In this Research Note, we examine one of the top three companies in the global access solutions market, dormakaba Group, based on their FY2022/2023 financial results, year ending 30 June 2023 and their latest Annual Report. This analysis which also covers the firm’s Shape4Growth strategy and its digital product portfolio, updates our previous article on dormakaba last year.

dormakaba is listed on the SIX Swiss Exchange and is headquartered in Rümlang, near Zurich, Switzerland. Around 16,000 employees worldwide support a growing customer base in more than 130 countries.

dormakaba Financials

dormakaba’s net sales rose by 3.3% to CHF 2,848.8 million in the 2022/23 financial year (previous year: CHF 2,756.9 million). Organic sales growth contributed 8.4% (of which 6.9% relates to pricing) to the overall increase.

Adjusted EBITDA, which excludes items affecting comparability, increased by 3.4% to CHF 384.8 million (previous year: CHF 372.3 million). The adjusted EBITDA margin was 13.5% (previous year: 13.5%).

Positive contributions to margins from strong price realizations and increased operational efficiency were partly compensating for a negative product mix, higher functional costs from strategic investments in growth and profitability, customer inventory destocking, the residual impact of inflation on freight, labor, and energy costs, and adverse currency exchange effects.

Shape4Growth Strategy

In July 2023, dormakaba launched a transformation program, as part of its Shape4Growth strategy, to further drive customer centricity, strengthen the company for the future, and achieve its mid-term targets.

The company expects resulting cost savings with a run-rate of approximately CHF 170 million by 2025/26 and a net reduction of full-time equivalent positions of up to 800.

The program aims to further consolidate the global production footprint, to reduce the supplier base, to improve sourcing capabilities and to re-focus Product Development through a single global roadmap.

In addition, dormakaba will optimize its General & Administrative functions by leveraging shared service centers for Human Resources and Finance. The transformation will be supported by consolidating IT initiatives to drive standardization for an improved customer experience.

Product Portfolio

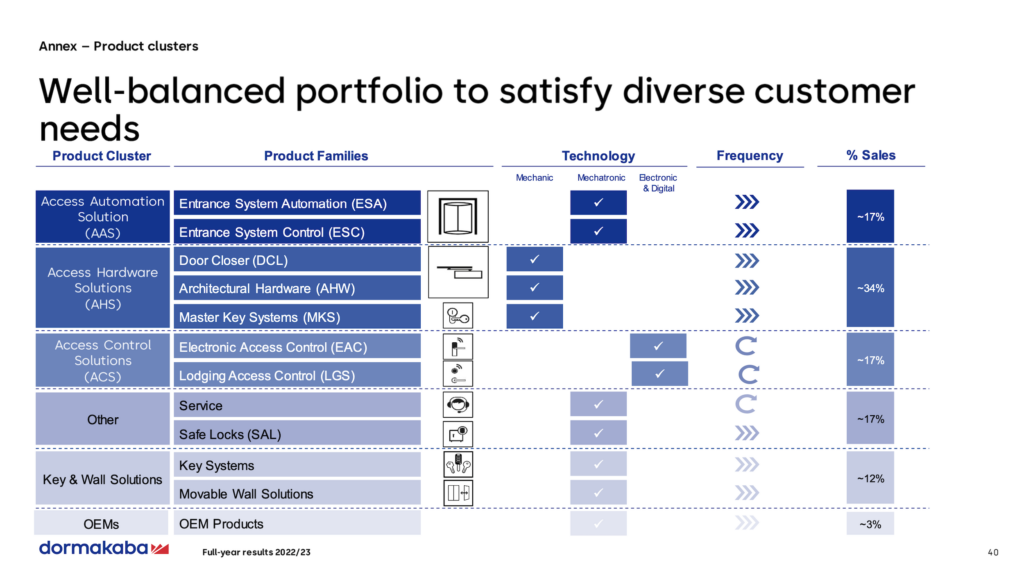

With a clear portfolio segmentation, dormakaba concentrates on global core businesses such as Access Automation Solutions (door operators, sliding doors, and revolving doors), Access Control Solutions (connected devices and engineered solutions), Access Hardware Solutions (door closers, exit devices, and mechanical key systems), and services.

The company is also a market leader for Key Systems (key blanks, key cutting machines, and automotive solutions such as transponder keys and programmers), as well as Movable Walls including acoustic movable partitions and horizontal and vertical partitioning systems.

In recent years, the product portfolio of dormakaba has increasingly embraced mechatronic, electronic and digital solutions. Their continued investment in product innovation and digitization has positioned the company well to offer attractive solutions for the emerging demands of customers and the market.