In today’s complex commercial real estate landscape, energy management has become a critical focus for asset managers, property managers, and facilities managers.

As urbanization accelerates, energy demand grows, and the energy market becomes more volatile, optimizing energy use is no longer just about lowering costs, it has become a key factor in achieving sustainability, resource efficiency, and energy security.

Our new research takes an in-depth look at how artificial intelligence-driven energy management technologies will transform the way HVAC systems operate, enhancing both operational efficiency and sustainability. It focuses specifically on next-generation software solutions that leverage AI and IoT technologies to track, analyze, automate, and optimize HVAC energy consumption and performance.

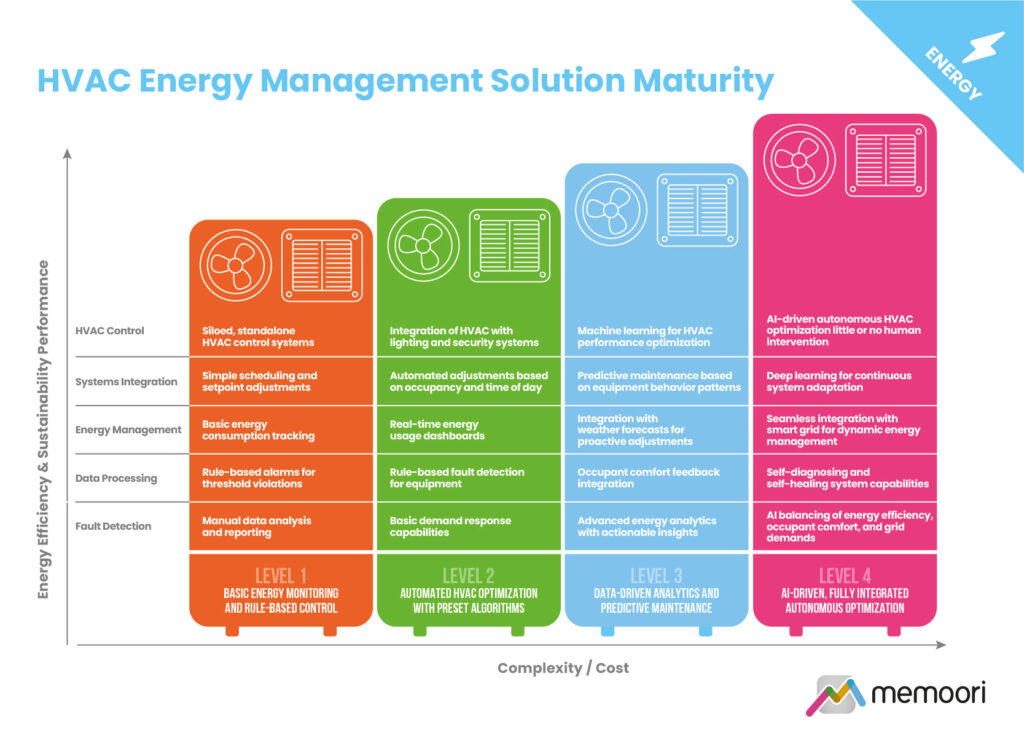

HVAC Energy Management Solution Maturity Model

To better understand the landscape of HVAC energy management solutions and their relative maturity, Memoori has developed a model categorizing these solutions into four distinct tiers.

- Tier 1 represents basic energy monitoring and rule-based control, with limited automation and integration.

- Tier 2 introduces semi-automated control and basic data-driven analytics, allowing for more comprehensive energy management.

- Tier 3 transitions to data-driven optimization incorporating machine learning and predictive analytics, enabling dynamic optimization based on real-time and predictive data.

- Tier 4 represents the pinnacle of HVAC energy management, with predominantly autonomous and AI-driven systems capable of optimizing performance without human intervention.

Based on an assessment of available data on technology adoption, the report develops a theoretical model of the global distribution across the HVAC Energy Management Solution Maturity tiers.

Market Sizing

The market for Energy Management Software for HVAC Optimization in Commercial Buildings is poised for significant growth over the next five years, driven by technological advancements, regulatory pressures, and increasing awareness of the need for energy efficiency.

The market for Energy Management Software for HVAC Optimization in Commercial Buildings is projected to grow from a baseline value of $3.65 billion in 2023 to $5.83 billion by 2029, representing a compound annual growth rate (CAGR) of 8.1%. Our projection accounts for regional disparities in adoption rates, macroeconomic influences, and technology-driven shifts to deliver a comprehensive and realistic market outlook.

Data centers account for an outsized proportion of market revenues relative to their floorspace, representing 11.4% of overall HVAC optimization software revenues ($449 million) in 2024. HVAC cooling can account for up to 40% of a data center’s total energy use, making efficient HVAC management crucial. AI-driven HVAC solutions in data centers can dynamically adjust cooling outputs based on real-time data such as server load levels, external weather conditions, and internal temperatures.

This report provides valuable information to companies so they can improve their strategic planning exercises and develop their energy management software business. It provides a thorough competitive landscape analysis, profiling key players, market leaders, and emerging startups.