In this Research Note, we examine Airthings ASA, the Norwegian tech company focused on indoor air quality sensing. This analysis focuses on their 2022 financials and revised strategy for their commercial buildings offering, Airthings for Business, based on their Capital Market Day presentation, 26th October 2023. This article updates our previous article published in January 2023.

Airthings offers indoor air quality and energy-efficiency solutions for homeowners, businesses, and professionals. Founded in 2008 and headquartered in Oslo, Norway, the company has 125 employees.

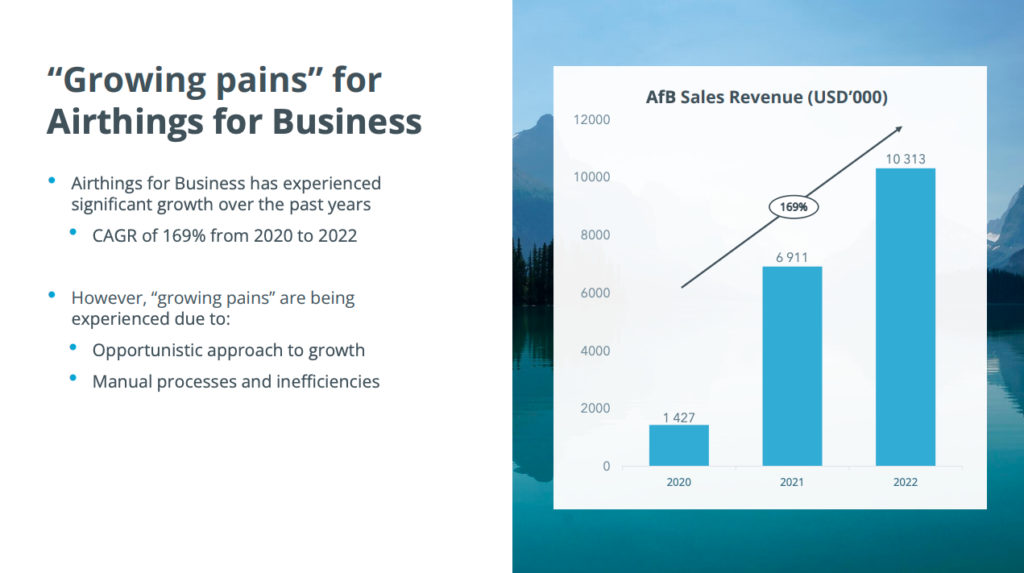

Airthings Financial Results 2022

On 10th February 2023, Airthings reported overall revenue of USD 35.5 million for the full year 2022, up 5% from 2021. Airthings for Business amounted to USD 10.3 million for 2022 (+49%). Annual recurring revenue (ARR) increased 26% year-on-year to USD 3.6 million, of which Airthings for Business accounted for USD 2.5 million.

Revised Strategy and 2023 Capital Markets Update

The 2022 results demonstrated that the company needed to rethink the strategy presented at the 2021 Capital Markets Update. On 26th October 2023, Airthings presented its Q3 results and hosted a Capital Markets Update focused on a revised strategy.

“Airthings is rolling out and delivering on a strategic pivot where we will be honing a selective go-to-market strategy, increasing the software product focus, and implementing an improved operating model. This is already driving traffic to the Consumer segment and strengthening the backlog in Airthings for Business, but it will take time before the full effects of the new strategy are reflected in the financials. In combination with increasing awareness in a more mature market, we are confident in the long-term outlook for the business,” says Chairman of the Board Geir Førre.

Go-to-Market Initiatives

Airthings for Business has identified three priority initiatives to drive growth in the number of customers:

- Generate more demand “pull” by focusing more sales activity directly with end clients and users. Until adoption ramps up, time needs to be spent with end-users selling the value of IAQ monitoring for health, wellness, efficient FM and energy efficiency.

- Streamline partner portfolio with a focus on those who add additional value to the end-user experience and reach. A fraction of their total partner count has historically been responsible for the bulk of their revenues.

- Limit geographical focus to the key regions of North America and EMEA. Historically, significant sales team capacity has been utilized trying to establish new geographies.

Product Focus Initiatives

Airthings for Business has identified three initiatives focused on addressing pressing customer needs:

- Develop additional solutions that enable end-users to reduce their energy consumption.

- Further optimize indoor air quality offering.

- Continue to support proactive and efficient facilities management.

The company acknowledges that its credibility has been eroded due to it being unlikely to fulfil its ambition reported at the 2021 Capital Market Update of reaching a revenue level of USD 100M already in 2024. Instead, they are demonstrating their ability to follow their refined strategy by delivering on the initiatives they have outlined with the aim of re-establishing trust and long-term value creation.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.