In this Research Note, we examine Evolv Technology, a U.S. provider of AI-based weapons detection for security screening. This article covers the firm’s development, 2022 financials, vertical market approach and growth strategy. It is based on Evolv’s 2023 Analyst Day Presentations, Q4 Earnings Deck, 2022 10K Report and our analysis.

The Boston, Massachusetts startup has developed security systems to detect anyone attempting to carry a weapon or other threat into venues without slowing the flow of visitors or employees. By fusing the latest sensors and Cortex AI, Evolv delivers weapons detection smart enough to screen thousands of people without the need to stop and empty pockets or remove bags.

Their solution claims to be ten times faster than traditional metal detectors. It can also discriminate between a weapon like a firearm and a personal item like a cell phone or wallet in under 250 milliseconds which is orders of magnitude faster and more efficient than alternative market offerings.

Founded in 2013, the company raised a total of $83.8 million in funding from venture capital firms and strategic investors in the first 7 years of its existence. Evolv Technology became a public company in July 2021 when it completed a SPAC merger with NewHold Investment Corp.

Evolv 2022 Financials

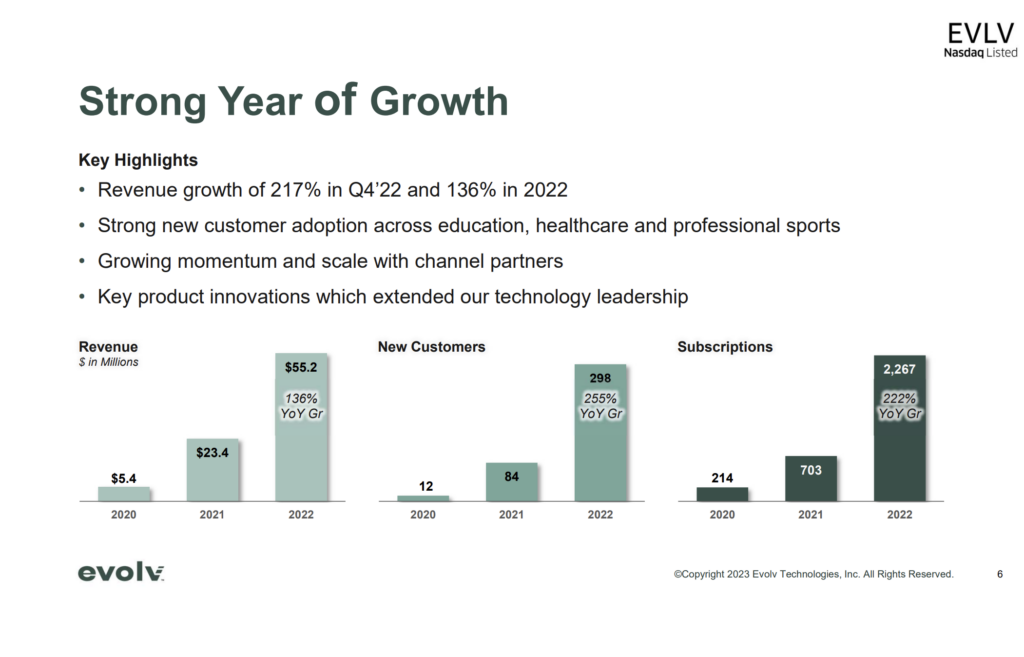

Total revenue was $55.2 million in 2022, up 136% from $23.4 million in 2021, reflecting strong growth in new customers as well as expanding deployments among their existing customers. Annual Recurring Revenue was $34.1 million at the end of 2022, compared to $12.9 million at the end of 2021, reflecting an increase of 164% year over year. Net loss was ($86.4) million, in 2022, compared to net loss of ($10.9) million, in 2021.

Evolv significantly expanded their market presence in 2022 with the addition of 300 customers across their key end markets which include education, healthcare, professional sports, warehouse/distribution and tourist attractions.

Evolv also more than tripled the number of deployed subscriptions of Evolv Express from 703 at the end of 2021 to 2,267 at the end of 2022. Deployments are an important measure of their growth due to the value of the long-term subscription contracts attached to each deployment. The total value of customer contracts not yet recognized was $144.6 million at the end of 2022 compared to $51.4 million at the end of 2021, reflecting a growth of 181% year-over-year.

Evolv Strategy

A key element of Evolv’s growth strategy is to introduce a "Pure Subscription" sales model. During the year ending December 31, 2023, the business intends to begin exclusively leading with their "pure subscription" sales model, where the customer leases their hardware, as opposed to purchasing the hardware outright and enters into a multi-year security-as-a-service subscription. The pure subscription model aligns more closely with the SaaS nature of their business and results in a more predictable and consistent recurring revenue stream as compared to the purchase subscription model.

Key strategic partners, include Johnson Controls, Securitas Technology (via Stanley Security, which was acquired by Securitas) and Motorola Solutions. Both Motorola Solutions and Stanley Security are investors in the company, as well as channel partners. Evolv saw growing momentum with their channel partners which were involved in over 65% of their order activity in 2022.

With the backing of several significant channel partners, Evolv anticipates that growing momentum and reach will enable the company to efficiently scale its business over time.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.