This Research Note examines the fire and security business of Halma plc and the financial results and acquisition strategy of their Safety Sector, year ending 31 March, announced on 15th June 2023. This analysis is based on financial releases, investor presentations and their Annual Report.

Halma is a group of around 50 life-saving technology companies. One of three broad sectors in which the UK public company operates, Halma Safety Sector (40% of group turnover) protects commercial, industrial and public buildings through fire safety systems and sensors for security, elevator safety and access control.

Established through the acquisitions of Apollo Fire Detectors, Advanced Electronics, FFE and Firetrace businesses, the sector benefits from a long-term focus on the fire detection market, with a strong presence in the UK and Europe.

Halma Safety Sector Financial Performance

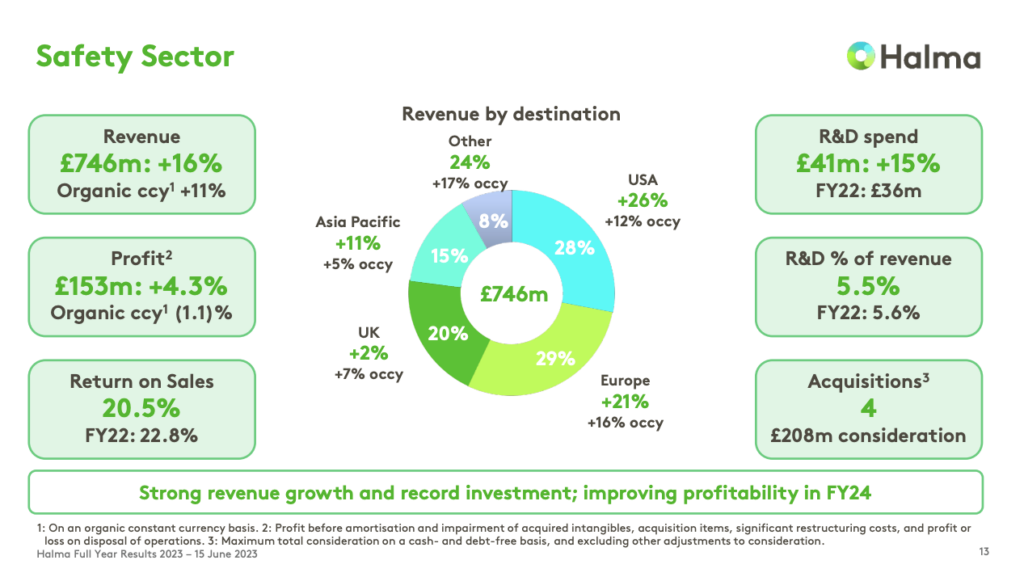

Revenue of £745.6m (2022: £641.4m) was 16.2% higher than in the prior year. Year-on-year revenue growth on an organic constant currency basis was strong at 11.2%, with double-digit growth in both halves of the year.

The largest subsector, Fire Safety continued to grow strongly, having seen substantial growth in the prior year, supported by organic constant currency revenue growth in all companies.

Halma M&A

On 31 January 2023, Halma acquired the entire share capital of Thermocable (Flexible Elements) Limited for its Safety sector fire detection company, Apollo Fire Detectors Limited.

Thermocable, founded in 1963 and based in Bradford, UK, is a developer and manufacturer of Linear Heat Detectors (LHDs). LHDs are temperature sensitive cables, installed in areas at risk of overheating and fire, which trigger an alert when they detect a change of temperature.

Thermocable’s specialist detection technologies expand the range of devices Apollo offers, helping to keep more people safe from the risk of fire. The company was acquired for £22.5m, which comprised the purchase price of £22.0m and net cash/debt adjustments of £0.5m. There is no contingent consideration payable.

Thermocable contributed £1.3m of revenue and £0.5m of profit after tax for the year ended 31 March 2023. If this acquisition had been held since the start of the financial year, it is estimated that the Group’s reported revenue and profit after tax would have been £5.3m higher and £1.5m higher respectively.

On 27 March 2023, Halma acquired the FirePro Group. Headquartered in Limassol, Cyprus, FirePro is a leading designer and manufacturer of aerosol fire suppression systems. Its systems protect people, critical infrastructure and equipment from fire using a non-pressurised condensed aerosol technology which does not contain ozone-depleting substances or fluorinated greenhouse gases and extinguishes fire without causing damage to the environment.

FirePro’s products, for which it holds several patents, have been installed in over 110 countries, across a broad range of industries and applications, and have listings and approvals with certified bodies around the world.

FirePro was acquired for a total consideration of £133.2m (€151.3m), which comprised the cash and debt-free purchase price of £132.0m (€150.0m) and other adjustments of £1.2m (€1.3m).

FirePro contributed £0.4m of revenue and £0.1m of profit after tax for the year ended 31 March 2023. If this acquisition had been held since the start of the financial year, it is estimated that the Group’s reported revenue and profit after tax would have been £19.8m higher and £9.2m higher respectively.

Halma Safety sector strategy is to grow and acquire small to medium-sized businesses in high-value niche markets with high barriers to entry and with global reach in selected fire detection and suppression markets.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.