In this Research Note, we examine the ADT Commercial fire and security business, based on their 2022 Results, investor presentations and strategy throughout 2022, updating our previous analysis.

ADT is a US public company providing smart home, commercial security, and solar solutions serving residential, small business, and commercial customers in the United States. Total revenues were $6.4 billion in 2022.

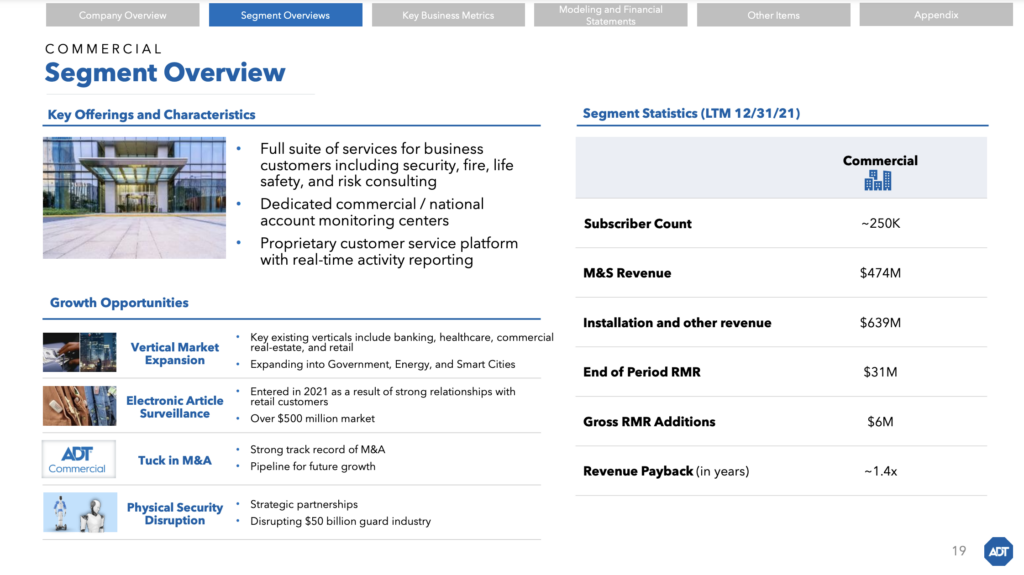

The ADT Commercial segment (19% of total 2022 revenues) installs, integrates, maintains and inspects commercial building safety and management technologies, which include fire detection and suppression, video surveillance, and access control systems.

ADT Commercial revenue in 2022 was $1,230 million, up 10%, versus prior year. Improvements were driven by an increase in product and service prices as well as strong installation and sales performance. Commercial Adjusted EBITDA increased 32% to $127 million, with an adjusted EBITDA margin of 10%.

These improvements were driven by higher revenue, which was partially offset by the impact of cost inflation on materials, labour, and fuel.

Monitoring and related services revenue accounted for 44% of Commercial revenues while 56% related to security installation, product and other revenues. Higher installation revenue related to strong sales performance, despite supply chain delays.

The ADT Commercial business has a strong track record of growth with 28% CAGR since 2016, achieved through M&A with 13 tuck-in acquisitions since their IPO in 2018.

ADT Commercial Acquisitions

In May 2022, ADT Commercial announced that it had purchased Key-Rite Security, based out of Denver, Colorado. Since 1975, Key-Rite Security has been a locally owned and operated security provider specializing in access control, surveillance, intrusion, and intercom systems for a wide range of commercial environments.

ADT Commercial entered the guarding space with the launch of the EvoGuard brand at CES 2023. EvoGuard is aimed at helping to cost-effectively enhance corporate security programs, while responding to high turnover rates and ongoing labor shortages in the guarding market.

EvoGuard will use artificial intelligence and augmented reality in combination with a fleet of autonomous humanoid robots and indoor drones for comprehensive security surveillance in a wide variety of commercial areas.

In partnership with Norway-based robotics company, Halodi Robotics, the humanoid robot is being developed to:

- Conduct autonomous patrols in commercial facilities.

- Perform two-way communications between the public and an operator.

- Open doors and operate elevators.

- Interact with employees.

- Inspect and remove hazards or obstructions using fully articulated hands.

- Complete various tasks requiring fine motor-skilled actions.

- Capture 360-degree view of patrol areas via a robust camera system.

- Self-dock and self-charge at designated stations.

In collaboration with Israel-based Indoor Robotics, the goal of the Tando autonomous indoor drone, currently in development, would be to function as an additional layer of 24/7 surveillance to patrol commercial facilities. The humanoid robot and the autonomous indoor drone are currently in its piloting phase, with anticipated commercialization targeted for late 2023.

ADT Commercial is aiming to disrupt the $50 billion manned guarding business with robotics technology.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.