technology Categories for Startups in the Smart Buildings Landscape

- 2. Funding and Investments in Startups H1 2025

- 3. Mergers & Acquisitions of Startups H1 2025

- 4. Australasian Startups Gaining Traction H1 2025

Companies Mentioned Include (BUT NOT LIMITED TO);

3millID | Accessy | Adaptis | aedifion | Aetos Imaging | Airlich | Allume Energy | Amperon | Ampotech | AppWork | Astrape Networks | Asuene | AttoTude | Axiom Cloud | Beagle Systems | Bearing | Bedrock Energy | Bitpool | Blue Auditor | Bright Spaces | brighter AI | BRINC | Bueno Analytics | Building Controls & Solutions | Butlr Technologies | ButterflyMX | Cactos | Canary Technologies | Capalo AI | Cape Analytics | Carbon Reform | CarbonQuest | Carbyne | Centerseat | Chekt | CIM | Claros | CleanArc Data Centers | Clear Current | Conduit formerly HostAI | Coram AI | CriticalArc | Crowdkeep | Crusoe Energy Systems | CXApp | Dashdive | Deep Sentinel | Degree Analytics | DejaBlue | desk.ly | DG Matrix | ecoplanet | Edgecom Energy | Edo Energy | Engrate | Enrise | Enter, fka Baupal | Ento Labs | Equilibrium Energy | Etainabl | Exergenics | Exowatt | Eytrix | Flock Safety | Floral Energy | Fluix AI | FMClarity | Fram Energy | Fresh Coast Climate Solutions | Fusebox | Go To Green | Gradyent | Gravity | Green Fusion | Grid Edge | GridSwitch | Hakimo | Hallo Theo | Hammer Missions | HESSTec Hybrid Energy Storage Solutions | Hyperco | Hyting | Iknaia | Intelex Vision | InterAll | InVisit | Iota Spectrum Partners | iPronics | iwell | Jurny | Kind Humanoid | Laiier | LogicLens | Lookthrough | Lumana | Lumoview Building Analytics | M3 innovation | Marlowe | Metiundo | MHz Invensys | Mixergy | Mode | Motif | Nafas | Niko Energy | Nimble Energy | Node Energy | Novacene IoT | Novisto | Nube IO | nZero | Oaktree Power | Occuspace | Omnidian | Oosto fka Anyvision | Operance | Optiml | Ostrom | Otorio | Paul Tech | Perch Energy | Persefoni AI | Phosphorus Cybersecurity | PlaceOS | Planted | Podero | Poppy | Propflo | ProptechOS | Protex AI | Pupil | Pyrra Technologies | qbiq | REKS | Reshape Energy | RPD Energy | Scale Energy | Scale Microgrids | Sensorfact | Signatrix | Skedda | Skysafe | SmartSolar | SP Smart Meters Asset Limited (SPSMAL) | Spintly | Station A | Steryon | SunRoof | Swtch Energy | Telescope | Tether | tibo energy | Tilt Energy | trawa | Turing | Twelve Labs | Tyrrell Building Technologies | uHoo | Undagrid | Uniforce Security | Unleash | Unleash Live | Uptick | Urban Footprint | UrbanVolt | Utopi | Veesion | Verkada | Videtics | Virtual Facility | Voltfang | Westbridge | WiggleDesk | Willow | XY Sense | Zeitview fka DroneBase | Zendo Energy | ZeroEyes | ZutaCore