In this Research Note, we examine Alarm.com, a US provider of physical security, intelligent automation, and energy management solutions for smart homes and commercial real estate.

This analysis highlights their 2023 financial results announced on 22nd February 2024, business model, strategy and M&A, based on their 2023 10K Report, investor presentations, and news throughout the year.

Alarm.com, a Tysons, VA-based firm founded in 2000, became a Nasdaq public company in June 2015. Alarm.com’s cloud-based platform offers a suite of IoT solutions addressing opportunities in the residential, multi-family, small business, and enterprise commercial markets.

Their solutions include security, video and video analytics, energy management, access control, electric utility grid management, indoor gunshot detection, water management, health and wellness, and emergency response. During 2023, their platforms processed more than 325 billion data points generated by over 150 million connected devices.

Alarm.com 2023 Financials

Highlights of their financial performance for 2023 include:

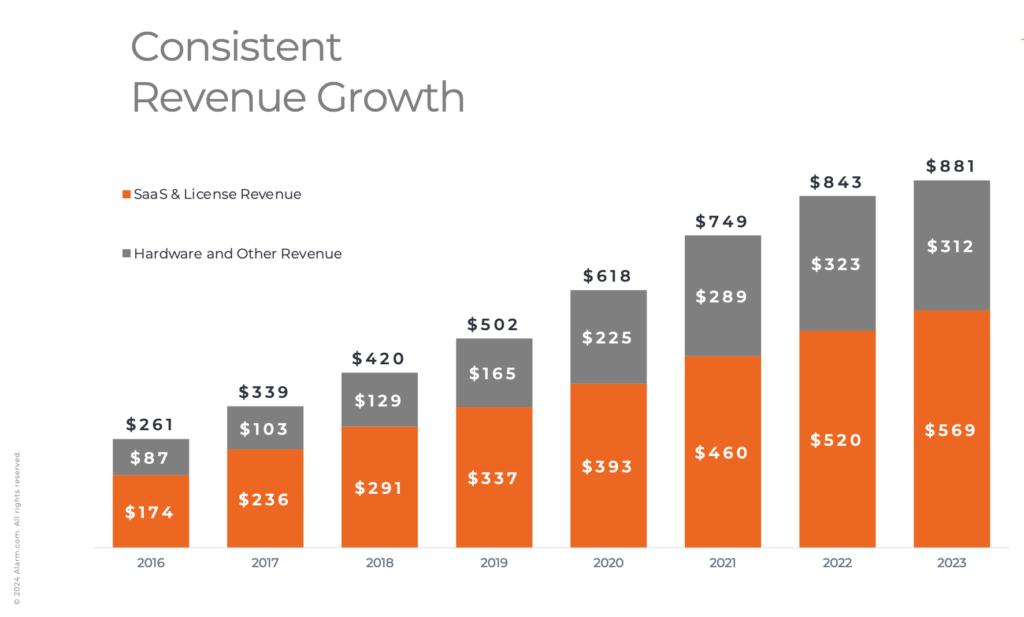

- Total revenue increased 5% to $881.7 million in 2023 from $842.6 million in 2022.

- SaaS and license revenue increased 9% to $569.2 million in 2023 from $520.4 million in 2022. SaaS and license revenue represented 65% % of 2023 revenue. Software license revenue decreased to $23.2 million in 2023 from $26.8 million in 2022.

- Hardware and other revenues, including the sale of video cameras, video recorders, cellular radio modules, smart thermostats, image sensors, gunshot detection sensors and other peripherals, represented 35% of 2023 revenue.

- Net income increased 44% to $80.3 million in 2023 from $55.6 million in 2022.

- Non-GAAP adjusted EBITDA, a non-GAAP measurement of operating performance, increased to $154.0 million in 2023 from $146.8 million in 2022.

Business Model and Strategy

Alarm.com goes to market through a network of over 11,000 service provider partners who install and maintain their systems in homes and businesses. The company provides SaaS software to around 9.1 million subscribers.

The firm has expanded their business for commercial enterprise customers with video analytics and gunshot detection acquisitions and diversified their offering for the smart home with smart thermostats and flexible grid services.

Their strategy to enter the commercial security sector has been to develop Alarm.com for Business, to enable companies to benefit from integrated services in terms of intrusion, access control, and video, as well as some of the automation offerings such as temperature monitoring.

The OpenEye acquisition also offers a higher tier of video analytics services for SMBs. And Shooter Detection Systems sells primarily to enterprises, the highest end of the commercial market.

Acquisitions

Alarm.com’s M&A strategy is focused on small targets, technology startups and tuck-in acquisitions with 10 transactions closed between 2017 and 2023, 7 of which we covered in our 2022 Examined article.

In April 2023, Alarm.com announced the acquisition of substantially all the assets of Vintra, a San Jose, Californian startup providing AI-powered video analytics for the enterprise commercial market, for $7.2 million.

Alarm.com acquired Vintra's core intellectual property, its research scientists, software engineers, and technical services teams as part of the acquisition. Integrating Vintra's software capabilities and its science and engineering teams will expand Alarm.com's deep learning program and accelerate the deployment of advanced video analytics solutions for the Alarm.com and OpenEye platforms.

In May 2023, Alarm.com acquired EBS, a Polish specialist in the design and manufacturing of smart communicators, for 9.8 million in cash. Integrating with EBS smart communicators will expand their support for legacy security control panels that are widely deployed in international markets, providing its service providers with a cost-effective solution for efficiently deploying connected property solutions.

In October 2022, the company completed an 85% stake in Noonlight, a US connected safety and emergency response platform, for $31.9 million in cash. Noonlight was founded in 2013 as a personal safety mobile application and has grown into an IoT device monitoring platform that has organically attracted over 3.5 million Noonlight app users.

Alarm.com has a history of majority-stake acquisitions - enabling companies to continue to operate as independent businesses and brands, while still benefiting from the public company’s industry know-how, resources, networks, and leadership team.

With its strong SaaS business model and nimble acquisition strategy, Alarm.com has established a favourable position in high-growth recurring revenues and technology deployment in smart buildings.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.