The unification of Archibus, SpaceIQ, Serraview, and iOffice to form Eptura in October 2022 was one of the major mergers in the global integrated workplace management (IWMS) sector. This Research Note examines the business, one year on.

Headquartered in Atlanta, Georgia and with large regional offices in London, UK and Melbourne, Australia, Eptura was created in October 2022 reporting over 1,000 employees, 16.3 million users and a customer base spanning more than 16,000 of the world's leading companies, including 40% of the Fortune 500.

Backed by Thoma Bravo, a leading software investment firm, Condeco, the UK-based provider of workspace scheduling software, was merged with iOffice + SpaceIQ, the US-based workplace and asset management company, to create Eptura.

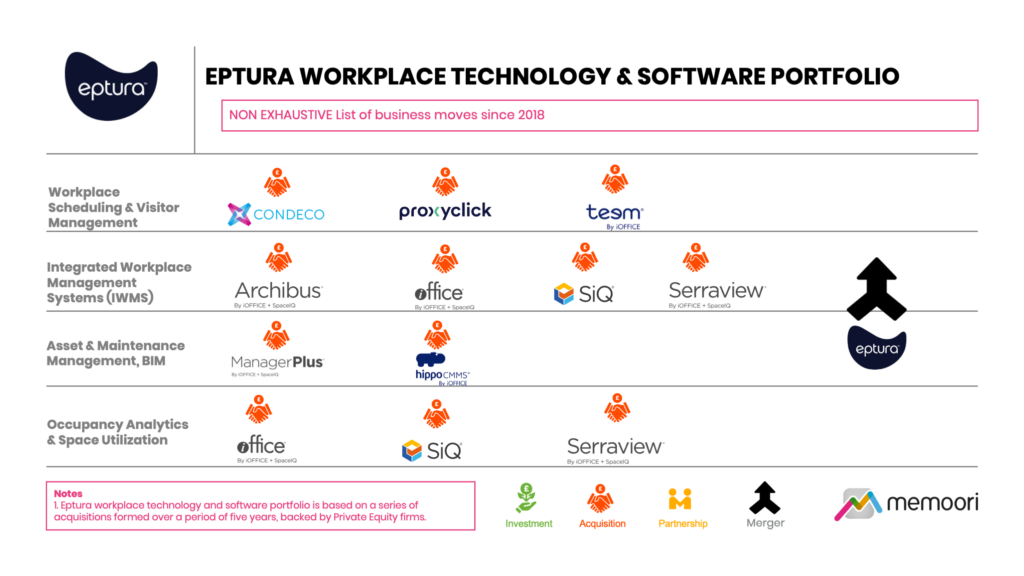

Established from the merger of 10 separate workplace software brands, Eptura is now considered as the leading vendor to consolidate the hybrid work market offering a unified software portfolio across space planning, workplace scheduling, asset and maintenance management, integrated workplace management systems, visitor management and workplace experience solutions.

Condeco

Founded in 2005, Condeco offers resource scheduling software, supported by digital signage and kiosk hardware. The company serves over 2,000 leading companies, providing technology to improve employee experiences and manage workspaces, allowing companies to quickly adapt to the ever-changing office environment.

In August 2021, Condeco received a strategic growth investment from Thoma Bravo and JMI Equity. The investment was expected to accelerate Condeco's growth globally and drive increased innovation within Condeco's workplace scheduling technology platform.

Paul Statham, Condeco founder and CEO prior to the Eptura merger, reported in May 2022 that the group had grown from $60 to $100 million in 18 months. This growth is likely to have been supported by the acquisition of ProxyClick, a Belgian cloud-based visitor management software provider, in January 2022.

Eptura One Year On

Memoori estimates 2022 Eptura revenues in the region of $200 - $220 million, while the headcount reported in October 2023 amounts to 500+ employees.

In this highly competitive workplace management sector, Eptura is one of several recent mergers being strategically executed between competitors to achieve critical mass and to join forces against competition.

For example, Johnson Controls’ acquisition of FM:Systems, Trane’s acquisition of Nuvolo and Schneider Electric’s investment in Planon illustrate the trend for building management firms and HVAC equipment players to expand their addressable market into software-based offerings.

Consequently, it will be interesting to see how the workplace technology market will develop in the future. Eptura’s position and pure-play software approach might be challenged if unified platforms integrated with building management systems become attractive propositions for building owners and operators.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.