This article was written by Daphne Tomlinson of Tomlinson Business Research

The acquisition of Verisae announced on 22nd September, is the third deal by Accruent this year, and further evidence of the wave of M&A activity by the major players in the facilities management sector to consolidate their positions in the market.

Verisae offers a cloud-based integrated facilities management software platform across a variety of verticals focusing on building maintenance and asset management functionalities. The company’s revenue is estimated to be in the mid-$40 million range.

“We can now help customers manage their complete facilities lifecycle from strategy to execution by connecting real estate and facilities to assets and service teams through the Internet of Things" said John Borgerding, CEO, Accruent.

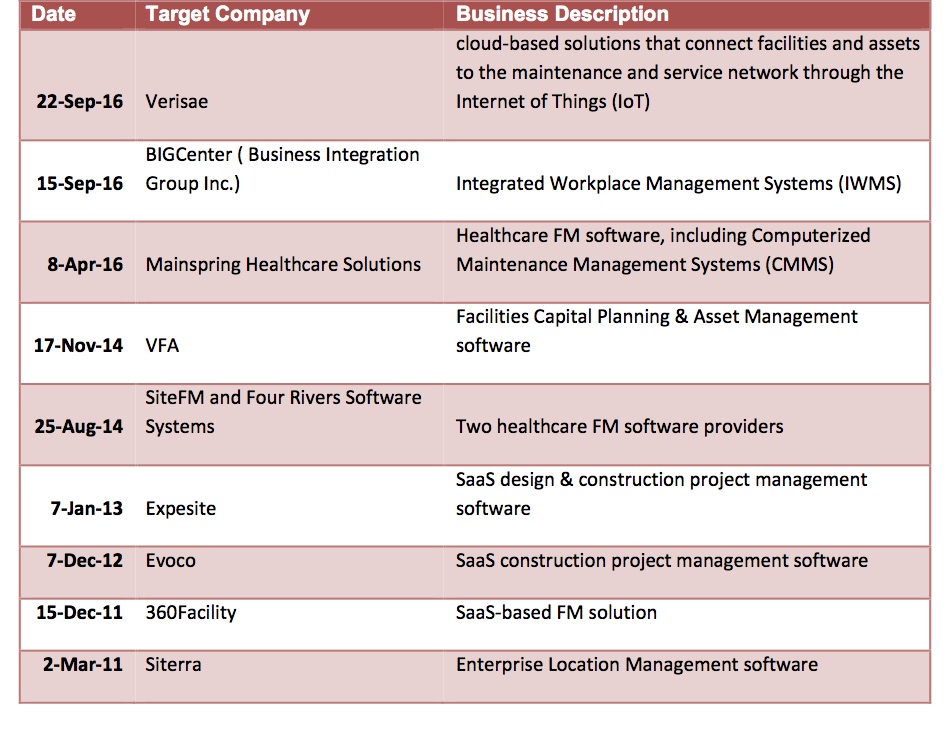

Accruent, with an estimated revenue in the range of $100 - 120 million and around 600 employees, claims to be the world’s largest provider of real estate, facilities, and asset management software, although it is mainly present in the US market. The company was itself acquired by Genstar Capital in May 2016, its third private equity owner in its 21-year history and has been active in acquiring nine US software providers since 2011.

These latest acquisitions support 3 trends identified in our recent report on The Market for Building Performance Software 2016 to 2020.

The most significant growth in real estate and property management software is expected to occur in the Asset and Maintenance Management (AMM) market, as facility managers become increasingly concerned with aging buildings together with a renewed focus on enterprise asset maintenance and expenditures, increasingly mobile workforces that necessitate the need for increased asset utilization and efficiency, and a demand for less-costly SaaS-based software solutions.

The rise of IoT is also prompting providers to invest in platforms, which can provide a range of solutions, for example, proactively assessing and targeting equipment maintenance, ascertaining occupancy levels to improve space utilization in the agile work environment or addressing energy management optimization in commercial buildings.

The integration of energy management software with other software aimed at supporting processes in the management of commercial and industrial facilities and real estate has been a continuing trend over recent years.

Other FM software companies who have made acquisitions in 2016 include Yardi, who acquired Proliphix, a US provider of cloud-hosted remote management software to provide inexpensive monitoring and control of HVAC systems for large enterprises with small facilities.

The investment community has also shown increased interest in this growth sector since June 2016, providing funding for companies to expand. For example,

- TA Associates, a leading global growth private equity firm, has completed a growth equity investment in Maintenance Connection, Inc., a leading US provider of Computerized Maintenance Management Systems (CMMS).

- Main Capital Partners, a private equity investor with an exclusive focus on the software sector in Benelux and Germany, has invested in the growth of Axxerion, a Dutch supplier of SaaS solutions for IWMS and Real Estate facilities. Customers include CBRE Global Investors, KPMG, Rabobank, Facilicom, and Liberty Global.

- UK software company, Condeco has raised $30 million to consolidate its position as a world leading provider of workplace management technology. Condeco offers workplace scheduling and office utilization software and hardware, to maximize the use of office space, ensure high-pressure meetings and flexible work areas run smoothly and to provide essential real-time data on workspace usage for future planning. Led by Highland Europe, the investment, representing a minority interest, will be used to accelerate the company’s expansion across the U.S. and internationally.

- Lucernex completed a significant minority investment from HCAP Partners (formerly Huntington Capital), a leading mid-market private equity firm. The investment will further fuel the growth that Lucernex has experienced as more of the world’s leading retailers, restaurants, healthcare providers and financial services firms adopt its cloud-based Integrated Workplace Management System (IWMS) and Store Lifecycle Management (SLM) solutions.

Founded in 2000, Plano, Texas-based Lucernex is a relatively small (revenue estimated to be in the $20 to $30 million range), but fast-growing, IWMS vendor.

The company has recently been the subject of a lawsuit filed in September 2015, by Accruent, who claimed Lucernex had taken its trade secrets and competed unfairly. However, in September, a Texas Court found that Accruent’s allegations were unsupported by any evidence.

“When a company like Lucernex rapidly takes a leadership position in a market previously dominated by legacy providers, it’s not uncommon for lawsuits to be filed in an attempt to slow their momentum,” stated Joe Valeri, Lucernex’s Chief Executive Officer, after the court case was dismissed.

As competition heats up, we expect to see further consolidation in the facilities and real estate management software sector, as providers broaden their portfolios, offer integrated solutions and rise to the challenge of the new opportunities in IoT and data-driven software.

[contact-form-7 id="3204" title="memoori-newsletter"]