This Research Note examines the recent HubStar announcement that it has acquired Relogix, a Canadian occupancy analytics firm. We assess the portfolio and acquisitions of Hubstar Group, the rationale for the Relogix transaction and our forecast for the occupancy analytics market in 2024 and beyond.

Our recent review of workplace technology acquisitions in the commercial smart buildings space over the last 12 months highlighted significant M&A transactions in integrated workplace management systems (IWMS), workplace experience apps, occupancy analytics, visitor management software and associated workplace hardware.

We are seeing established players augment their software and technology offerings while startups are partnering and merging to gain critical mass.

HubStar

HubStar is a workplace technology company with headquarters in Marlborough, Mass and London, UK. The company provides a hybrid working platform to drive productivity, collaboration and workplace experience while reducing real estate costs.

The HubStar Group was established in 2018 and now comprises of several workplace technology firms;

Smartway2 was founded in 2014 and is headquartered in Marlborough, Mass. specializing in workplace booking and scheduling solutions. Smartway2 Limited (UK registered company) was acquired by Hubstar (formerly known as Ubiquitti) in March 2018.

Lone Rooftop was founded in 2014, headquartered in Amsterdam, Netherlands and is now rebranded as Hubstar. It specialises in a Positioning Intelligence Engine (PIE) for workplace analytics. The company was acquired by Hubstar in September 2021.

Relogix was founded in 2015, headquartered in Ottowa, ON, Canada. It specialises in workplace occupancy sensors and analytics solutions. Acquired by Hubstar in January 2024. 24 employees are listed on LinkedIn.

Relogix Acquisition

The transaction combines HubStar’s analytics capabilities and commitment to R&D investment with Relogix’s workplace analytics platform, Conexus, which already hosts vendors from the scheduling market, multiple sensor technologies, and major corporations such as Microsoft, Schneider and JLL.

Steve Vatidis, Executive Chairman, HubStar said “The next phase of HubStar’s journey will be accelerated by the combination of our AI-powered utilization measurement and hybrid occupancy optimization capabilities with the highly automated, easy to install, no footprint sensors that Relogix is renowned for”.

Steve Vatidis, the sole shareholder of Hubstar Group Ltd, a private company incorporated in London, UK, is the former CEO of integrated workplace management systems (IWMS) company, Manhattan Software which was sold to location-based solutions company Trimble in 2014.

Relogix has struggled to gain traction in the highly competitive occupancy analytics space, as the following headcount analysis published in November 2023 demonstrates: As of October 2023, Relogix had 27 employees, a decline of 31% over the last two years since October 2021 and a decrease of 21% since October 2022.

Hubstar’s strategy would appear to focus on selecting underperforming assets and consolidating them into an overall workplace management portfolio with more momentum.

Market Outlook

Workplace technology has become a significant focus for acquisition activity in recent years as M&A deals enable commercial real estate stakeholders to augment their software and IoT offerings.

These acquisitions and investments are indicative of a buoyant workplace technology market accelerated by the changing needs of commercial real estate landlords and tenants in a return to the office.

We expect acquisitions to continue in the near term as occupancy analytics technology plays a crucial role in the data-driven approach to establish human-centric workplaces for building occupants and to support more efficient operations for facility owners and workspace operators.

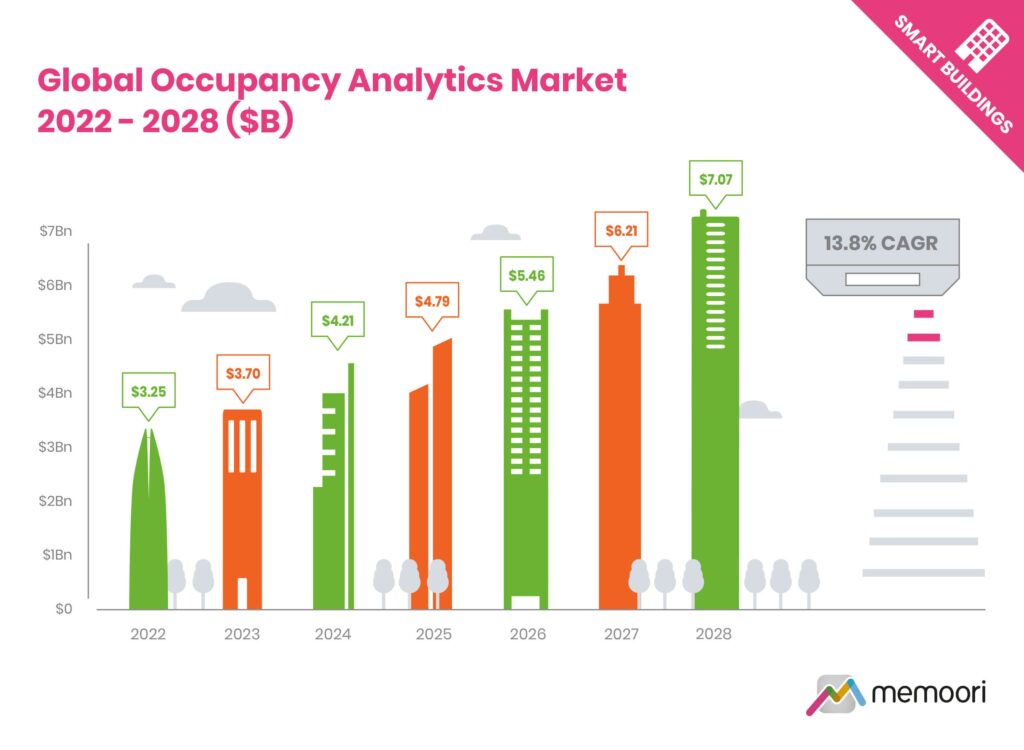

Our 2023 Occupancy Analytics Report forecasted that the Global Occupancy Analytics market in the commercial office space is estimated at $3.25 Billion in 2022, rising to $7.07 Billion by 2028, growing at a rate of 13.8% CAGR.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.