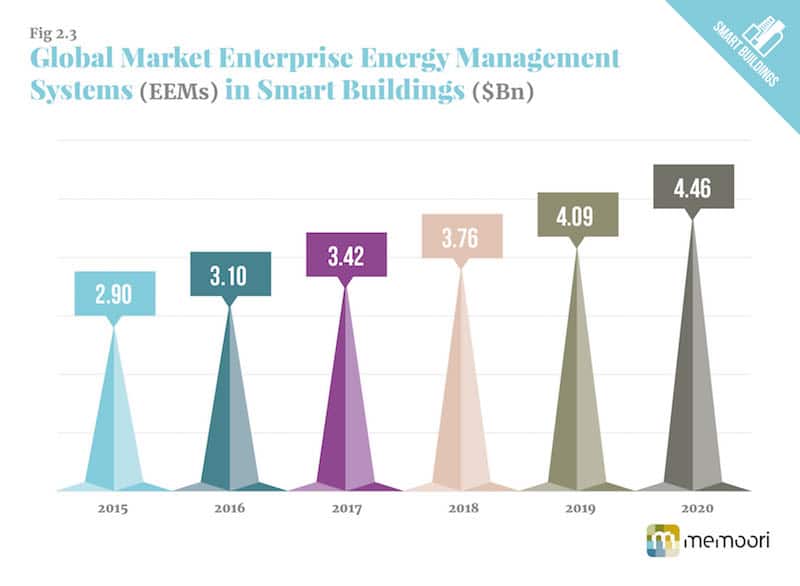

Our new research report shows that the markets for Enterprise Energy Management, BECS Supervisory Software and Smart Building to Smart Grid Interface Software will rise to nearly $10Bn by 2020; with related software on the Smart Grid side growing at a healthy 12% CAGR to nearly $2bn by 2020.

The Harmonization of the Smart Grid and Smart Building Markets has begun! They are beginning the tricky process of integration as major global firms look to capitalize on opportunities surrounding distributed energy.

North America leads the way in terms of smart building to smart grid software sales with some 70% of the overall market, thanks to a pioneering approach to demand response and a conducive policy environment; But other regions are catching up to the possibilities and their access to quality data is being boosted by government mandated smart meter rollouts.

Energy services companies (ESCOs) such as Siemens, Schneider Electric, Honeywell and Johnson Controls are all pursuing aggressive acquisition policies to shore up and expand their capabilities across the energy value chain.

Our report details a total of 459 deals pertaining to the market between 2010 and 2015 as firms look to build the skill sets required to leverage opportunities around the Internet of Things and develop new Energy Management offerings.

At 149 pages with 30 charts & tables & ONLY $999 for a single user license, Smart Buildings Meet the Smart Grid: Markets, Trends & Enabling Technologies 2015 to 2020 report filters out all the important conclusions, supported by facts, to demonstrate what is shaping the future of the smart building industry. You can learn more at the reports website - http://memoori.com/portfolio/smart-buildings-meet-smart-grid-2015-to-2020

[contact-form-7 id="3204" title="memoori-newsletter"]