In this Research Note, we examine Allegion plc, a leading pure-play provider of security and access control solutions. Our analysis is based on their 2022 annual results, 2023 Investor & Analyst Day presentations, corporate venture capital investments and recent activities.

Allegion, a US public company, headquartered in Ireland is the standalone business formed in 2013 from the former commercial and residential security businesses of Ingersoll Rand. The group is predominantly focused on mechanical security products and systems, which are currently undergoing digital transformation in their core access control, door and locking systems businesses. Allegion reports approximately 12,300 employees worldwide.

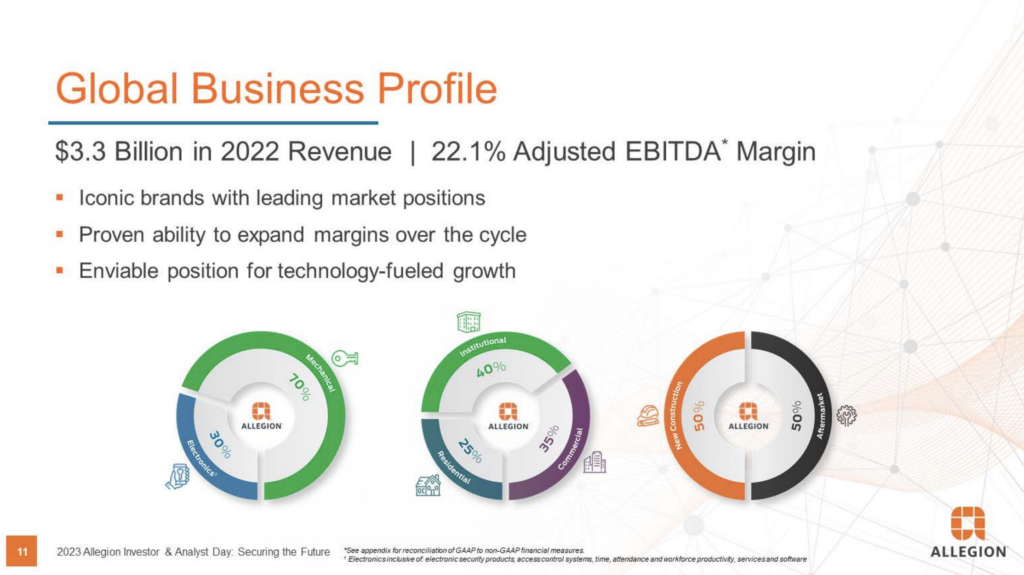

Full-year 2022 net revenues of $3.27 billion increased 14.1%, compared with the prior year (up 10.7% on an organic basis). The Access Technologies acquisition contributed 6.5% to total growth. The organic revenue increase was primarily driven by strong prices across all regions as well as volume growth in Americas non-residential, offset by pressures on residential in the Americas segment and international volume.

Full-year 2022 operating margin was 17.9%, compared with 18.5% in 2021. The adjusted operating margin for the full-year 2022 was 19.5%, compared with 18.8% in 2021. The 70-basis-point increase was driven primarily by price and productivity exceeding inflation as well as favourable mix, offset by the dilutive impact of the Access Control Technologies acquisition, foreign currency pressure and investments.

In 2022, Allegion increased its revenue mix to 30% electronics, which are defined as sales originating from electronic security products, access control systems, time, attendance and workforce productivity services and software.

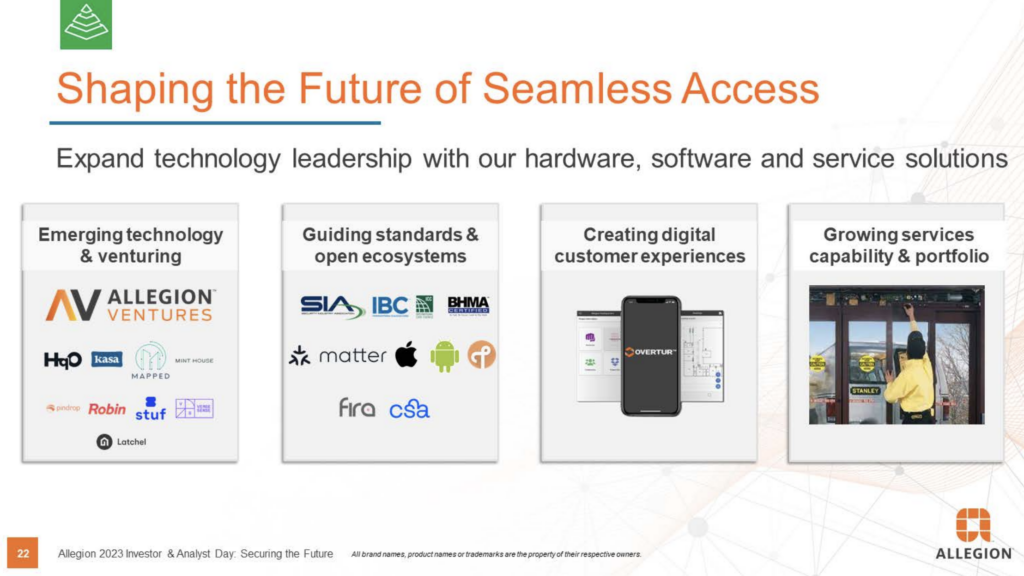

The continued growth of the digital products category is due, in large part, to Allegion’s record of M&A. In the first year after its spin-off, the firm acquired electronic lock company SimonsVoss, marking its intentions in the market, and since 2017 Allegion has embarked on a wide range of investments and partnerships, in addition to a spending spree which has seen them acquire a number of new firms, most notably Isonas in 2018, Yonomi in 2021, Stanley Black & Decker’s Access Control Technologies automatic entrance solutions business in July 2022 and several workplace IoT firms, Plano and Workforce IoT. We covered their strategic direction in the smart building and proptech space in our December 2022 analysis.

Electronics revenues in both the residential and non-residential segments are a key growth driver. Allegion reported 40% growth in Q2-2023 Americas electronics revenues.

Allegion Ventures Access Control

Allegion Ventures, the $50 million corporate venture unit of Allegion plc, is also an important contributor to identifying emerging smart building technologies for its parent company. The unit was formed in March 2018 to invest in technology and software that go beyond traditional approaches to bridge physical and digital security and create seamless user experiences.

Strategic investments in 2022/2023 include:

- Mar 2023: Latchel, founded in 2017, helps rental property managers streamline maintenance operations. Allegion sees a potential to connect maintenance, concierge services and building access control with this investment.

- Feb 2023: Co-led an $11 million Series A round for self-storage startup, Stuf.

- Jul 2022: Participation in a $30 million Series C round of Robin, the hybrid workplace management platform provider.

- May 2022: Participation in a $35 million Series B round of Mint House, a provider of tech-enabled residential hospitality in the short-term rental market.

Having reported only 21% of revenues originating from electronic security in 2020, Allegion group is accelerating its technology-driven growth through acquisitions and strategic investments.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.