In this Research Note, we examine the development of Acuity Brands Intelligent Spaces Group (ISG) and its 2023 financial results, y/e 31st August 2023. Our analysis is based on their 4th October 2023 presentation, analyst call and announcements throughout the fiscal year. This article updates our previous analysis published last year.

While lighting makes up 95% of Acuity Brands revenue (they are now the largest lighting manufacturer in North America with $3.95 billion in FY 2023 revenues), it is their Intelligent Spaces Group that focuses on smart building technology. The Intelligent Spaces Group comprises the Distech Controls and Atrius brands, offering building management systems and software for improving energy efficiency, optimizing occupant experience and monitoring physical assets.

Acuity Brands Financials

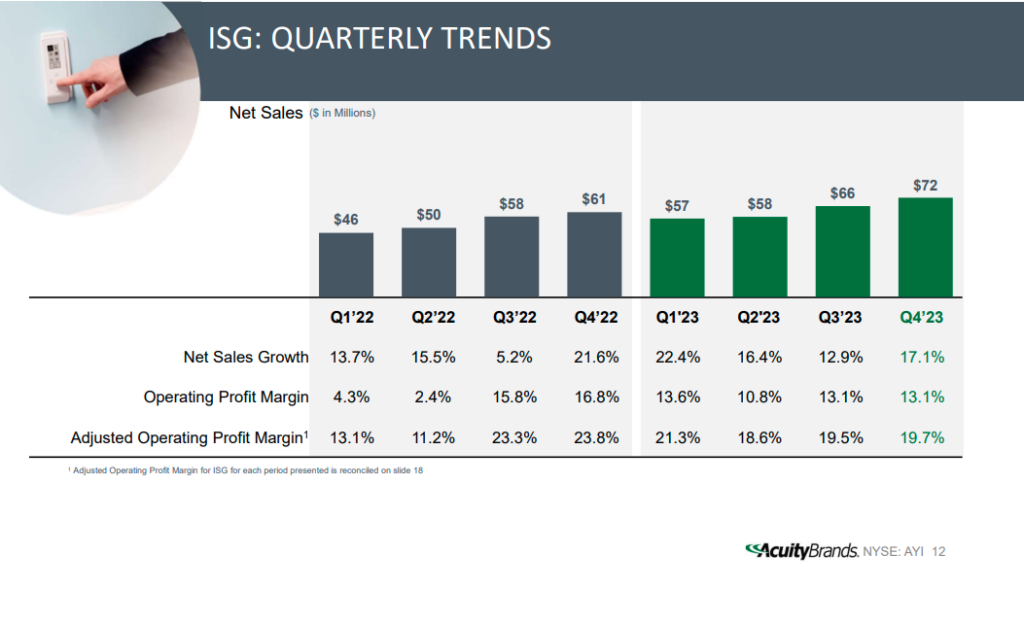

ISG's net sales for the fourth quarter were $72 million, an increase of 17.1%, as Distech continued to win business across new and existing customers. This quarter, the group also had a modest benefit from the acquisition of KE2 Therm.

ISG generated net sales of $252.7 million for fiscal 2023, an increase of $36.6 million, or 16.9%, as compared to the prior year. ISG operating profit was $32.1 million for fiscal 2023, an increase of $9.4 million compared to the prior year. ISG adjusted operating profit was $50.1 million for fiscal 2023, an increase of $10.2 million as compared to the prior year.

Full-year fiscal 2024 guidance forecasts that ISG will continue to generate sales growth in the mid-teens as the group continues to take share and expand geographically and into new control areas in the built environment.

We can expect to see further acquisitions in the Intelligent Spaces Group.

Distech Controls

Distech Controls currently accounts for the majority of ISG segment sales. Their strategy is based on geographic expansion and on increasing their addressable market by expanding what they control in a built space. Acuity Brands singled out the UK market at their Q4 presentation where they have increased their presence in FY 2023. The business continues to expand in Asia and in Australia over the course of this year and beyond.

In April 2023, Acuity Brands, Inc. announced a definitive agreement to acquire KE2 Therm Solutions, Inc., which develops and provides intelligent refrigeration control solutions that use proprietary advanced controls algorithms, software, and controls. The company’s technology is specified by a wide range of end users, consultants and major OEM manufacturers of evaporators, walk-in freezers and coolers for both new install and retrofit refrigeration applications.

Founded in 2009 to accelerate the penetration of smart digitized and connected refrigeration controllers in North America, the company is headquartered in Washington, Missouri. KE2 Therm is integrated into the Distech Controls business.

“We are focused on increasing our addressable market for Distech Controls,” said Peter Han, President of the Intelligent Spaces Group. “In recent months, we have expanded our presence in new regions and now, with the acquisition of KE2 Therm, we will expand into the commercial refrigeration controls market as it transitions from analog to digital controls”

Atrius

In June 2023, Atrius DataLab, built on Microsoft Azure, was launched: “its most comprehensive building automation platform product to date, to transform and unify operations across a built space”. The applications built on top of DataLab’s data-agnostic architecture support facilities, energy, and sustainability managers to better understand resource consumption across a portfolio with the tools to quickly measure, track, and report on sustainability progress.

"Atrius DataLab funnels all a building’s information streams – from lighting, HVAC, refrigeration, sustainability programs, asset location, and more – through its standards-based digital twin architecture using RealEstateCore (REC). Acuity Brands has contributed greatly to the development of REC 4, and we are impressed with how fast Acuity has embraced REC,” said Dr. Erik Wallin, chairman of RealEstateCore. “REC 4 uses the Brick Schema and enables the delivery of industry-leading solutions like Atrius DataLab.”

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.