In this Research Note, we examine the Chinese video surveillance giant, Hikvision (Hangzhou Hikvision Digital Technology Co., Ltd) focusing on their 2022 financial results, based on their 2022 Annual Report and analyst reports. This article updates our previous analysis.

Hikvision is the world’s largest manufacturer of video surveillance equipment. Established in 2001, the Company was listed on the Shenzhen Stock Exchange in May 2010. Hikvision provides a broad range of physical security products, covering video security, access control, and alarm systems. They also provide integrated security solutions powered by AI technology to support end-users with new applications and possibilities for safety management and business intelligence.

Over recent years, the group have deepened their knowledge and experience in meeting customer needs in various vertical markets, including smart city, transportation, retail, logistics, energy, and education. Hikvision has established one of the most extensive marketing networks in the industry, comprising 66 subsidiaries and branch offices globally. Hikvision reports more than 58,000 employees.

Hikvision continues to develop new technologies including AIoT. The company remains committed to making solid investments in perception technology, artificial intelligence, etc., and to explore new opportunities for innovation in its technologies, products, solutions, and application scenarios. In 2022, Hikvision invested RMB9.81 billion in R&D, accounting for 11.8% of the Company’s total revenue. The Company had about 28,000 R&D and technical service personnel.

In addition, Hikvision is extending its business beyond video surveillance to smart home, robotics, automotive electronics, intelligent storage, fire security, infrared sensing, X-ray detection, and medical imaging to explore new channels for sustaining long-term development.

In April 2023, Hikvision released its full-year 2022 financial results, reporting a total revenue of RMB 83.17 billion (USD 12.1 billion), achieving a year-over-year (YoY) growth of 2.14%. The net profits attributable to shareholders of the company were RMB 12.84 billion (around USD 1.8 billion), reflecting a YoY decrease of 23.59%. This year witnessed the first negative profit growth since the company was established, as they experienced many new challenges in a complex and changing environment.

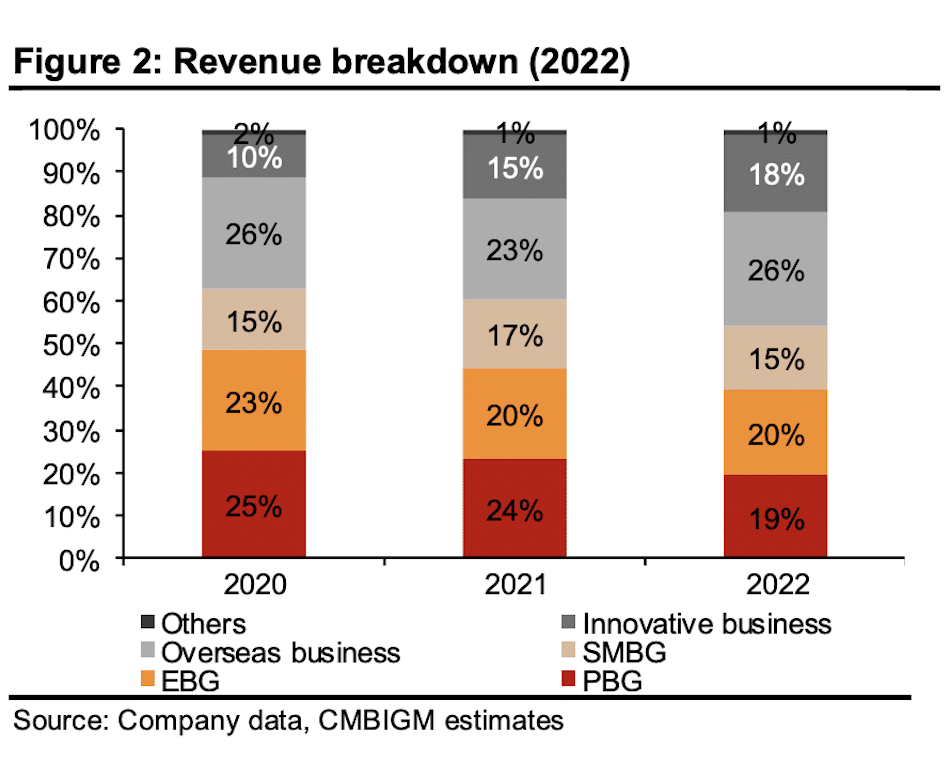

The chart above is from a CMB International Analyst Report, Taking Time to Recover, 17th April 2023, which showed the development of revenue mix over the last three years. Hikvision has divided its business into five groups: public business group (PBG), enterprise business group (EBG), SME business group (SMBG), overseas business and innovative businesses.

China is its biggest and fastest-growing market and accounts for around 70% of its revenue. Hikvision management believes business has bottomed out from the pandemic with Q4-2022 being the trough. Analysts commented that fourth-quarter results were adversely affected by a massive coronavirus infection wave in China after pandemic controls started to ease in November.

Due to the infection wave, they presume most unfulfilled orders in the December quarter will be recognized as revenue in the first half of 2023. Post-COVID recovery has been slower than expected and only EBG, the large enterprise-focused business resumed positive growth in Q1-2023. We have yet to see a rebound in the public security, SME and overseas businesses.

Hikvision has established “innovative businesses”, units which operate independently of their surveillance operations via a co-investment scheme. These business units are all based on video intelligence technology to explore new channels for sustaining long-term development. The 8 innovative businesses are EZVIZ Network, HikRobot, HikMicro, HikAuto, HikSemi, HikFire, Rayin and HikImaging.

Innovative businesses in 2022 accounted for 18% of total revenues, up from 10% in 2020. 2022 revenue grew +22.8% YoY to RMB 15.07 billion (over USD 2.1 billion).

The IPO of EZVIZ Network marks a milestone for the Company. On December 28, 2022, EZVIZ Network was successfully listed on the STAR Market of the Shanghai Stock Exchange as the first spin-off subsidiary of Hikvision. 2022 revenue was RMB 4.32 billion.

HikRobot (Hangzhou Hikrobot Technology Co., Ltd.): 2022 full-year revenue for the robotics business was RMB 3.916 billion (USD $570 million), a year-on-year increase of 47.5%. Hikrobot is a manufacturer of AMR and machine vision products, with a focus on industrial IoT, smart logistics and manufacturing, and warehousing automation. Its AMR products consist of latent robots, robotic carriers, forklifts, cargo-to-you robots, as well as robotic control and smart warehousing software systems.

Hikvision began divesting Hikrobot for a separate listing on China’s A-share market in 2022. It is worth noting that Hikvision is currently the largest shareholder in HikRobot, holding 60% of the Company's shares. In March this year, the Shenzhen Stock Exchange accepted Hikrobot’s bid to list on the Growth Enterprise Market to raise 6 billion yuan.

Proceeds from the IPO will be used to finance the construction of Hikrobot’s production facility in Tonglu, a city in Zhejiang known as the birthplace of Chinese logistics giants. The money will also go toward developing the company’s next-generation AMR and machine vision technologies, as well as supplementing its working capital.

Non-surveillance businesses will remain a core growth driver for Hikvision.

This article was written by Daphne Tomlinson, Senior Research Associate at Memoori.